I understand the impact of this specific feature to your business. @Faith no More.

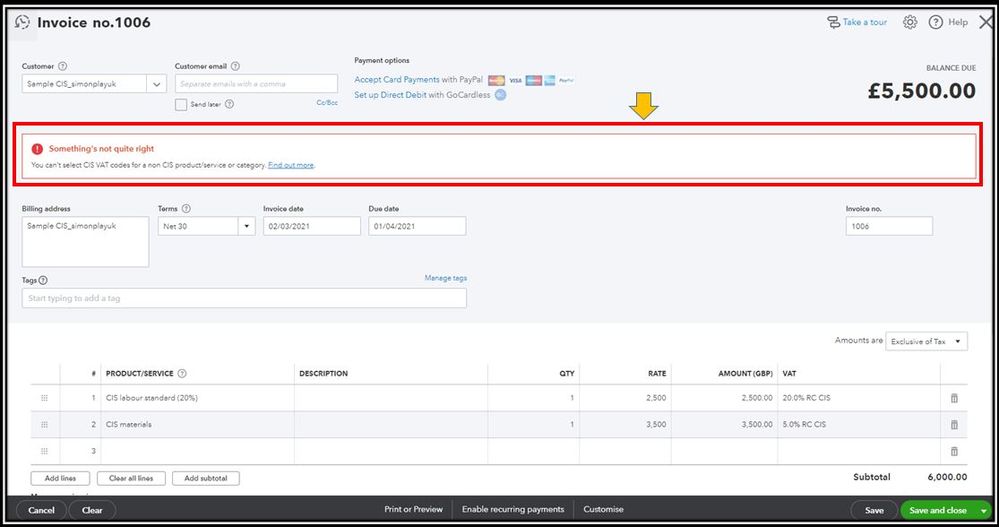

Currently, we've been receiving reports about the inability to use CIS Reverse Charge VAT codes in invoice line items.

Our product team are working hard to resolve this. In the meantime, you can use the workaround available. In order to save your transaction, please use the following temporary workaround:

- Please itemise the supplies and materials using "CIS Labour Gross (0%) - Sales Transactions (Invoice)

- Please itemise the supplies and materials using "CIS Gross (0%) - Purchase Transactions (Bill)

Also, make sure to use a relevant memo/description so that the transactions can be traced and updated once the data-fix has been deployed in order for the transactions to be updated with the appropriate account.

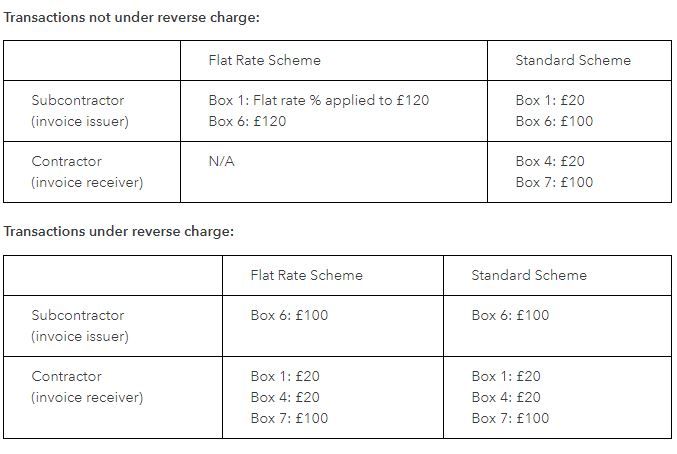

To determine how the codes affect the VAT return, check out this screenshot:

Lastly, you'd want to enable the VAT summary in your invoice so your contractor would see the exact VAT amount. Here's how:

- Go to the Gear icon.

- Choose Custom Form Styles.

- From the Custom Form Styles page, select the invoice template you're using.

- Click Action from Edit column.

- Select the Content tab.

- Click the Pencil icon to edit Footer settings.

- Mark the VAT Summary tick box.

- Click Done.

Also, if you choose to include VAT in the calculation, you can set the invoice to show it. Here's how:

- From the Edit invoices page, go to the Content tab.

- Click the Pencil icon to Edit the Contents of the invoice.

- Make sure to mark the VAT tick box.

- Select the Show more activity options link.

- Put a checkmark on the Show tax inclusive amounts tick box.

- Click Done.

You can read through this article to learn more about managing your invoice template: Customise invoices, estimates and sales receipts in QuickBooks Online.

For more information about the domestic reverse charge, as well as some guides on how to handle an invoice in QuickBooks, I recommend the following article: VAT: domestic reverse charge for building and construction services.

Get back to us here if you have other questions or concerns. I'm always here to help.