Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I tried to file my VAT MAT for the quarter ended 31 March 2020 and it crashed.

Now doing 30 June 2020 and the position is:

- The 31 March 2020 data was sent to HMRC as they took payment for the amount due on 13 May.

- QB Desktop in VAT>Prior VAT returns does not show the 31/3/2020 return as processed

- If I Go into FIL VAT MTD it shows the 31 March 2020 return as filed (as expected, as they took payment), but the balance is the total showing for June quarter is the total of the March and June quarters.

So it seems that QB Desktop filed the March quarter but did not generate a VAT journal and put the VAT liability into accounts payable.

It seems I have to run the VAT return process on QB Desktop for 31 March quarter to clear out the VAT balanced and create the VAT liability so I can match it against the payment made on 13 May.

How do I fix this?

Mant thanks

Solved! Go to Solution.

It seems to have been a random crash. Spoke to support, did a manual VAT return from VAT 100 Report page, and then did the next VAT MTD return no problem. Worked in QBD Pro 2019, now updated to 2020.

Let's get rid of the MTD VAT crash error, Steven Segal,

You can start by updating QuickBooks Desktop to keep the software up-to-date and have the latest features and fixes. Here's how:

I've added these articles for other troubleshooting steps if you're getting the same results:

Once done, log in to your company file and submit VAT MAT for March 2020.

If the same issue issue persist, I suggest contacting our QuickBooks Desktop Team. They can further investigate why the system isn't creating a journal entry after you've submitted your returns.

Let me know how this goes by commenting below. I'm always around to help ensure you're able to clear out VAT balance in the system.

I had automatic updates on. I reset and updated again. All were installed except File Doctor, that came up with error 12007.

I then logged back in. The March 2020 VAT return said it was submitted - per my first post HMRC took the money on the due date - but I tried again and it threw out some error code and did nothing. I checked that it has not generated a VAT journal.

Clearly what happens is that "File VAT MTD" files with HMRC first and then updates QBD. Clearly what happened is that it filed with HMRC and then crashed. QBD clearly has a system to avoid a return being submitted twice, so I need to find a way to get QBD to do the return data transactions without trying to file at HMRC first.

Can this be done manually somehow? Possibly through "File VAT" rather than "File VAT MTD"?

Re previous post, I went into "File VAT" and it generated the 30 June VAT return. I then changed the dates to 1/1/2020 to 31/3/2020 and it generated the data for the return that has gone to HMRC and not been done on the system. If I press submit, will it correctly update the system?

Hello there, @Steven Segal.

I appreciate you letting us know that your QuickBooks is up to date and for sharing the error you received. I recognized the importance of being able to file the tax return on time and perform the task without any issues.

Based on the information shared, we’ll have to perform in-depth troubleshooting steps to resolve the issue. I have to collate sensitive information to pull up an account to verify it.

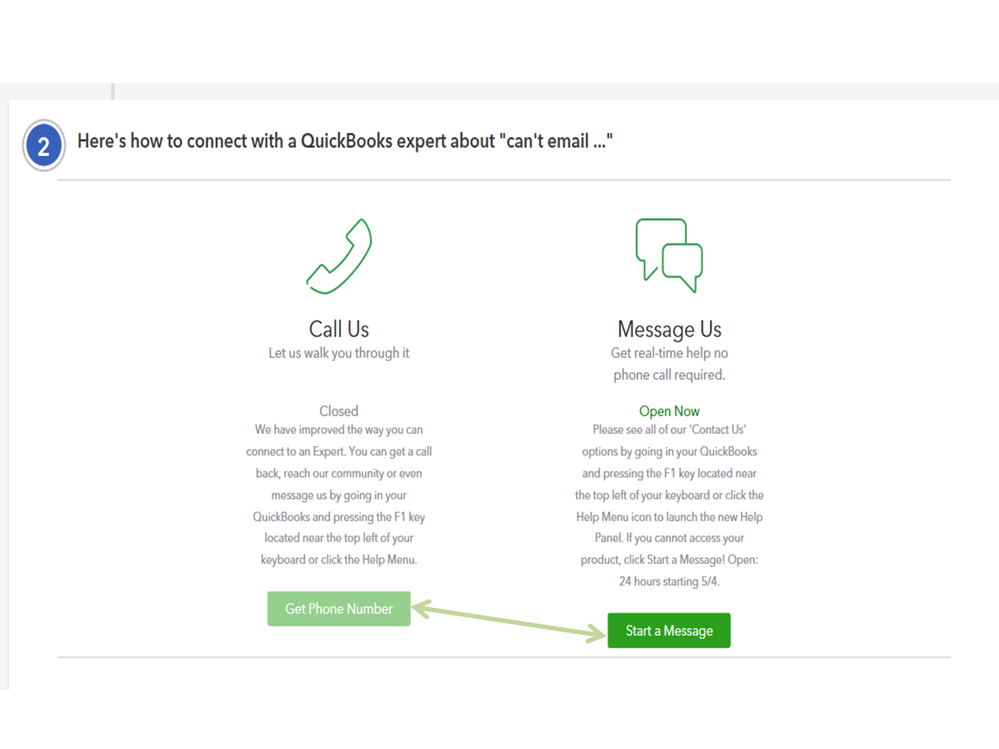

The Community is a public platform and I don’t want any of your personal data displayed here for security reasons. I recommend you get in touch with our Technical Support Team since they can access your company file in a secure space.

They have tools to configure the setup for your MTD and make sure you’ll no longer have to manually file the VAT return. Contacting our support can help prevent duplication of filed tax forms

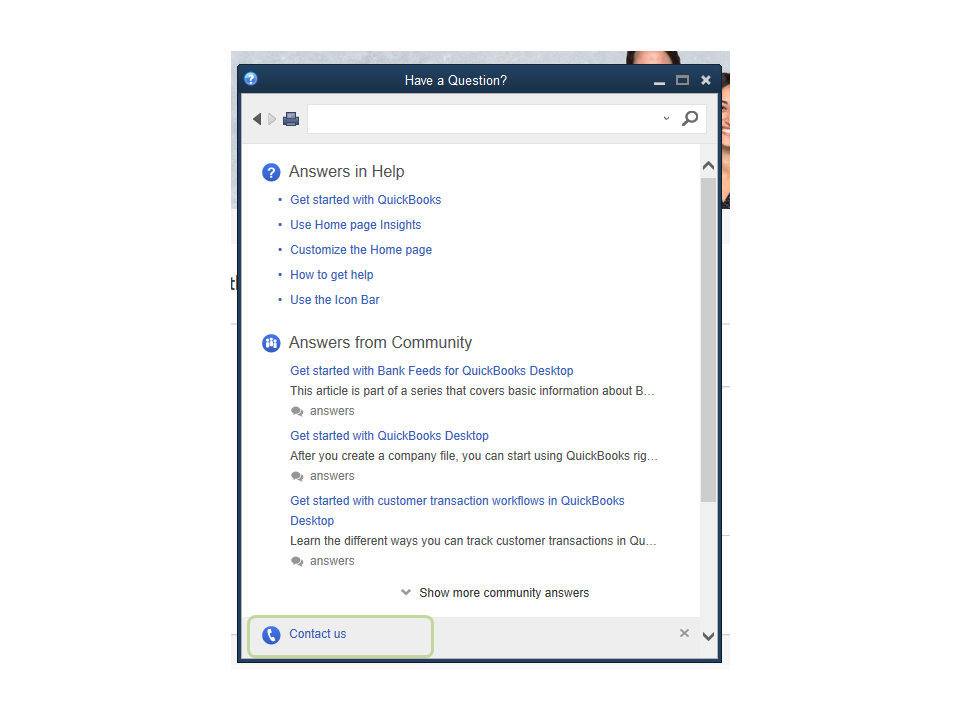

Here's how to reach them:

This will get you going in the right direction submitting the tax return. Also, I’m adding a link containing a breakdown of articles about filing the VAT return via the MTD: Making Tax Digital.

If there’s anything else I can help you with, click the Reply button and post a comment. I’ll jump right back in to assist further. Have a good one.

Thanks. Will do this and report back.

Regards

It seems to have been a random crash. Spoke to support, did a manual VAT return from VAT 100 Report page, and then did the next VAT MTD return no problem. Worked in QBD Pro 2019, now updated to 2020.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.