The best way to link your existing Expense transactions to the new Invoices (Bills) is to convert the original Expense to a Bill payment, Alison. This will automatically clear the open bill.

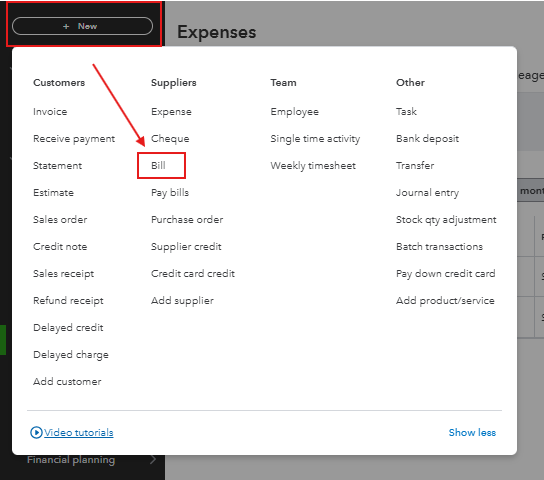

First, ensure that all backlogged invoices are entered into QuickBooks as Bills. Here's how to do it:

- Click on + New. Then, select Bill under the Suppliers column.

- Enter the Supplier name.

- Input the necessary information exactly as recorded in your expense transaction.

- Enter the Category and the Amount for that specific invoice.

- Click Save and new to enter the next invoice, or Save and close when you're done.

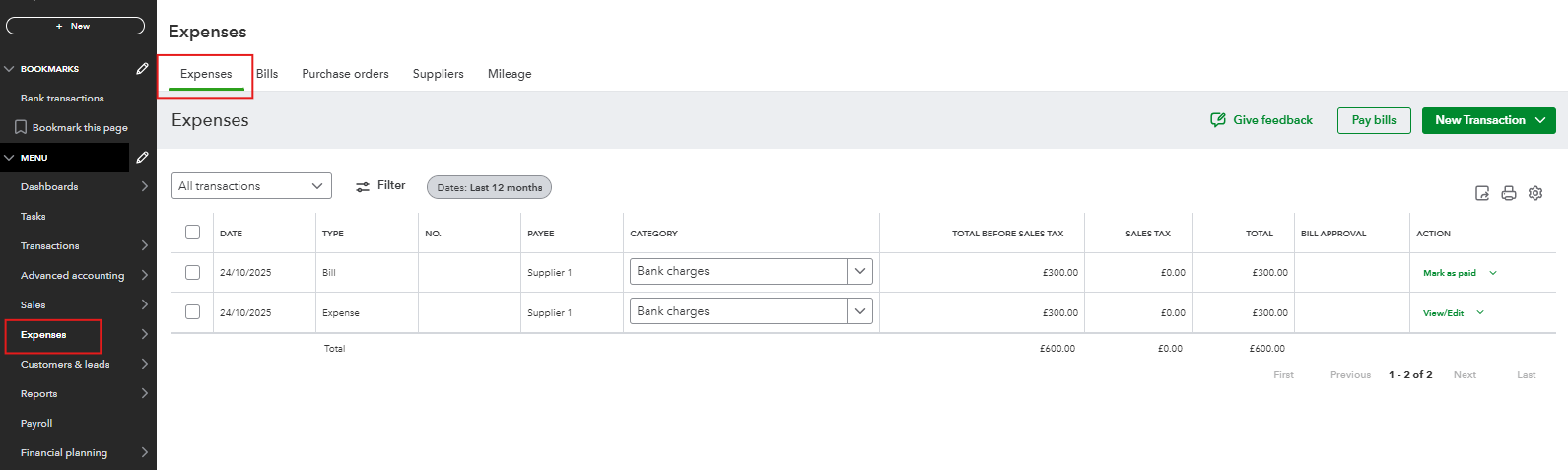

Next, you need to link the original direct debit transaction you've recorded as an Expense to the new Bill. Here's how:

- Go to Expenses from the left navigation bar, then click the Expenses tab.

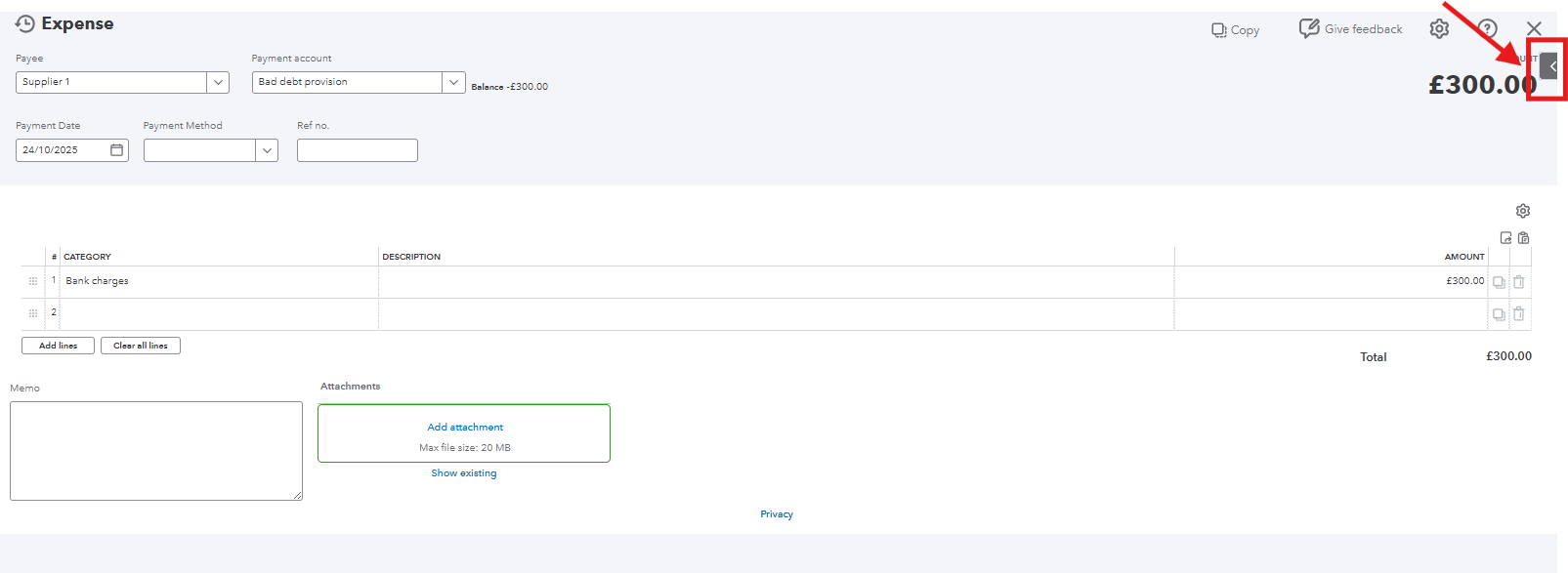

- Find and open the Expense transaction you want to link.

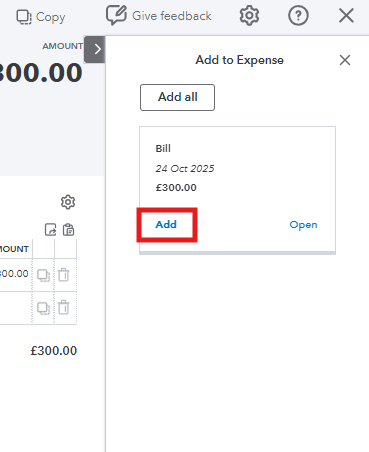

- On the Expense screen, look at the top right corner for a small arrow and click it. A pop-up will appear saying Add to Expense, showing the bill you just recorded. Click Add to link it.

This will change the transaction type from Expense to Bill payment. As a result, the original expense entry will be replaced with a bill payment entry, effectively clearing the outstanding bill and accurately reflecting your accounts payable records.

If you have any additional questions, feel free to revisit this thread.