Glad to have you here in the Community, @david-cobbold.

I can walk you through on where to locate the total VAT due and on how to access their information in QuickBooks Online.

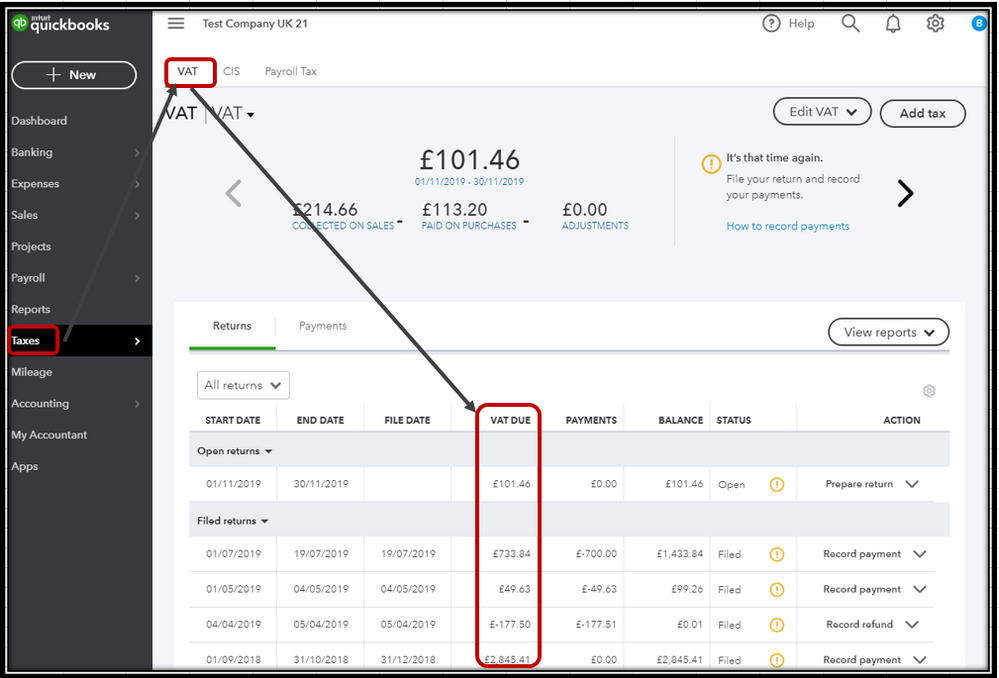

If you're referring to the total VAT due amounts for your transactions, you can access them through the VAT section on your account. Once you create any taxable entries in QBO, the VAT due amount can be seen in the said section.

You can go to the Taxes tab and refer to the VAT section. The amount will be displayed at the VAT DUE column.

Please see the screenshot attached for your reference:

![]()

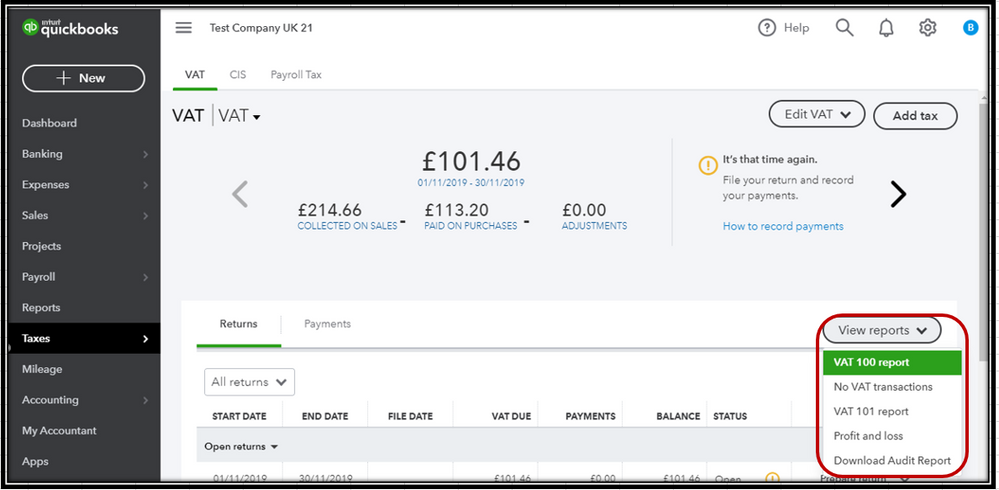

To view the total amount and the transactions attached to these figures, you may run the VAT report by clicking the View reports section on the VAT page. Here's a sample snip to guide you:

![]()

You can also pull up the VAT Summary and VAT Detail report as it also contains the total amount of the VAT entries on your account together with their information.

However, if you're referring on how to be a VAT registered and on how to get this information, I recommend reaching out to HMRC so you'll be guided accordingly.

Lastly, if you need help with setting up and submitting a VAT return in QBO, these articles attached got you covered:

Let me know if there's anything else you need about this or with QuickBooks. I'll be around to lend a helping hand. Take care, @david-cobbold.