Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi, Several bills from suppliers were paid for by a director using a personal credit card.

Although there's a 'directors loan account' set up in QBO it is not showing as an option in the drop down box 'bank/credit account' on the 'bill payment' screen.

How do I record the transaction in QBO so that:

1. The suppliers bills are shown as being paid and their balance is correct.

2. The amounts owed to the director are shown in the 'directors loan account' i.e. it's an option in the drop down box.

I suspect I may have to create a 'directors loan credit card account' but would prefer not to if that's possible?

Thanks.

Hello there, @WelshCountryMum.

I'll make sure you can record business expenses paid by the company's director using a personal credit card in QuickBooks Online (QBO), so you can keep your financial data accurate and updated.

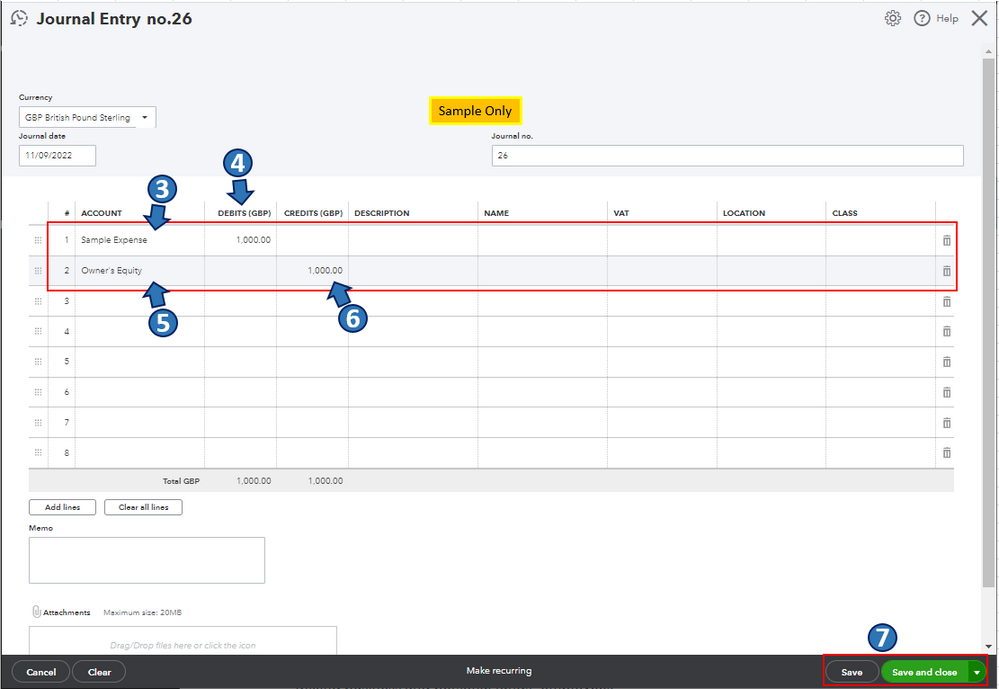

While we don't recommend mixing personal and business funds, we know it's unavoidable sometimes. To do this, you can start by creating a journal entry where you need to use the expense account for the purchase and the Partner's equity or Owner's equity. There isn't a need to create a 'directors loan credit card account' or use the existing one since will be using the Owner's equity.

Moreover, a journal entry is a complex transaction. With this, I encourage you to consult with your accountant before doing so. They can provide expert advice tailored to your business needs.

Whenever you're ready, follow these steps to record the business expenses paid for with the director's personal funds:

Once you're done, you'll have to decide how you want to reimburse the money. For this, you can either record it as a cheque or an expense. For the step-by-step guide, you can refer to this article's Step 2 section: Pay for business expenses with personal funds.

Also, you may want to check out this article as your reference to guide you in managing situations where business and personal finances mix in QBO: Mixing business and personal funds.

Let me know if you have other concerns about managing bills and expense transactions in QBO. I'll gladly help. Take care, and have a great day, @WelshCountryMum.

Thanks for your reply Rea_M.

Would the steps you've suggested link into the supplier bills and show them as being paid and their balance correct, as per my question?

If so, which of your numbered points below does this happen? If not, how can I overcome this?

Thanks.

Three-steps to this...

(1) give the director a slap, tell him/her/they/them not to do it again (it's costing your time to clean up)

(2) pay the amount(s) from company bank account to the director (or direct to their credit card)

(3) enter these payments in QBO as the Bill Payments

There's no need to be keeping track of the director's credit card in QBO - it'll only encourage them to do it again!

As long as you have bank payments going out matching to Bills in QBO the QBO accounts will balance.

Hope this helps.

Hello WelshCountryMum, So it will only show on the suppliers account if you hit the creditors account on the Journal Entry. As per the steps provided, it won't post on the suppliers account since it is debit to expense account and credit to Partner's equity or Owner's equity. But it will show on the transaction list of the supplier profile if you select the supplier name on the journal entry. So if you select the supplier name on the journal entry it will show on the supplier transaction list but wont show up on the AP reports. If this is not want you are really wanting then we would advise you speak with an accountant who will be able to advise more on this for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.