I can assist you in adjusting the values in boxes 6 and 7 of your VAT return, @Aakruti.

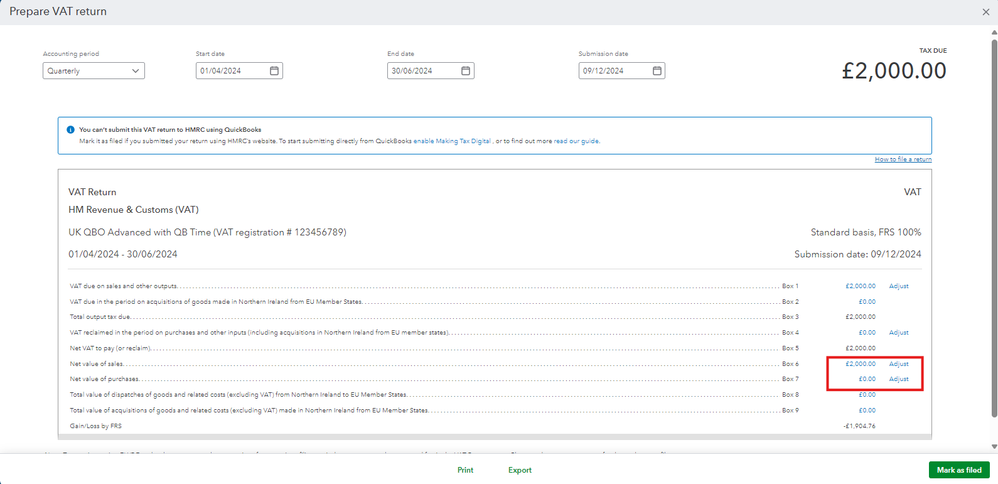

You can adjust the amounts in boxes 6 and 7 before submitting your information. QuickBooks will automatically generate a journal entry for these adjustments, which can be located in the audit log or through a search. These journals are recorded immediately upon creation. If you are using a flat-rate VAT scheme, you won’t be able to change these boxes, and you will need to consult your accountant. Here’s how to make adjustments:

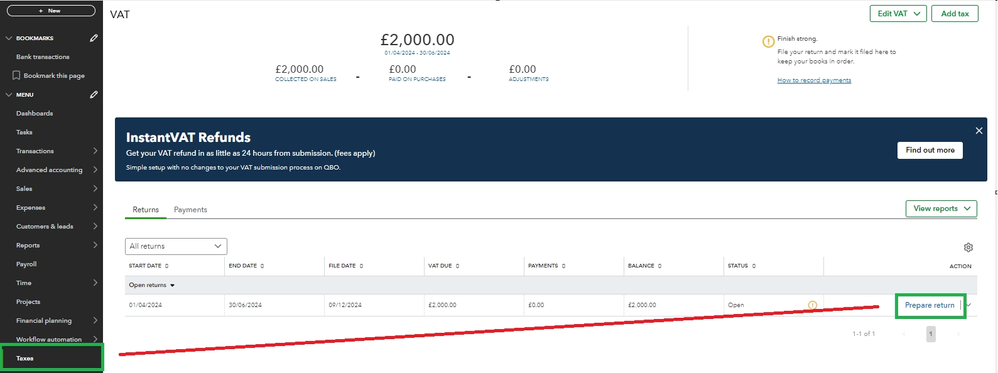

- Go to Taxes and select VAT.

- Click Prepare return for the period you are submitting for.

- Select Adjust next to the VAT line that you want to change.

- In the Adjustment amount section, enter the amount of the adjustment.

- Enter a Memo to describe the adjustment.

- Select Save.

-

If you have already submitted your VAT return, please contact our support team for assistance in making the necessary adjustments. For more information about VAT adjustment, visit this link.

Additionally, let me share this article to help you learn more about how QBO calculates VAT.

Let me know if you still have other concerns about your VAT forms. Have a great day.