- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- Help! FRS Charity: Vat Amount Query

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Hi

We are a small charity with 15% revenue created from trading services, so 15% of our income has VAT applied, rest is exempt ie all Donations or Grants.

We had to register for VAT and opted for a FRS scheme. Rate we are on is 6.5%

At the moment when I do the vat return QBs Vat's section multiplies this 6.5% rate to most of our Income rather than only the traded income.. can anyone help with this query?.. so say last quarter we collected £250 in Vat yet our VAT bill was £9.5k.

Does anyone know what is going on?

Any help will be great.

Jay

Solved! Go to Solution.

Labels:

0 Cheers

Best answer October 05, 2020

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Hi

I have worked this out... If I select "No Vat" next to the transactions rather than "Exempt" or "Zero Rate" then the VAT amount is correct.....

MiH

0 Cheers

5 REPLIES 5

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Welcome to the Community, @MiH.

Let me provide some insights on how the VAT and FRS calculated in QuickBooks Online (QBO).

The reason why your FRS 6.5% rate calculates most of your income is that all of your sales transactions have a 20% standard VAT. To correct this, you'll want to make sure that those transactions that shouldn't be calculated have a zero-rated VAT or No VAT.

Most importantly, I recommend seeking help with a VAT expert or your accountant. This way, they can help make sure that you submit a VAT return that is acceptable with HMRC.

You might want to check out this article to learn how to manage your VAT codes and rates: Set up and edit VAT settings, VAT codes, and VAT rates.

Please let me know if you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response. Have a great day.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Hi

All the data is entered with either 20% Vat, Zero/No Vat or Exempt.. but still when QBs runs the VAT return all income is applied to this 6.5%

Simple example:

- Consultancy Sales - £100 = 20% Vat = £120

- Crowdfunding income - £5000 No Vat/Exempt

- Product Sales = £500. + 20% Vat = £600

When I run VAT

- QBs work out 1+2+3 = £5600*6.5% = £364

- When it should be 1+3 = £600*6.5 = £39

I think its a technical thing on QBs .. I was wondering whether The QBs Vat is linked to the TYPE selected on the chart of accounts when you create a new code...

Jay

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Thanks for getting back here, @MiH.

I've got steps to help you fix your VAT return. You can delete and then recreate the transaction number 2 (Crowdfunding income - £5000 No Vat/Exempt). As it's No VAT it should not be reported to any VAT return. If this still shows, I recommend reaching out to our QuickBooks Online care team to further investigate the root cause of the issue.

Let me walk you through the steps:

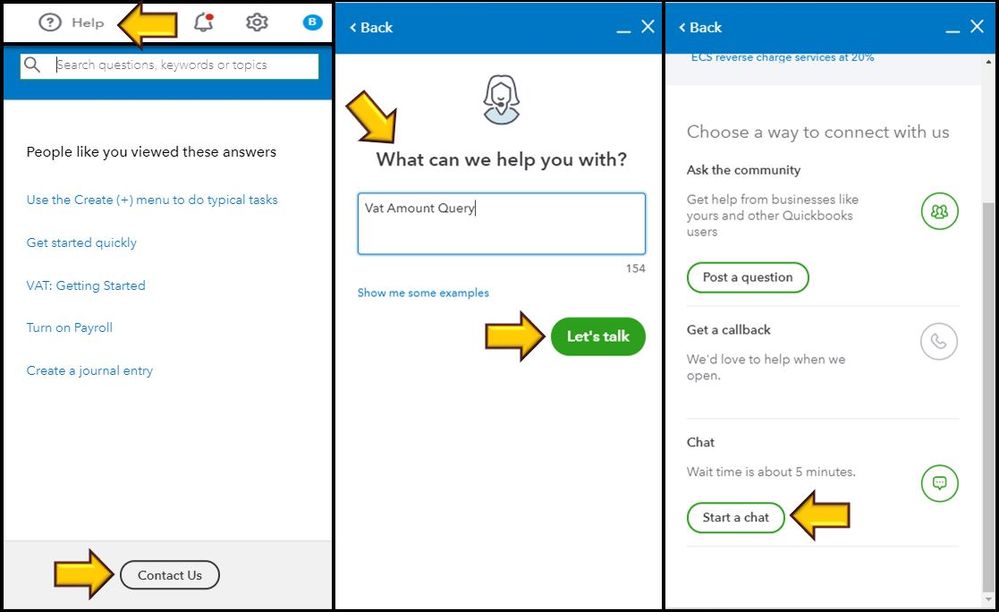

- Go to the Help icon.

- Click Contact us.

- From the What can we help you with? box, enter VAT amount query.

- Hit Let's talk.

- Choose Start a chat.

Here's a helpful article that you can check out just in case you want to edit VAT settings, codes, and rates: Set up VAT.

Please keep in touch if you need any more assistance with VAT return or any QuickBooks-related issues. I've got your back. Have a good day and keep safe.

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Hi

I have worked this out... If I select "No Vat" next to the transactions rather than "Exempt" or "Zero Rate" then the VAT amount is correct.....

MiH

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

Help! FRS Charity: Vat Amount Query

Hello MiH,

Glad to hear you have got your issue all sorted now.

If you need any further assistance you now where to find us.

Have a good day.

0 Cheers

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...