Welcome back to Community, francesca-procto.

Refunds for overpayment can be recorded using a Cheque or an Expense in QuickBooks Online (QBO). By doing so, it reduces your bank's balance and offsets the customer's open credit or overpayment.

First step is to record the refund for your customer. I'll show you how below:

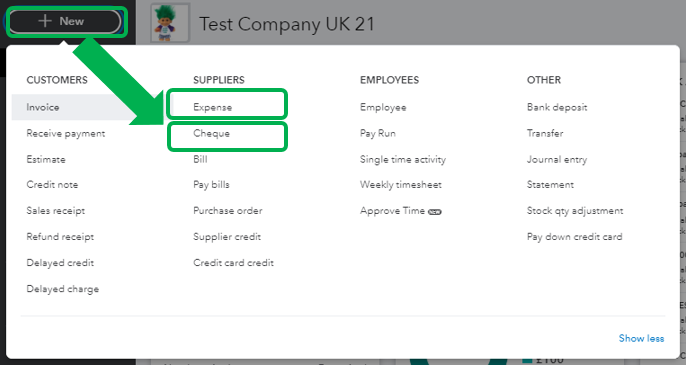

- Go to the + New icon.

- Select Expense or Cheque.

- Select the customer you want to refund from the Payee drop-down. From the Payment account drop-down, select the bank account where you deposited the overpayment too.

- On the first line of the Category column, select an Accounts Receivable.

- Enter how much you want to refund in the Amount field.

- Fill out the other fields as you see fit, then select Save and close.

Then. you can follow these steps to link the refund to the customer's credit or overpayment.

- Go to the + New icon.

- Select Receive payment.

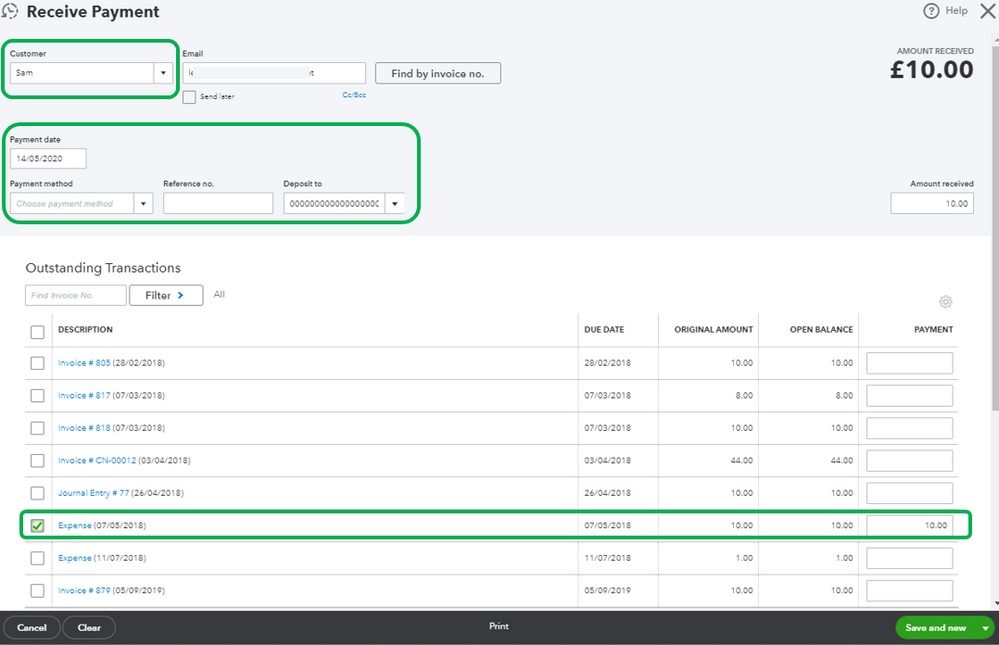

- Select the same customer you used for the cheque or expense.

- Fill out the other fields as you see fit.

- Under the Outstanding Transaction section, select the checkbox for the Expense or Cheque you created.

- Make sure the payment is equal to the open balance, then select Save and close.

For a more in-depth insight about the whole process of recording refund overpayment in QuickBooks Online, check out this article: Record a customer refund in QuickBooks Online.

You can always get back to me for more questions, Take care and have a wonderful day ahead!