Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Will the charity set up in QBO support coding transactions into 4 categories (Nominal, Project, Department and Funds)

We use Sage which has these 4 categories but its difficult to input all transactions and/or get reports

Solved! Go to Solution.

Hello Charity - Andy,

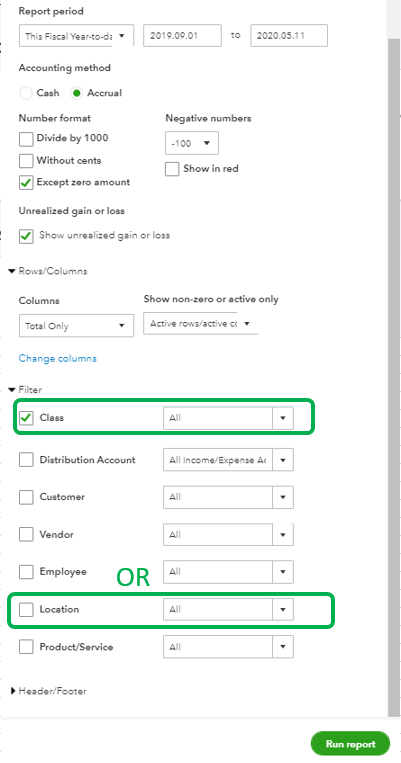

Yes, QuickBooks Online Plus or Advanced allows you to add categories (Class or Location) for your transactions. We just need to turn on and set it up for you to utilize its functionality. I'd also recommend reviewing the following articles for you to picture out what the features can do:

For you to find out whether QuickBooks Online fits for your business or not, you can give the trial version a try. Here's how you can sign up for QuickBooks Online:

From there, you can use the articles I've provided above to turn on and set up the class tracking features.

Keep us updated if you have follow up questions about QuickBooks Online. We'll be right here to guide you.

Hello Charity - Andy,

Yes, QuickBooks Online Plus or Advanced allows you to add categories (Class or Location) for your transactions. We just need to turn on and set it up for you to utilize its functionality. I'd also recommend reviewing the following articles for you to picture out what the features can do:

For you to find out whether QuickBooks Online fits for your business or not, you can give the trial version a try. Here's how you can sign up for QuickBooks Online:

From there, you can use the articles I've provided above to turn on and set up the class tracking features.

Keep us updated if you have follow up questions about QuickBooks Online. We'll be right here to guide you.

Hello Andy - I would be really interested to know how you decide to Class, Location and Project for your charity. I would like to be able to split Statement of Financial Activities and elements of the Balance Sheet by

(i) Funding source type (Unrestricted, restricted and designated funds)

(ii) Area of Activity

I was considering using Location and Class for these 2 splits. But from what I have read there are limitations to what you can do, with Classes in particular, on the Balance Sheet side of things - which may lead me to think about using "Location" for the Funding split and "Class" for the activity split - as the Balance Sheet split by funding type is key (in the funds section of the Balance Sheet at least).

Thanks very much

Good day, Deborah19.

We appreciate your interest in knowing more about how class and location tracking works in QBO.

Let me share some insight about the report you want to run. To be able to split the Statement of Financial Activities, you can pull up this report by Class or Location separately.

Here's how:

However, for Balance Sheet, it will only show the location details.

The following article contains additional information about the Statement of Activities report: Accounting Term: What Is a Statement of Activities?.

I'd also like include this aricle to ensure that you're able to access all of your reports in QuickBooks Online: Available Reports in QuickBooks Online.

Be sure to get back to me if you have other concerns. I'll be around to answer them all for you. Keep safe and have a good one!

Hi,

I would probably just use Class, set up the main class ( from the lists menu at the top not the short cut on the forms) as Restricted and Unrestricted and then you can set up sub classes for the individual funds.

We have clients who are using QB for community interest companies. However, we have noticed it is difficult to track expenses by location. You need to have effective cost-coding knowledge to implement it.

Mostofa from Tax Care Accountants

Hi. I'm new to QuickBooks and trying to improve the existing ledger for the charity I've started working for. I'm trying to report as you are by funding streams and activities. I'd be interested to get where you got to with Class and Location. Did that work for you? Thanks Lesley

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.