Hello there, @clarelg.

I've got some instructions to provide on how you can enter the reclaim for VAT under the Flat Rate Scheme (FRS) in QuickBooks Desktop.

To reclaim the VAT for FRS, you'll need to create a Fixed Asset item worth more than £2000 on a bill. This way, the Reclaim button will be available. Know that this process will not work if you're going to add the item from the Lists menu. It should be straight to the bill.

In doing this, make sure that the date for the item is similar to when the bill was generated. Since the VAT 100 Report is date driven and will depend on the transaction date.

To do that:

- Hit on Vendors at the top.

- Select on Enter Bills.

- On the Items Tab, click the first line under Items column.

- Tick on Add New.

- Create Fixed Asset Item then put appropriate amounts and accounts.

- Press on OK.

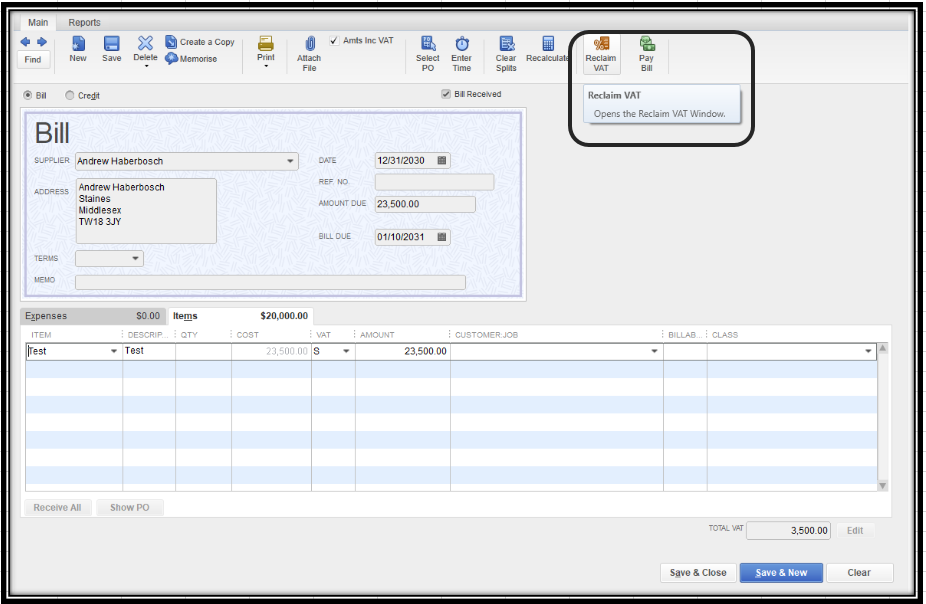

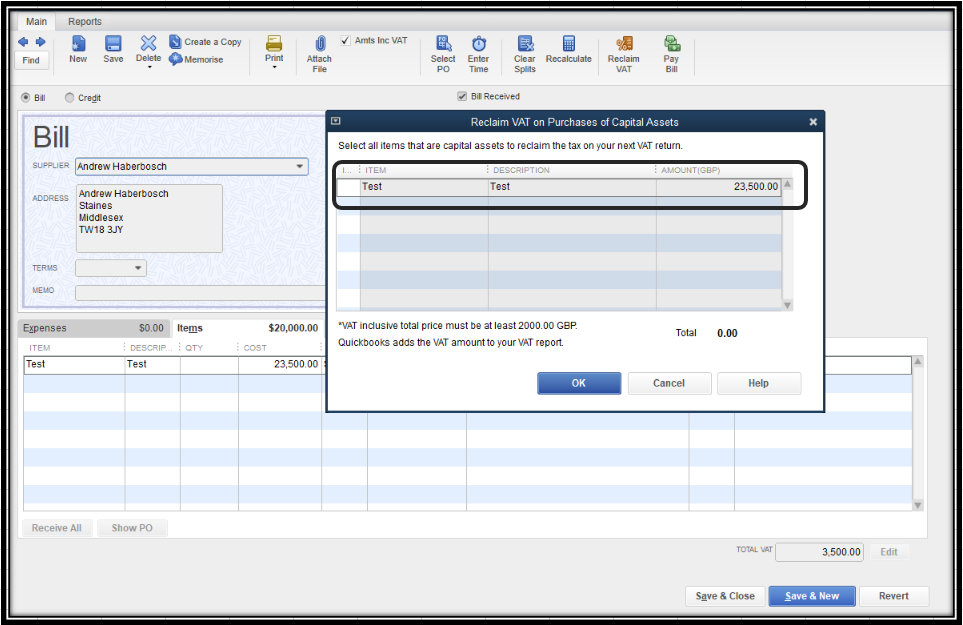

Once done, the Reclaim button will be now visible from the top and you'll just need to select the item that you made. I've attached sample screenshots below for your visual guide:

I'm also adding here some links that you can check out about modifying items and submitting a return in QuickBooks Desktop for your reference:

You can always visit me here if you have any other concerns. I'd be glad to help. Have a lovely day!

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Accept as solution"