We can perform some troubleshooting steps to trace why not all transactions go into the VAT control account, 24Des.

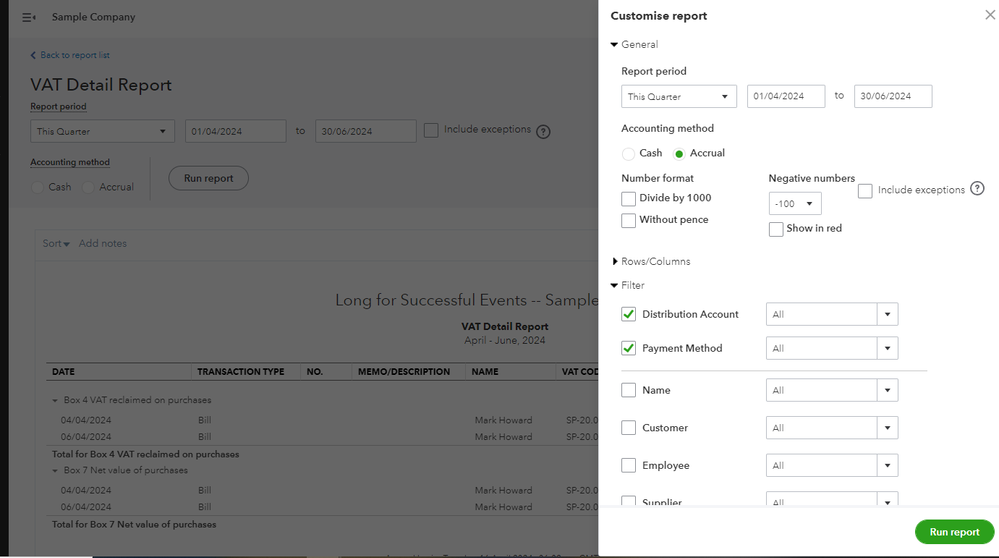

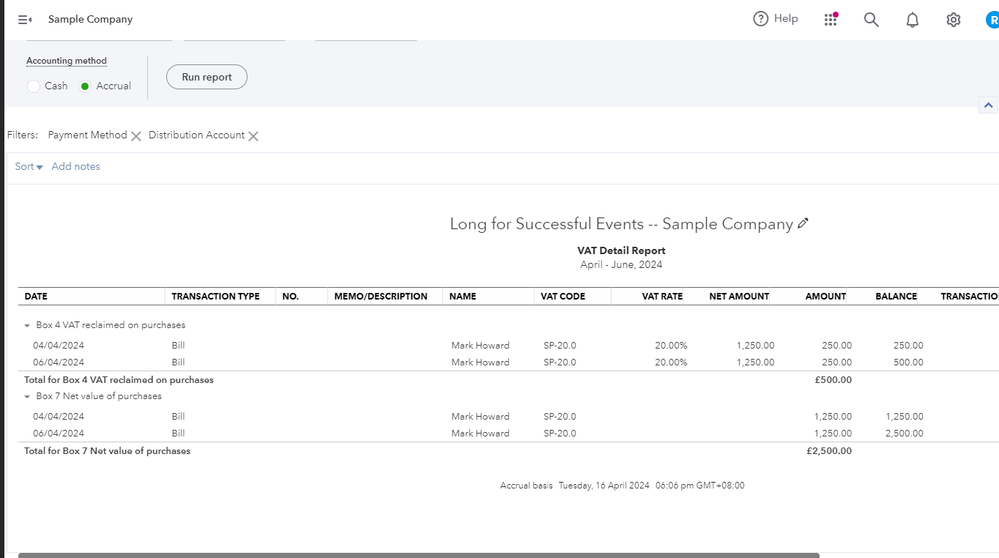

We can run the VAT Detail report to check all the bank transactions with the corresponding VAT. This report lists all transactions that are included in each box on the VAT return. Then, we can customise the report as to Distribution Account and Payment Method to see all bank transactions with the VAT linked. Here's how:

- Go to Reports (Take me there).

- Enter VAT Detail Report in the Search field.

- Select the report period and desired date range.

- Tap the Customise tab.

- Click Filter.

- Choose Payment Method and select the bank.

- Select Distribution Account and choose the specific account.

- Press Run report.

If there are bank transactions not linked to specific VAT, just double click for you to assign the correct VAT. The amounts on the VAT report are calculated for the dates you choose at the top of the report screen. Also, if you've backdated any transactions or made any changes to a transaction you have already filed (known as Exceptions), these will not be included on this screen. To see these transactions (known as Exceptions), just refer to your VAT Exception Report, or go to the Submit return screen.

I've added this helpful resource that you can open to have a detailed look at the taxes you owe and the reason you owe them: Check how much VAT you owe in QuickBooks Online.

Feel free to visit these articles to understand more about VAT exceptions in QuickBooks Online:

I'm just one reply away if you have any follow-up questions about managing your VAT account or customising other VAT reports. The Community is always available to make sure all your QuickBooks needs are taken care of.