- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Reports and Accounting

- :

- How do I create advance invoice for the next month without adding it to current month A/R?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I create advance invoice for the next month without adding it to current month A/R?

We manage condominium associations and we bill our tenants in advance for association dues. For example, the current month is September and on September 20, we will send invoices regarding Association Dues for the month of October. The problem is, QB adds it already for the current month Accounts Receivable. Our method is, Assoc. Dues for October should be added to the total of A/R for October. Is there a way I can do this? I've tried re-changing the date but it didn't seem to work.

Solved! Go to Solution.

Labels:

0 Cheers

Best answer September 19, 2019

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I create advance invoice for the next month without adding it to current month A/R?

Hi there, @Arzini.

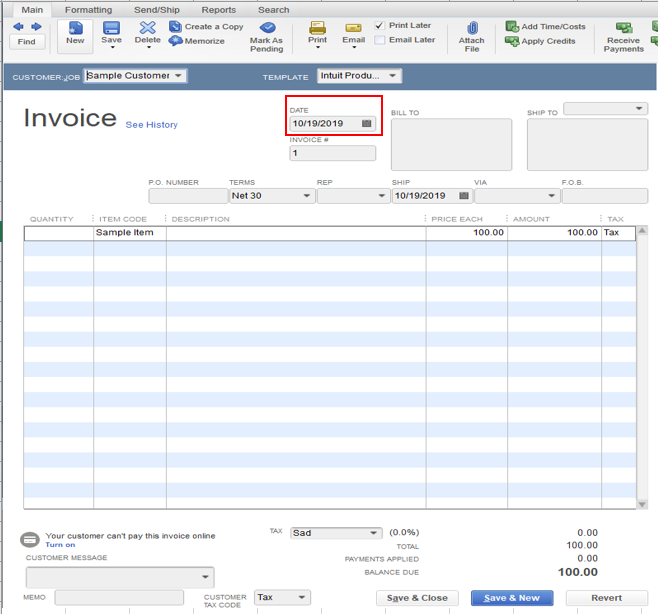

Let's edit the invoice date to show the association dues for October instead of the current month in your A/R Aging report.

When creating an invoice, you'll need to make sure that the invoice date will be dated base on your association dues. This way, your invoice will show on the month of the association dues in the A/R report.

Here's how to edit your invoice date:

- Go to the Customer Center menu.

- Select the customer, then find the invoice.

- In the Date section, edit the date into the association dues for October.

- Click Save and Close.

Once done, you can now review the A/R Aging report to double-check.

Moving forward, you can utilize the Invoice Memorize Transactions to automate transactions entry upon creating monthly invoices.

- Go to the Customers menu, select Create Invoices.

- Fill out the necessary information.

- Click the Memorize option from the Invoice Menu.

- Select Automate Transaction Entry.

- Choose Monthly from the How Often drop-down.

- Select the next date.

- Enter the necessary information you want to add.

- Click OK.

Here's an article you can read on for more details: Create, Edit, or Delete Memorized Transactions.

In case you can to send progress invoices in the future, you can check out this article for your reference: Set up and Send Progress Invoices in QuickBooks Desktop.

Feel free to visit us again if you have any other questions with QuickBooks. We're always here to help.

0 Cheers

3 REPLIES 3

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I create advance invoice for the next month without adding it to current month A/R?

Hi there, @Arzini.

Let's edit the invoice date to show the association dues for October instead of the current month in your A/R Aging report.

When creating an invoice, you'll need to make sure that the invoice date will be dated base on your association dues. This way, your invoice will show on the month of the association dues in the A/R report.

Here's how to edit your invoice date:

- Go to the Customer Center menu.

- Select the customer, then find the invoice.

- In the Date section, edit the date into the association dues for October.

- Click Save and Close.

Once done, you can now review the A/R Aging report to double-check.

Moving forward, you can utilize the Invoice Memorize Transactions to automate transactions entry upon creating monthly invoices.

- Go to the Customers menu, select Create Invoices.

- Fill out the necessary information.

- Click the Memorize option from the Invoice Menu.

- Select Automate Transaction Entry.

- Choose Monthly from the How Often drop-down.

- Select the next date.

- Enter the necessary information you want to add.

- Click OK.

Here's an article you can read on for more details: Create, Edit, or Delete Memorized Transactions.

In case you can to send progress invoices in the future, you can check out this article for your reference: Set up and Send Progress Invoices in QuickBooks Desktop.

Feel free to visit us again if you have any other questions with QuickBooks. We're always here to help.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I create advance invoice for the next month without adding it to current month A/R?

How does the "Days in advance to enter" work?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

How do I create advance invoice for the next month without adding it to current month A/R?

Glad to see you again, @Arzini.

The Days In Advance To Enter gives you the ability to send the invoice to clients before the transaction date. The system will create the entry on the specified number of days entered on that field, but the posting will be whatever you select for Next Date.

If you have any questions or need clarifications, let me know. I'm always here to help. Take care!

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...