If your business is VAT registered, you’ll need to activate your VAT module in QuickBooks. This is an important step to make sure that VAT is ready for use when you’re creating your invoices.

If you are bringing over your existing spreadsheets to QuickBooks, you need to make sure VAT is activated before importing your excel spreadsheets.

Below are the steps to set up your VAT in QuickBooks.

- Select Taxes on the left hand menu, this takes you to the VAT page.

- Press the Set Up VAT button to activate VAT.

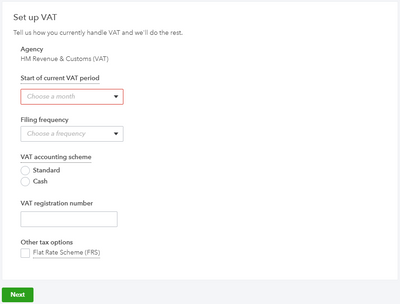

- On the Set Up page, fill in the following fields to complete the process.

- Start of current VAT period

- Filing frequency - the frequency you submit your VAT return.

- VAT accounting scheme - this determines which transactions are added to each VAT period:

- Standard: You pay VAT as of the invoice date

- Cash: You pay VAT after your customers pay you

- VAT registration number

- Other tax options: Flat Rate Scheme. Only choose this scheme if you're registered for flat rate VAT.

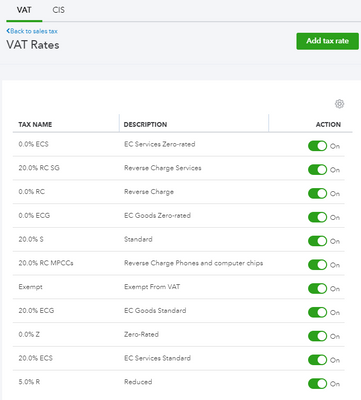

- To view the VAT codes that have been set up for you, click on Taxes on the left hand menu, then click on the Edit VAT dropdown followed by Edit rates.

- If you need additional VAT codes, click on Add tax rate button and fill in the necessary fields.

To find out which VAT codes to use for your business, visit HMRC page or speak to your accountant.