Hi there, ricky7,

If you're using the Flat Rate Scheme (FRS) for your taxes, you can unselect this option. By doing so, you'll be able to edit the invoice and enter the correct date.

Here's how:

- Go to Taxes from the left navigation bar.

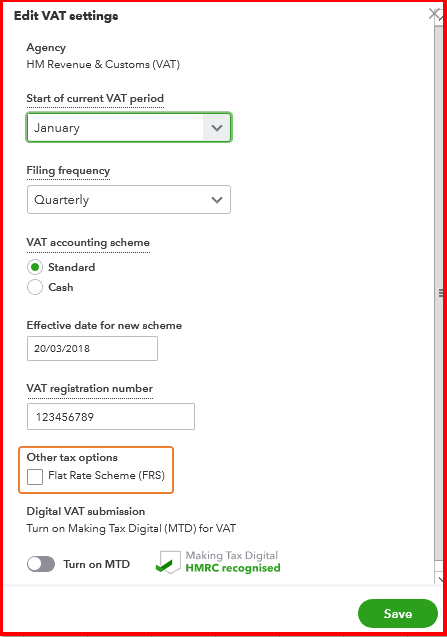

- Click Edit VAT, then select Edit settings.

- Untick FRS, then click Save.

Once done, locate and open the invoice. Then, make the necessary changes.

After that, I recommend contacting our QuickBooks Online Technical Team. By doing so, they can see if they'll be able to make an adjustment on your VAT return. They'll also check if you're not using the FRS option for your taxes.

Here's how to contact them:

- Select Help (?) at the top right.

- Select Contact Us to connect with a live support agent.

Should you need additional information, please leave a comment below. I'll get back to you.