Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Solved! Go to Solution.

Hi info797,

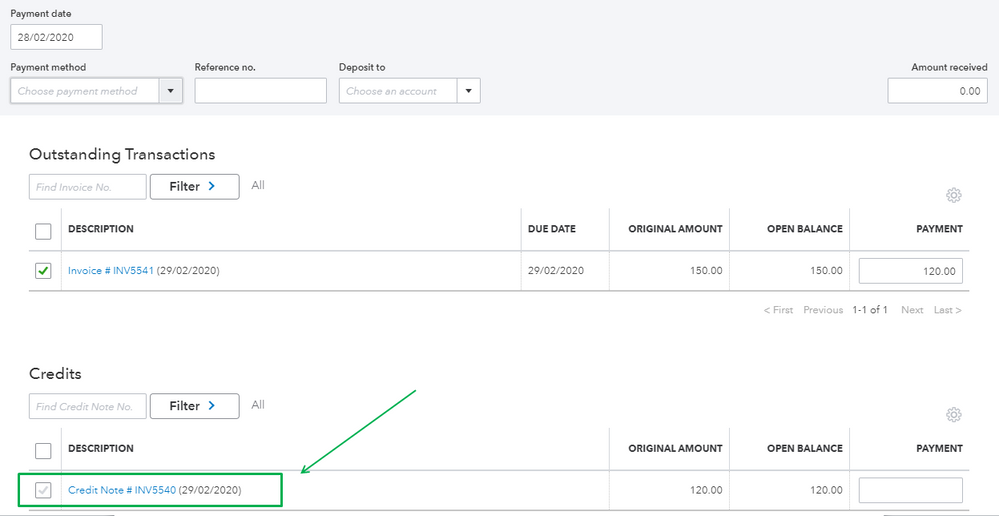

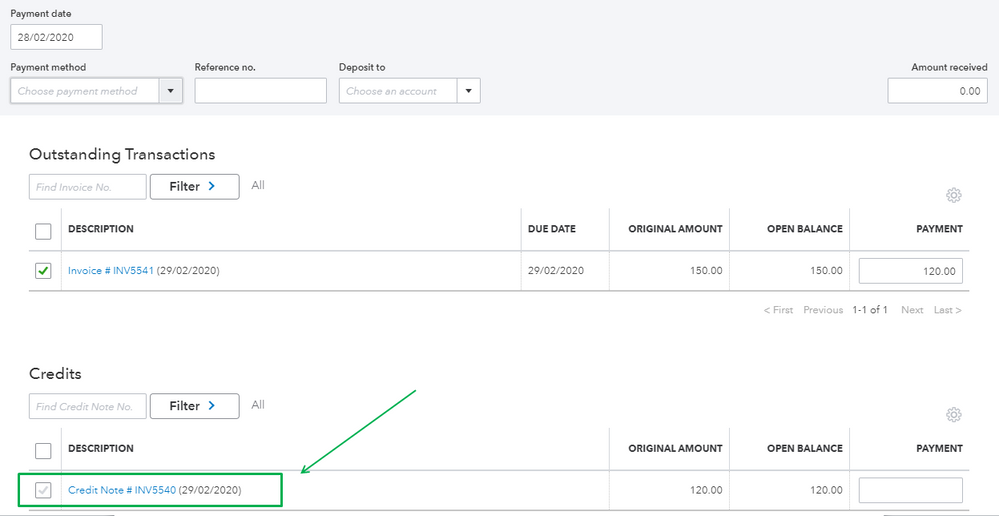

You can remove any credits applied on the invoice before sending it your customer. I'll show you how.

You might want to disable the Automatically apply credits feature in your company settings. Most companies disabled this feature that requires security deposits on invoices.

I'm linking an article in case you want to enter and apply credit notes and delayed credits in QuickBooks Online (QBO).

We'll be around if you have any other concerns. We're here to help.

Hi info797,

You can remove any credits applied on the invoice before sending it your customer. I'll show you how.

You might want to disable the Automatically apply credits feature in your company settings. Most companies disabled this feature that requires security deposits on invoices.

I'm linking an article in case you want to enter and apply credit notes and delayed credits in QuickBooks Online (QBO).

We'll be around if you have any other concerns. We're here to help.

Hi @info797

Your question is rather vague. Is it VAT you're concerned about?

Posting an invoice today (VAT becomes payable) but you don't receive customer's payment for a month or two?

Unfortunately, this is one of the joys of business & Accrual VAT.

If this is the main issue, you can apply to HMRC to join Cash VAT Scheme (https://www.gov.uk/vat-cash-accounting-scheme).

You can then (& only once you have joined the scheme) set QBO to Cash VAT Tracking & it will accrue VAT owed on payment date rather than invoice date.

Hope this helps.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.