Hello, @craig39.

You can create a vendor/supplier credit with vat code added to record the transaction you received from your vendor.

Here's how:

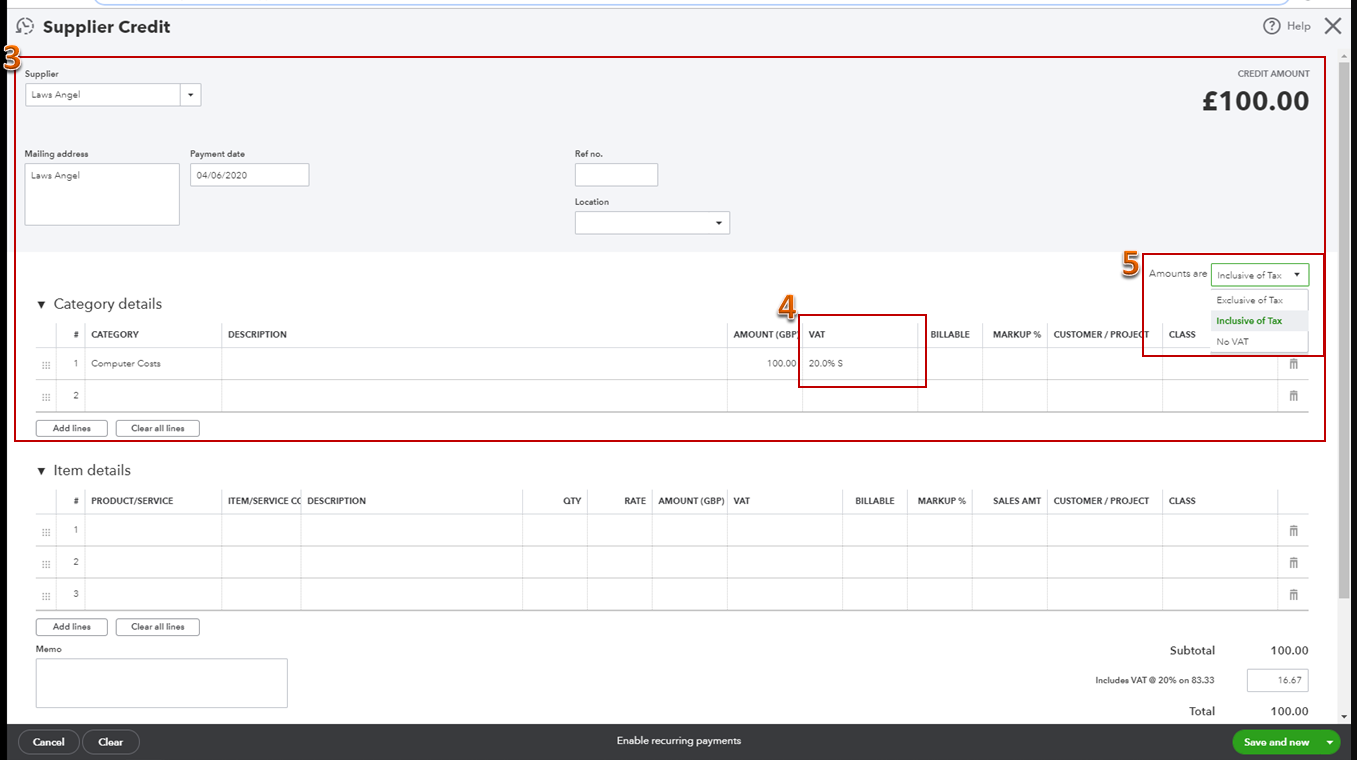

- Go to the New (+) icon at the left pane.

- Select Supplier credit under Suppliers.

- Fill in the necessary information on the Supplier Credit window.

- Select the 20% VAT code under the VAT column and select whether the amount is Inclusive or Exclusive of Tax.

- Save the transaction.

For additional reference about handling supplier credit and refunds in QuickBooks Online, check out this article.

If you need assistance with anything else, mention me in the comment section. I'll be ready to help. Have a great day!