Keeping track of your invoices with CIS calculations is my top priority today, domestic. I can show you how to send your transaction with the designated amount.

You must enable the Construction Industry Scheme (CIS) on your account and set your client as a CIS contractor. This way, QuickBooks Online (QBO) automatically calculates CIS deductions from your invoices. When you start using the CIS in QBO, the system will handle the necessary deductions, track your withheld or suffered amounts, and generate reports for HMRC.

To get started, revisit the contractor's profile to verify this further.

Here's how:

- Tap on Customers from the Sales menu.

- Locate the contractor's name.

- Ensure to mark the Is CIS contractor checkbox in the Additional info section.

- Enter their VAT Registration Number.

- Input their UTR number (Unique Taxpayer Reference).

- Tap Save.

If CIS is disabled on your account, turn it on by following the instructions from this link: Turn on CIS in QuickBooks Online.

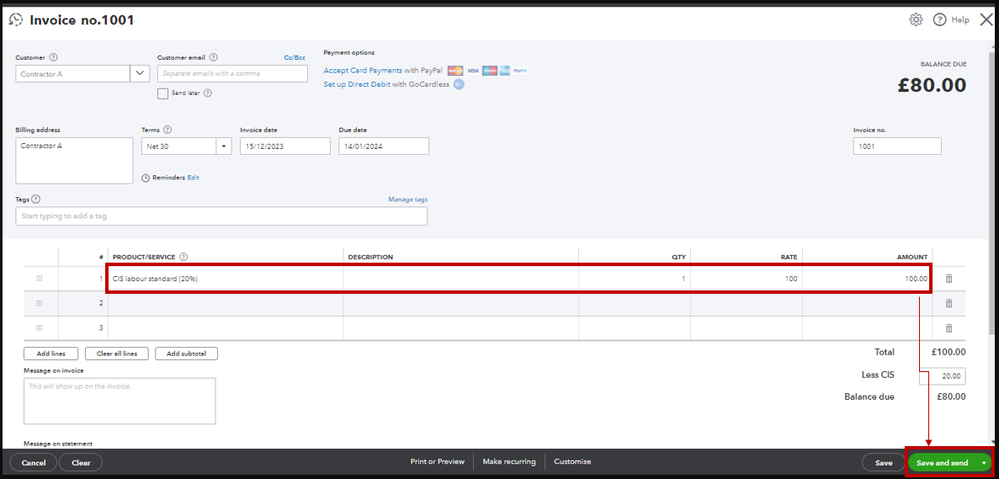

Once completed, the system automatically generates CIS products/services for you to use when recording your invoices. Then, select Save and Send to email the details to your contractor.

I'm adding this screenshot as your visual reference.

To know more about tracking CIS entries in our system, run through the details from this article: How to create CIS transactions in QuickBooks Online.

I want to ensure that all your CIS transactions and invoices are covered. Just leave a comment below if you have follow-up questions. I'm here to help you every step of the way.