You can simply record it as you usually do, Rob. I'd be happy to provide additional insights below.

To match your payments in real life, you can record the amount you actually paid to HMRC. Please follow these steps to proceed:

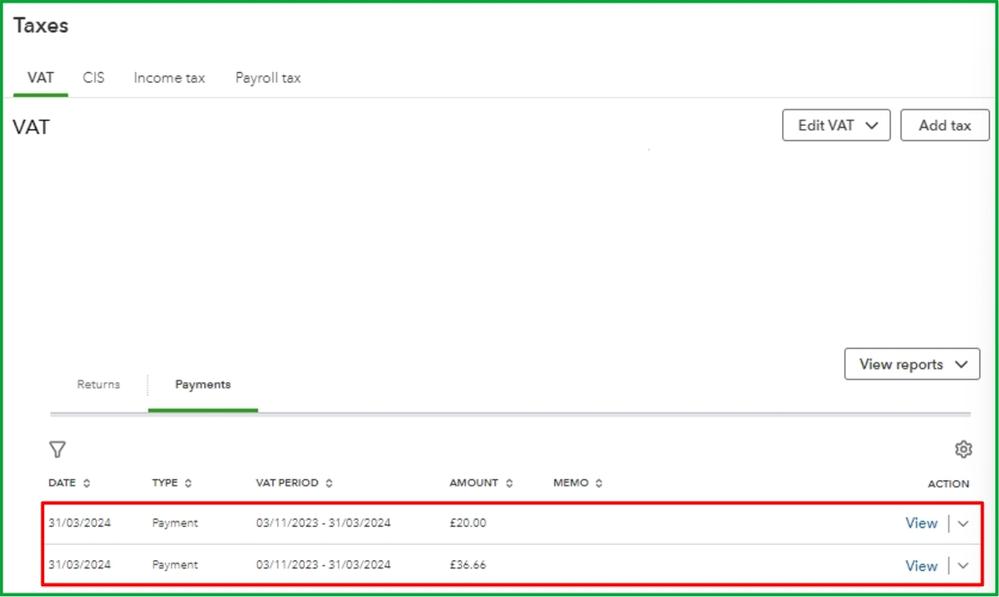

- Go to Taxes and select VAT tab.

- Click the dropdown menu next to the return.

- Tap Record Payment under the Action column.

- Choose the bank account you've used to pay HMRC.

- Enter the payment date and complete the appropriate fields.

- Once done, hit Save.

Refer to this article for more details about this process: Record a VAT payment or refund in QuickBooks Online.

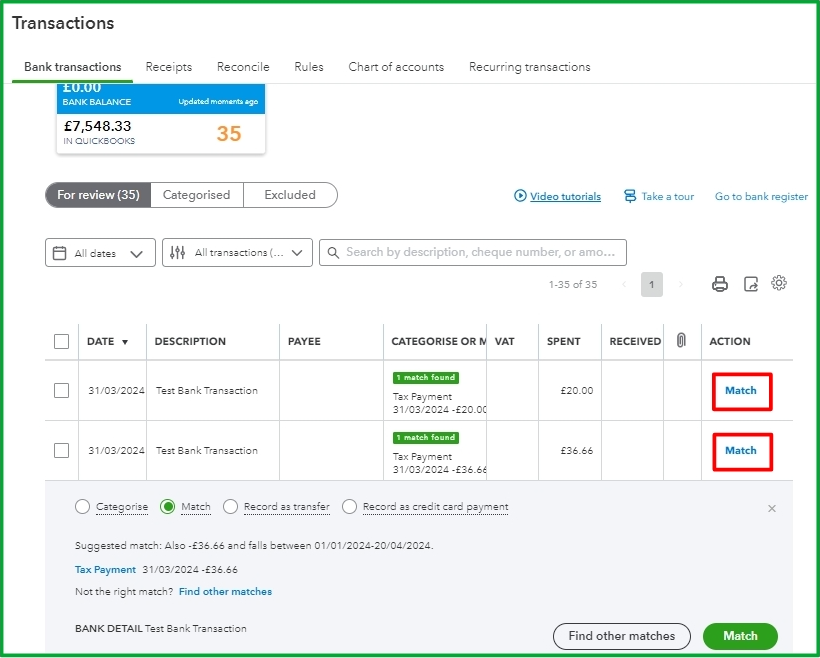

After recording the two separate payments, you can proceed with matching them to your transactions from the Banking page.

Additionally, you can check out this article to view various information on how to adjust the amounts on a return: VAT exceptions and reports in QuickBooks Online.

Should you require any guidance on recording VAT payments in QBO, feel free to get in touch. I'm here to support you whenever you need it.Have a great rest of your day!