Allow me to join you here and answer your questions on how QuickBooks accounts your sales and purchase taxes, Kim.

QuickBooks Online starts tracking VAT as soon as it's applied to transactions. The system will also account for it even if customer and vendor invoices are not yet paid.

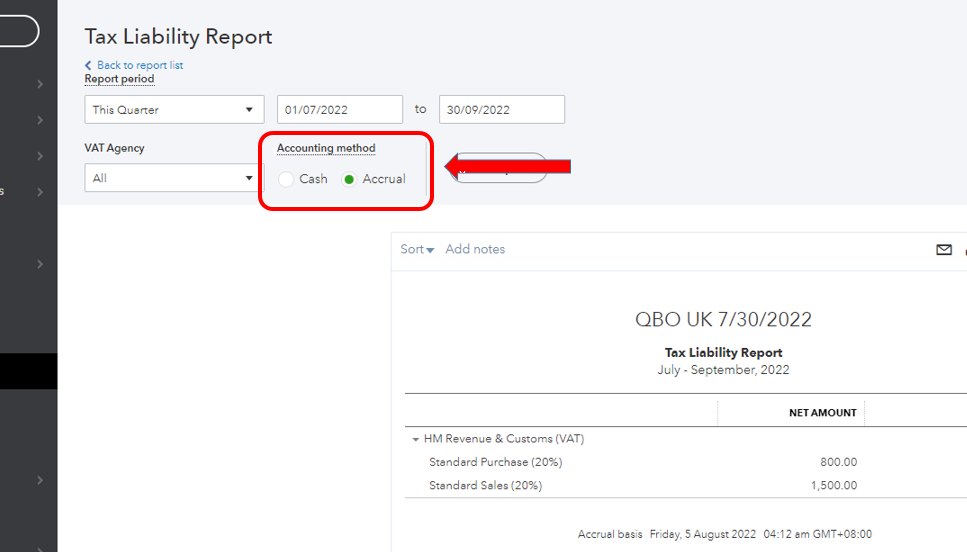

If you are on an accrual or cash accounting scheme, make sure to select the right settings to make sure VAT amounts are showing up in your report and returns.

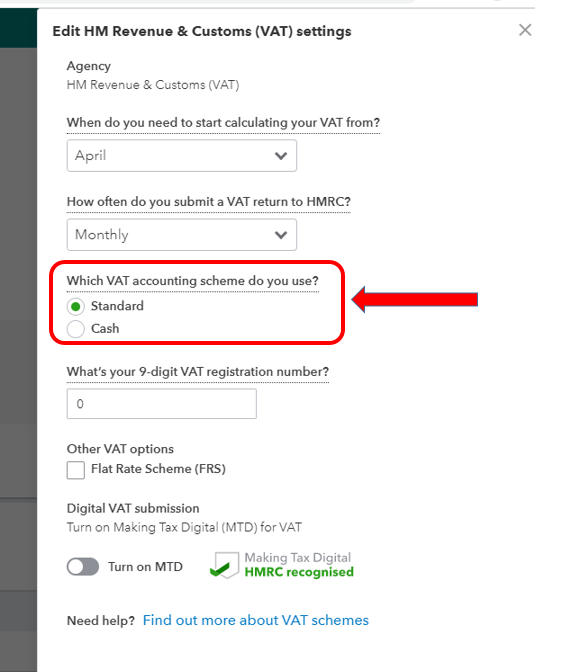

You can choose between Cash and Standard. Use Cash if you will track and pay VAT once you've been paid by the customer. On the other hand, select Standard if you want to account VAT on the invoice due date.

Here's how:

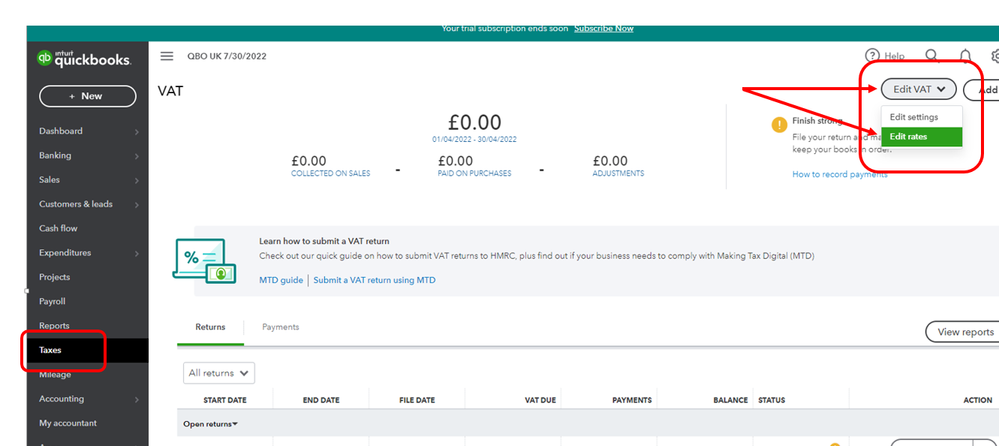

- Go to the Taxes menu and click Edit VAT in the upper-right hand corner.

- Select Edit settings.

- Choose your accounting method in the Which VAT accounting scheme do you use? section.

- Click Save.

When running VAT Liability and other tax-related reports, Go to the Accounting method section and select the right settings.

Additional details and references about this are discussed here:

I'd appreciate if you can keep us posted to let us know if that answers you questions about accounting for VAT in QBO. You can also post more inquiries if you need anything else from us.