Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hi

Im getting the We can’t connect to HMRC right now message and was told by quickbooks to speak to HRMC which Ive now done , they say there is no problem their end

Ive checked my status and details in quickbooks and HRMC and all the details are correct

I have just changed from sole trader to ltd company 01/04/2022 and my VAT number is staying the same

My last Vat qtr was 01/01/2022 to 31/05/2022

The open return on Quickbooks is showing from 01/05/2022 to 30/06/2022 so just 2 months

Any ideas how I might resolve this issue

Thanks

Hello there, @brodders1963.

I found an earlier post linked to your profile about connecting to the HMRC issue. My colleague already posted a response in the other thread so I've included the link below for easy navigation.

We can’t connect to HMRC right now.

If you have any other questions about the HMRC connection, please let me know by leaving any comments using the Reply button. I'll be here to lend a hand. Take care and stay safe!

Have you managed to sort this one? because im close to requesting my money back and going elsewhere.

Hi dboulter, thanks for joining this thread - 'we can't connect to HMRC right now' is a non-specific message that appears when there is an issue with the MTD connection on the account. This could be due to invalid credentials entered when enabling the MTD connection in QuickBooks (please note: the authorisation process will accept PAYE credentials as well as VAT ones, however only VAT should be used) or the user submitting is the wrong user type (e.g. a client accessing the VAT center in QuickBooks when MTD it is only authorised on an Agent Services Account with the accountant). Do you see a specific prompt when selecting the 'Take action' button on your VAT dashboard?

Hi, I am getting the same message, "We can't connect to HMRC right now" fro VAT return. I used this on my last quarter with no problems but it has hit a brick wall with this one. I checked the settings and my MTD HMRC connection is ON , also showing as enabled but it won't go any further. Any help would be appreciated

Thank you for bringing this to our attention. I see the urgency of getting this issue resolved. I'm here to share some updates about being unable to connect with HMRC.

I've checked here on my end and found there's an ongoing investigation where users are experiencing the same issue stated above. Please know that our team is aware of this matter and is currently implementing measures to fix it.

Getting this fixed is our top priority, and rest assured that this issue is being taken care of with the utmost urgency. With this in mind, I recommend contacting our QuickBooks Online Support Team. They'll be able to add you to the list of affected users and notify you via email once this is fixed.

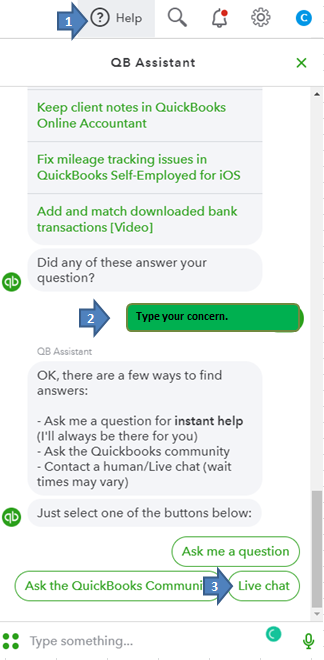

Here's how:

You can refer to this article for the time schedule: QuickBooks Online Support.

I've also added this article that includes answers to the most common questions about MTD for VAT: Making Tax Digital (MTD) for VAT FAQ.

Please post a reply below if you need further assistance with your QuickBooks-related queries. I'll be happy to assist you. Keep safe!

So does anyone have an update on this as we've got the same issue - every month having to disconnect and reconnect QB and HMRC connection. This time even that isn't helping. If this has been a known issue since January 2023 why isn't it fixed now??

Let me help you with connecting to Making Tax Digital (MTD) in QuickBooks Online (QBO), SueK01.

It's possible the credentials used for connecting QuickBooks Online to HMRC for Making Tax Digital (MTD) are not authorised to do a VAT filing. To resolve this, we'll need to check the following:

I'm adding this article to view the possible causes and other troubleshooting steps: Fix MTD issues and errors in QuickBooks Online. In case you'll still get the same error, I'd suggest contacting our Customer Support team. They can take a closer look into your account to review the settings and help you connect HMRC with QuickBooks. The instructions are outlined below:

You can check out this article for our most updated contact information: Support hours and types. For your reference with VAT processing in QBO, check our Resource page through this link: VAT for QBO United Kingdom.

I want to make sure I've got you covered. You can click the Reply button below for follow-up questions and clarifications about managing your taxes. I'll be in touch.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.