Thanks for taking the time to post here in the Community, @accounts36.

I'll help ensure you're able to see the Record Payment button so you'll be able to record a VAT payment.

Here are the possible reasons the Record Payment button isn't showing on your Taxes page:

- The VAT return wasn't submitted to HMRC.

- The VAT return wasn't marked as filed and the period wasn't closed.

To help fix this, let's first submit the VAT return directly to HMRC from QuickBooks. Here's how:

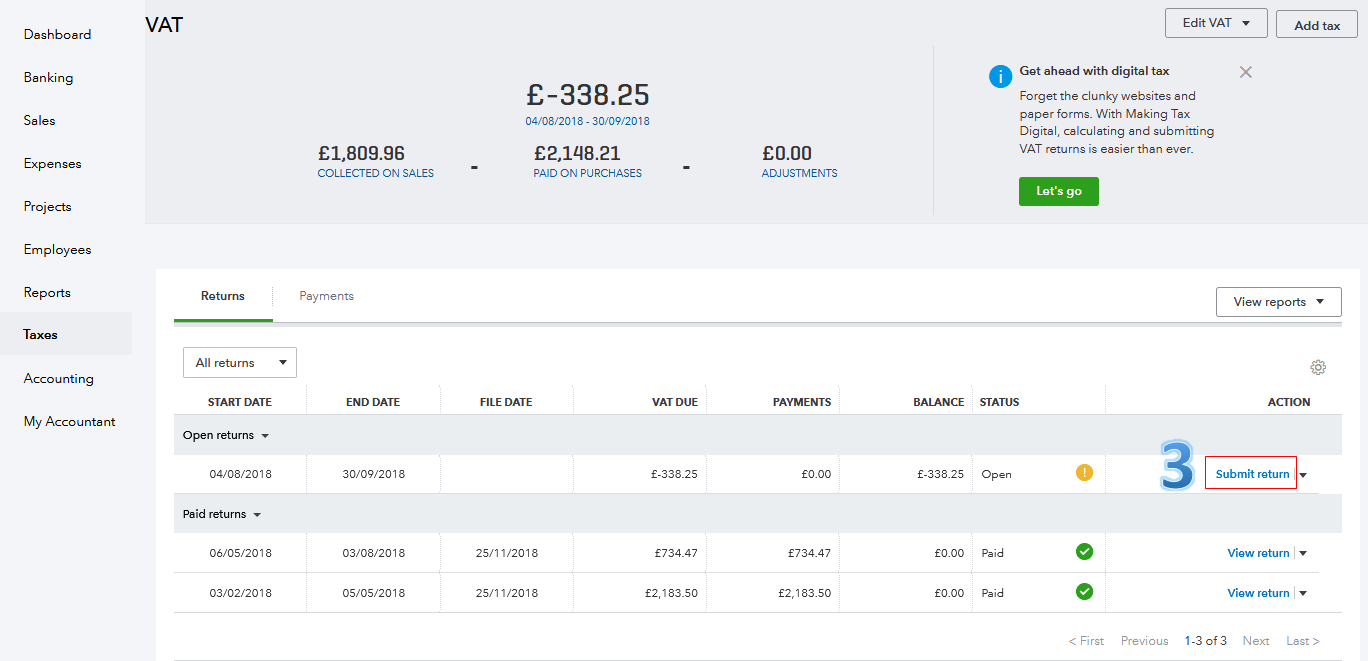

- Go to Taxes from the left menu.

- Click VAT at the top of the screen.

- Click Submit return to view your open return.

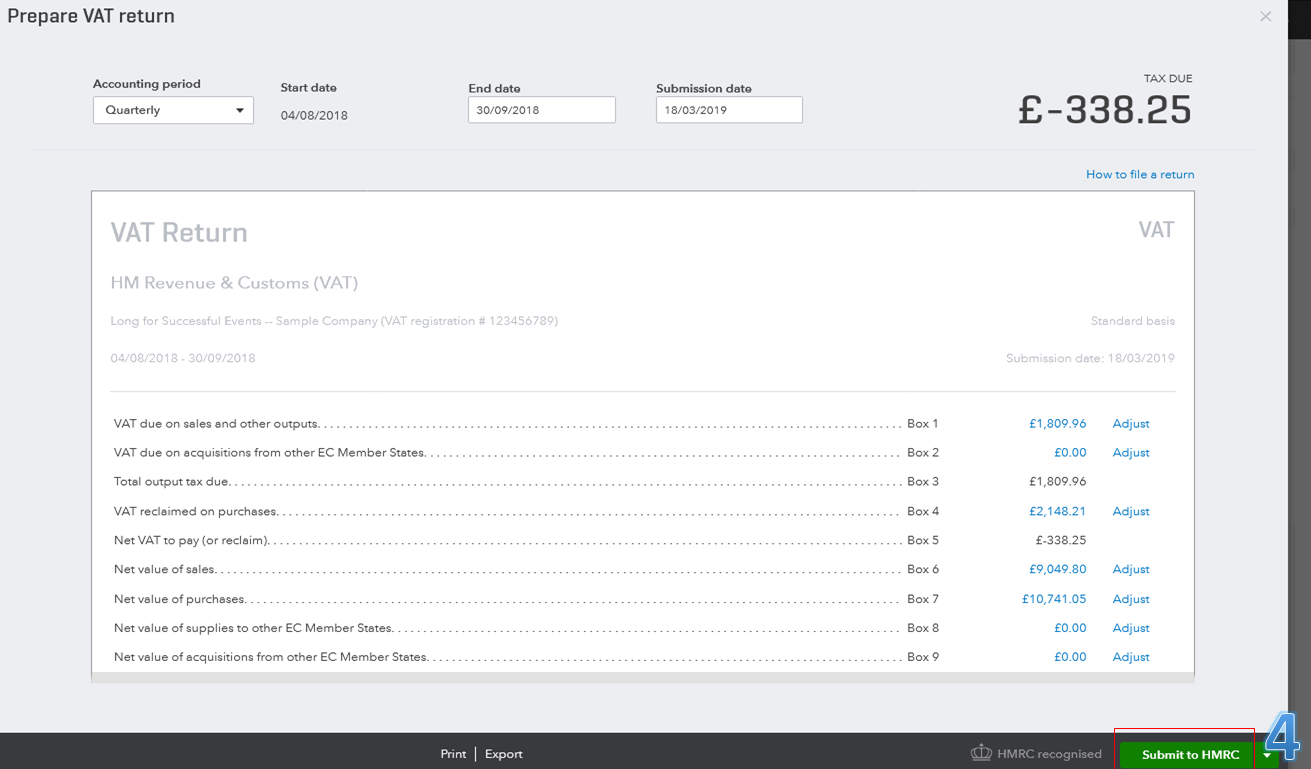

- On the Prepare VAT return page, review the dates and the amounts to make sure they are correct. When you're ready to submit it, click Submit to HMRC at the bottom of the screen.

- Type in your Government Gateway User ID and Government Gateway Password. Click Yes, I want to proceed.

- When HMRC receives your VAT return, you'll see the Pending with HMRC message. Click Close and continue working.

- Once successful, the status will change to Approved by HMRC.

If you prefer to file your VAT directly with HMRC, you can mark your return as filed and close the period. Here's how:

- Go to Taxes from the left menu.

- Click VAT at the top of the screen.

- Click Prepare return to view your open return.

- On the Prepare VAT return page, review the dates and the amounts to make sure they are correct. When you're ready to submit it to HMRC, click File online with HMRC.

- Choose Submit a VAT Return/Set up a VAT Direct Debit Instruction, then click Submit a return. Copy the amounts from your QuickBooks return to the HMRC webpage.

- Once done, go back to QuickBooks. Then, click Mark as Filed.

After performing any of the 2 solutions above, you can close the books. This way, it'll protect the transactions entered in the quarter you just filed. Once you've paid off the liability to HMRC, you can now see the Record Payment button on your Taxes page to record the VAT payment.

To learn more insights about filing your VAT return, you can check out this helpful article: Submit a VAT return in QuickBooks.

Please know that I'm always here to help if you have any other concerns, @accounts36. Have a wonderful day ahead!