Thanks for reaching out to the Community, Gtr.

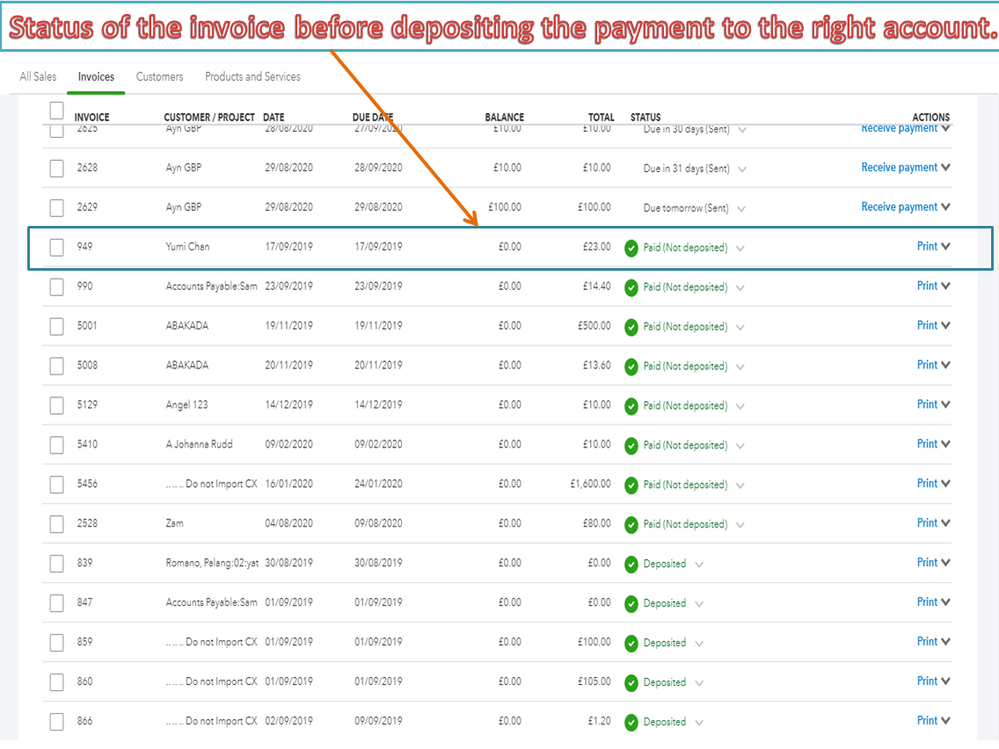

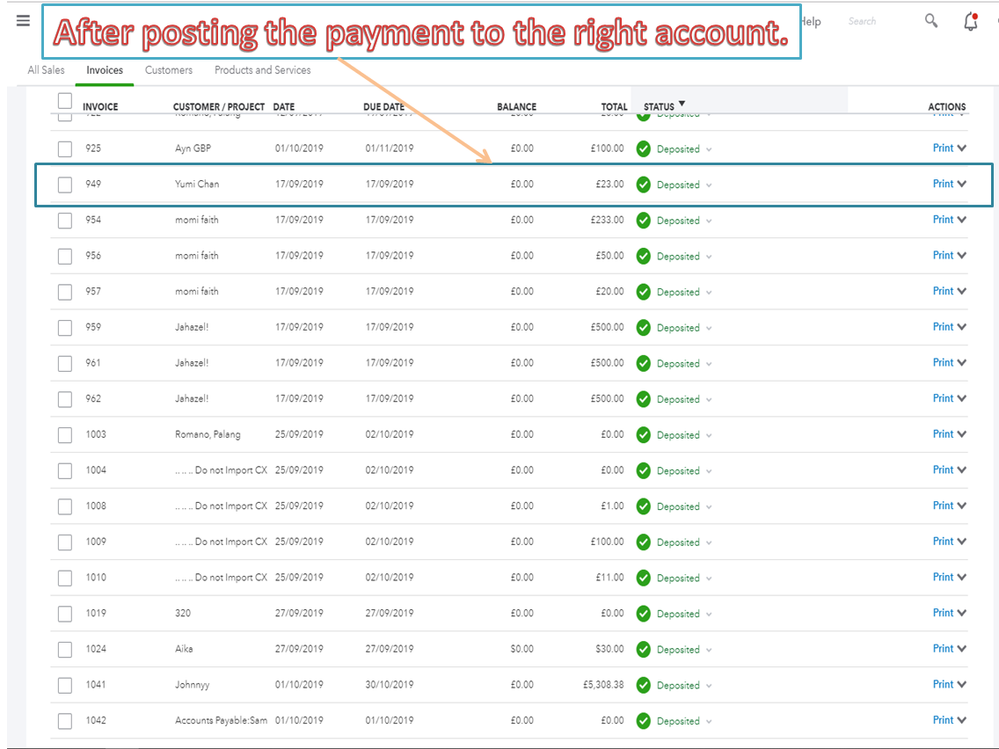

I can help clarify why your invoices show as Not Deposited in QBO. Then, make a deposit to change the status to Deposited.

The Paid (Not deposited) status indicates the payment isn't posted in your bank instead it’s recorded in the Undeposited Funds.

Allow me to show the process of how to correct the status of your invoices.

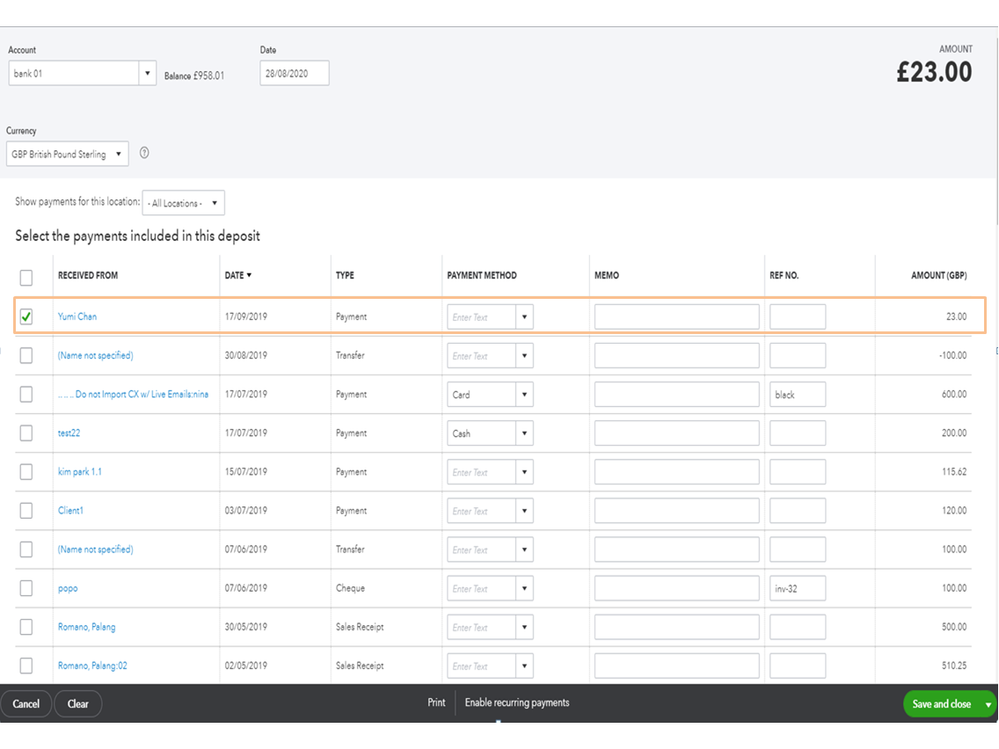

- Go to the + New icon at the left pane.

- Hit Bank deposit under the Others column.

- On the Account drop-down, select the bank account you wish to deposit the payments.

- In the Received from column, select the invoices by putting a checkmark on the box.

- Then, click Save and close.

Follow the same process to the remaining transactions you're working on.

Follow the same process to the remaining transactions you're working on.

The information I provided will point you in the right direction updating the status of the invoice to the right one. For additional resources, let me share the following articles. From there, you’ll find the complete steps to enter a deposit and then link it to an invoice.

Additionally, the Get Started guide contains articles about the processes you can perform in QBO such as banking, customers/vendors transactions, taxes, etc.

You can always visit the Community if you have any concerns or questions about QuickBooks. Please know I’m here to help and make sure you’re taken care of.