Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello SheilaMcC, thanks for posting on the Community page, You can mark the period as filed in QuickBooks Online, so it shows the amount and record the payment against that.

I was trying to pay the period 0123. All that shows under the TAB is the current period of 0423 (see screenshot) All the history of returns and payments going back years has not been uploaded!

Hello, @SheilaMcC.

I'm here to ensure everything is properly recorded to ensure the accuracy of your books.

When migrating from QuickBooks Desktop (QBDT) to QuickBooks Online (QBO), some transactions are converted into journal entries. Before adding any prior entries, I recommend running the Profit and Loss and Balance Sheet reports. This can help us check the accuracy of your data transfer. To verify your reports in both products, filter the date period to All Dates and the accounting method to Accrual. For more information, check out this article: Learn how features and data move from QBDT to QBO.

You may also pull-up the VAT Liability Report to view the taxable amount of sales, and payments.

Here's how:

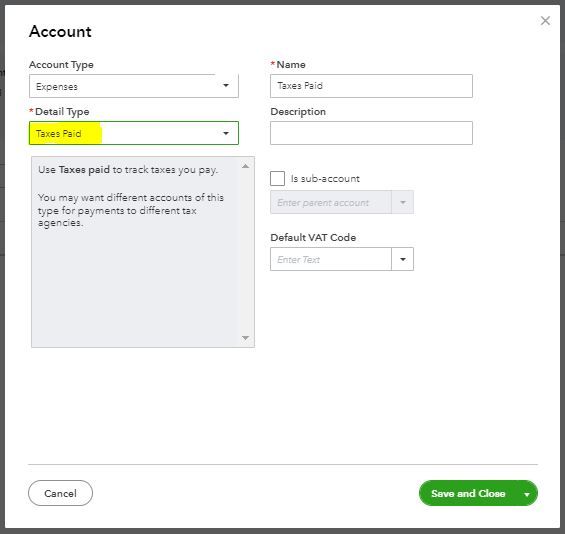

If you have outstanding liability, you can create an Expense transaction to record the payment. First, let's make sure to create an Expense account and use it in tracking the VAT payments. Here's how:

Once completed, follow these steps to enter an Expense or Cheque transaction to record the VAT payments.

Additionally, our support team can help answer any questions you have about the migration process. If you encounter issues at any point when migrating to QBO, email support@movemybooks.co.uk.

Furthermore, you'll want to check out this article to learn how to enter past sales and Accounts Receivable (A/R) transactions: Add Historical Information.

Get back to me if you have other questions about your VAT payments. We're always here to assist.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.