Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have set up payroll.starting as new tax year . 1st pay 1/04/2019 -07/04/2019.one of my employees are in the work place pension. Deduction rates are set @ 5% & 3% as need be , but when i run pay run is not deducting enough for pension ? Thanks

Hello Ian file,

Welcome to the Community - thank you for your question!

Which version of payroll are you using, QuickBooks Payroll or PaySuite? You can check this by going to your employees tab - if you are using PaySuite, 'powered by PaySuite' will be displayed at the top.

Thanks,

Talia

QB Payroll

Hello, @jdesouza60.

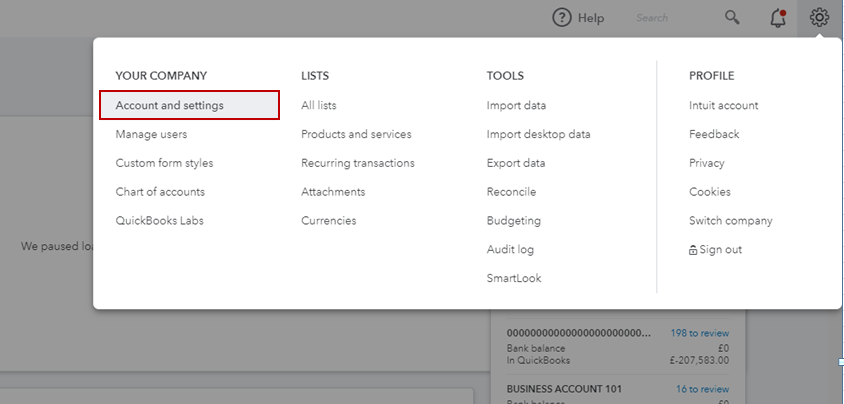

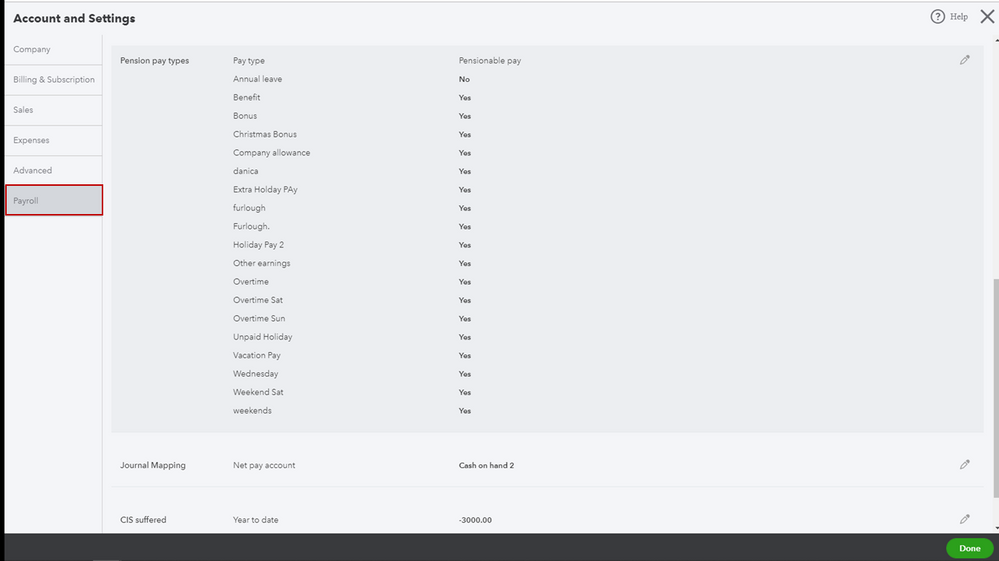

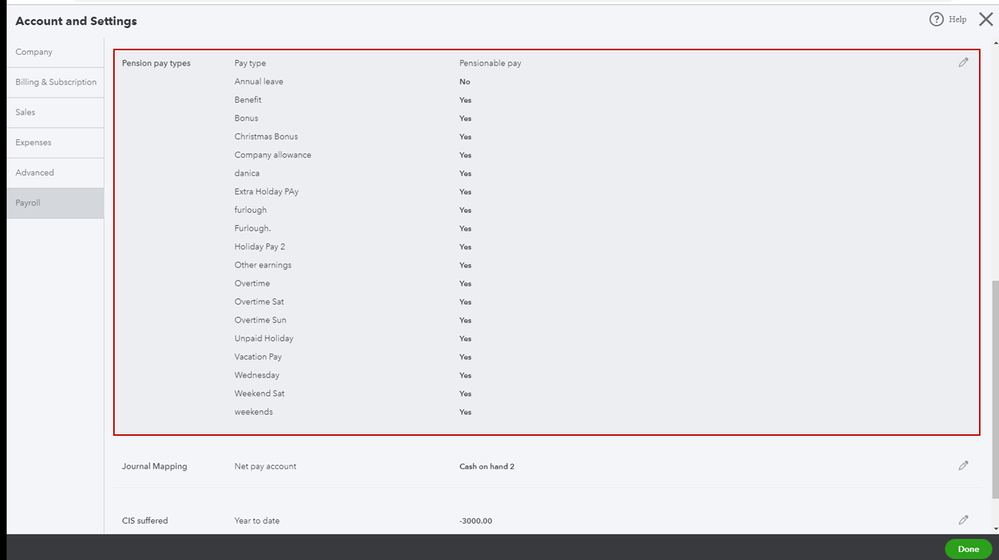

Pension deductions should calculate automatically depending on the setup entered in QuickBooks Online (QBO). At this time, we can review the pension pay types from the Account and Settings page.

Here's how:

You can also consider reading this article for additional reference about setting up workplace pensions in QBO.

As always, feel free to skim through our help articles and open the topic you need in case you need related links while working with QuickBooks in the future.

If you have any other questions, mention me in the comment section below. I'm always here happy to help. Have a good day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.