- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- Transactions

- :

- I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

Solved! Go to Solution.

Labels:

0 Cheers

Best answer December 10, 2021

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

What are you selling - goods or services?

Goods are straightforward - have a read of https://www.gov.uk/guidance/rates-of-vat-on-different-goods-and-services

International trade : Goods exported outside the UK are zero-rated, subject to conditions. You can read more about VAT on goods sent overseas.

Supply of services has always been (& remains) a bit of a dog's breakfast. There are a number of if, buts & maybes that could change the answer - so your accountant really is the one best placed to give advice.

See https://www.gov.uk/guidance/vat-how-to-work-out-your-place-of-supply-of-services which will give you the broad picture.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

Hi paul,

I have resolved the issue now thanks. You have to use the 0.00% Z code and quote the client's VAT number to enable them to account for the VAT. All sorted.

0 Cheers

4 REPLIES 4

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

Hello, Garren.

I'll jump aboard and give some details about the 20% RG SG VAT rate in QuickBooks Online.

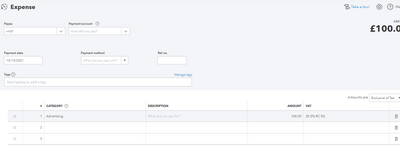

Are you referring to the 20.0% RC SG instead? This tax rate is only usable on purchase forms such as cheques, expense or bill. This is what it looks like in a sample expense form:

To elaborate some details, it is used for goods or services bought from someone in another EU country that are classed as standard rate in the UK.

If you're referring to a custom tax rate (instructed by the HMRC to use a similar rate for invoices), ensure that the Sales box is also checked.

We're unable to edit the rate and include the Sales box, but you can create a different custom rate with the Sales box checked. Then, inactivate the old one by opening it then clicking Make inactive.

If you're referring to a different tax rate, I would recommend double-checking this article to see what's the correct VAT rate applicable for your invoices: QuickBooks VAT codes,

I'd also recommend consulting a tax advisor, so you'll be guided on what tax rate to select.

Do you need help submitting your VAT return after recording those transactions and adding the correct VAT rates? Check this article out for the steps and details: Submit a VAT return in QuickBooks Online.

I welcome any other questions you might have regarding the VAT rates. Do you have any concerns recording your transactions? Please let me know the details and I'd be glad to work with you.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

Thanks jamespaul. This is for an invoice I am raising to my client in the Republic of Ireland. As I am not registered for VAT in Ireland they are going to account for the VAT when they pay my invoice. Do I have to select 0.00% RC SG instead?

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

What are you selling - goods or services?

Goods are straightforward - have a read of https://www.gov.uk/guidance/rates-of-vat-on-different-goods-and-services

International trade : Goods exported outside the UK are zero-rated, subject to conditions. You can read more about VAT on goods sent overseas.

Supply of services has always been (& remains) a bit of a dog's breakfast. There are a number of if, buts & maybes that could change the answer - so your accountant really is the one best placed to give advice.

See https://www.gov.uk/guidance/vat-how-to-work-out-your-place-of-supply-of-services which will give you the broad picture.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

I have toggled 20% RG SG as "on" in the Edit VAT section, but when I try to select it when raising an invoice, it is not there in the drop down list. Can anyone help?

Hi paul,

I have resolved the issue now thanks. You have to use the 0.00% Z code and quote the client's VAT number to enable them to account for the VAT. All sorted.

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...