I can certainly assist you with the steps to resolve this issue, Tom.

The original refund you recorded created a transaction, likely a Journal Entry or a Bank Deposit, that is now linked to the VAT return. We need to find and remove that specific source transaction.

Here are the steps:

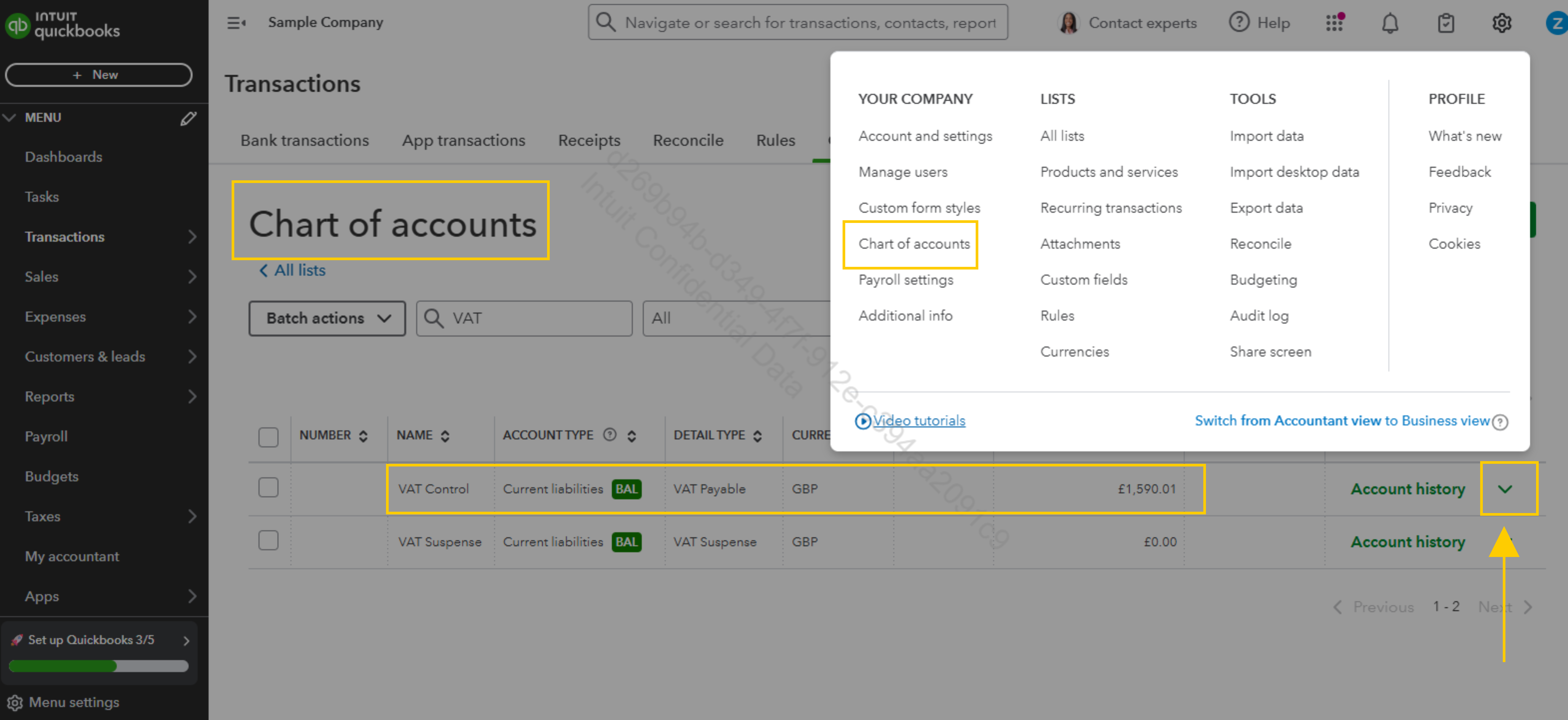

- First, select the Gear icon at the top right of your QBO screen.

- Next, under Your Company, select Chart of Accounts.

- Then, locate the VAT Control account (this is the liability account QuickBooks uses for your VAT).

- Thereafter, select Run report next to the VAT Control account.

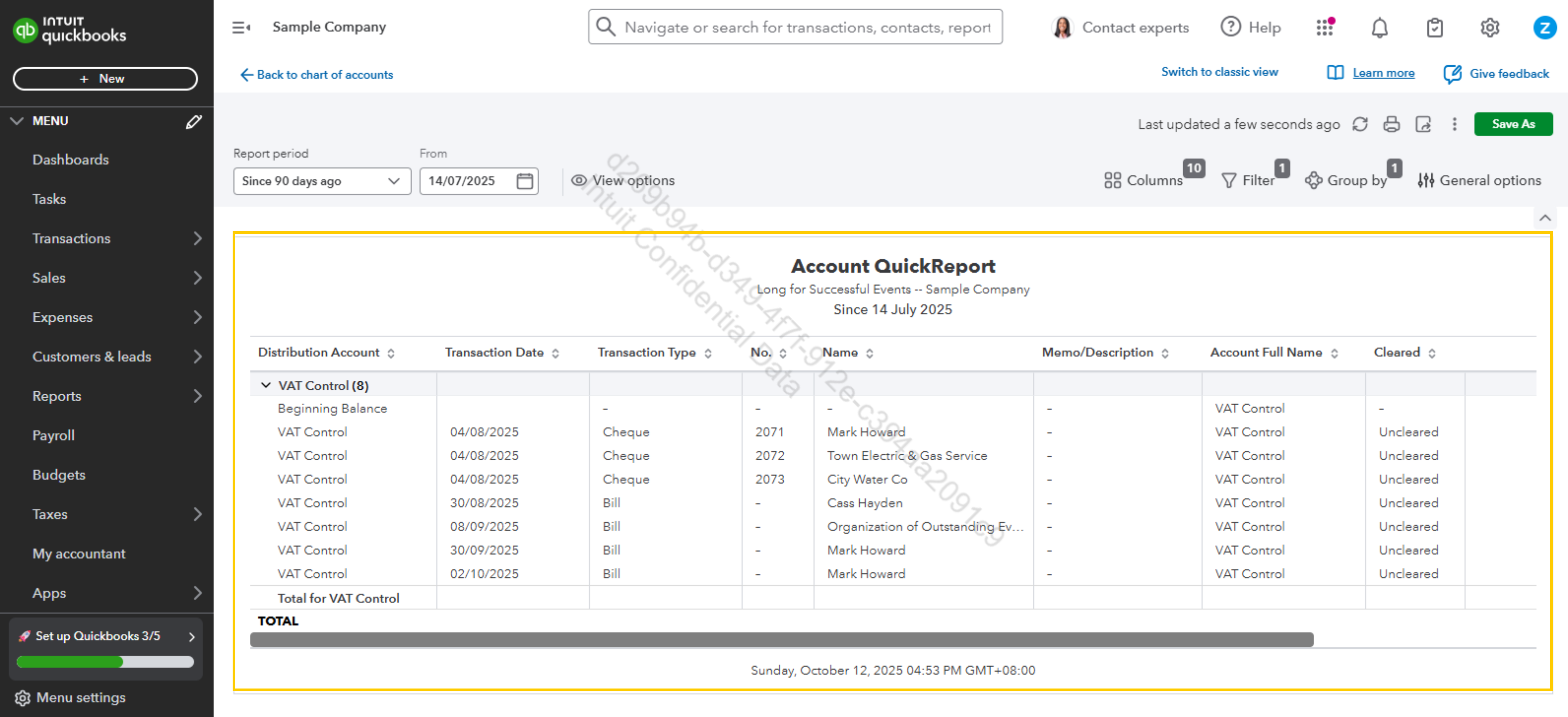

- Now, find the line item that represents the incorrect VAT refund. It will have the Refund amount and the date you entered it.

- Afterward, click on the transaction itself to open it.

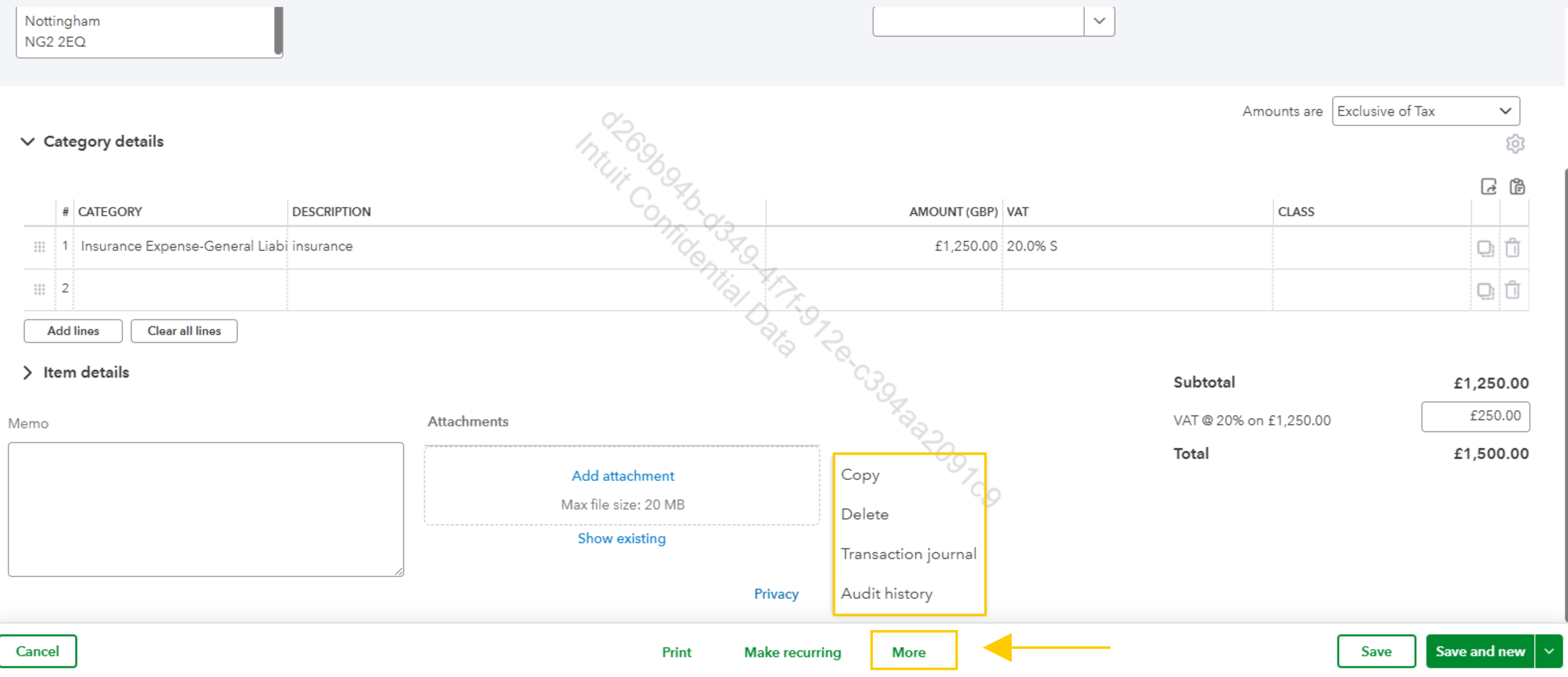

- Then, look for the More button at the bottom of the transaction window.

- Finally, click More and then select Delete. Confirm the deletion.

Deleting the source transaction will automatically unlink and remove the incorrect refund from your VAT return payments.

Please let us know if you have more questions about managing your VAT. We're always here to assist.