Greetings, @nick-dalton.

It’s likely possible that the past years' invoices entered in QuickBooks isn’t using the actual transaction date or hasn’t been marked as paid. Let’s find the entries causing the increase and correct it.

Here's how:

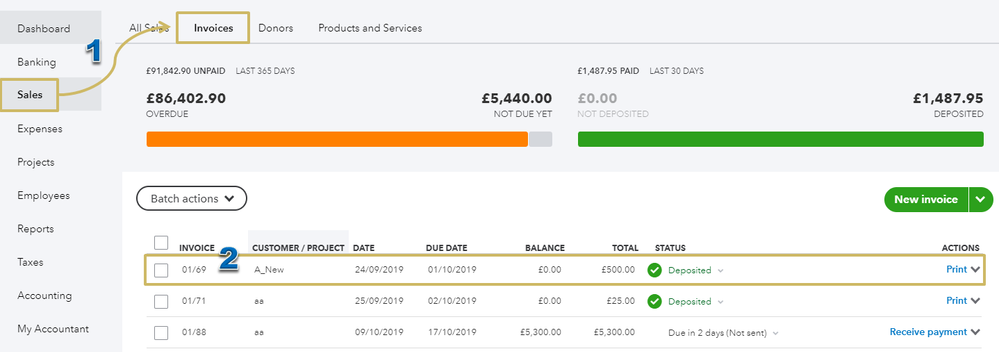

- Go to the Sales menu and pick the Invoices tab.

- Locate the invoice and open it.

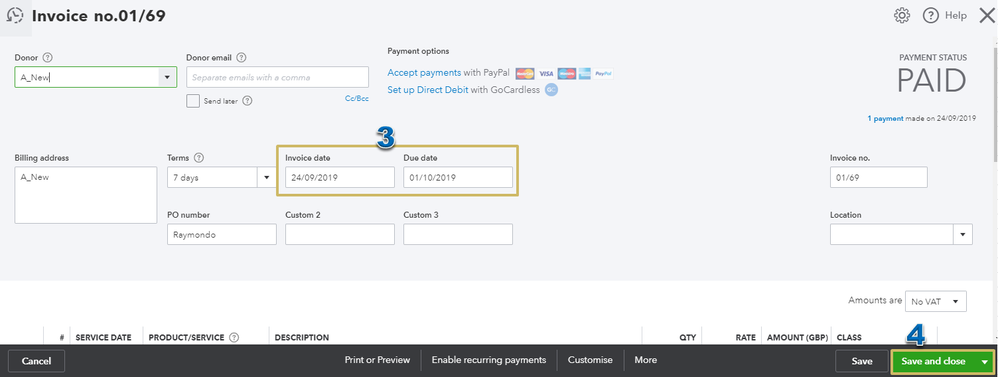

- Update the Invoice date and the Due date.

- Hit Save and close to record the changes.

Once done, follow the same steps to modify the rest of the transactions affecting the VAT figures. For more information about invoicing, take a look at this article: Create an invoice.

I also recommend pulling up the VAT Exception Report to see entries previously filed, but have changed, deleted, or added in QBO. Doing so ensures that no VAT collected (or credits earned) are missed or duplicated.

You can view the exceptions that are pending for the current filing by going to the Taxes menu. Find the VAT, then click the arrow next to Submit return to select View exception.

Refer to this article for the details: Vat exceptions and reports.

I’m only a couple of clicks away if you need anything else. I’m always here and ready to help. Have a great day!