- UK QuickBooks Community

- :

- QuickBooks Q & A

- :

- VAT

- :

- We just registered for VAT and MTD in the UK. How can we claim back VAT paid in the 6 months before registration (as allowed by the law)?

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We just registered for VAT and MTD in the UK. How can we claim back VAT paid in the 6 months before registration (as allowed by the law)?

Solved! Go to Solution.

Labels:

0 Cheers

Best answer May 25, 2023

Solved

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We just registered for VAT and MTD in the UK. How can we claim back VAT paid in the 6 months before registration (as allowed by the law)?

Hello Community Users, we just wanted to pop in and update this thread. If you have not done any returns in Quickbooks and you want to claim Vat for a previous period not claimed for purchases. The way to do this would be by doing an adjustment on the specific box in the prepare return section (the VAT 100)

The steps to do this are shown below however we have included a more comprehensive article on how to do VAT adjustments here .

1.Go to Taxes and click on Prepare return.

2.Click the Adjust option next to the Box 4 amount.

3.Enter the Adjustment amount.

4.Add a memo about the adjustment.

5.Click Save.

Any questions we'd be happy to answer them here on the community!

0 Cheers

2 REPLIES 2

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We just registered for VAT and MTD in the UK. How can we claim back VAT paid in the 6 months before registration (as allowed by the law)?

Thanks for posting to the Community, @simone-nulli.

Allow me to chime and give you a solution.

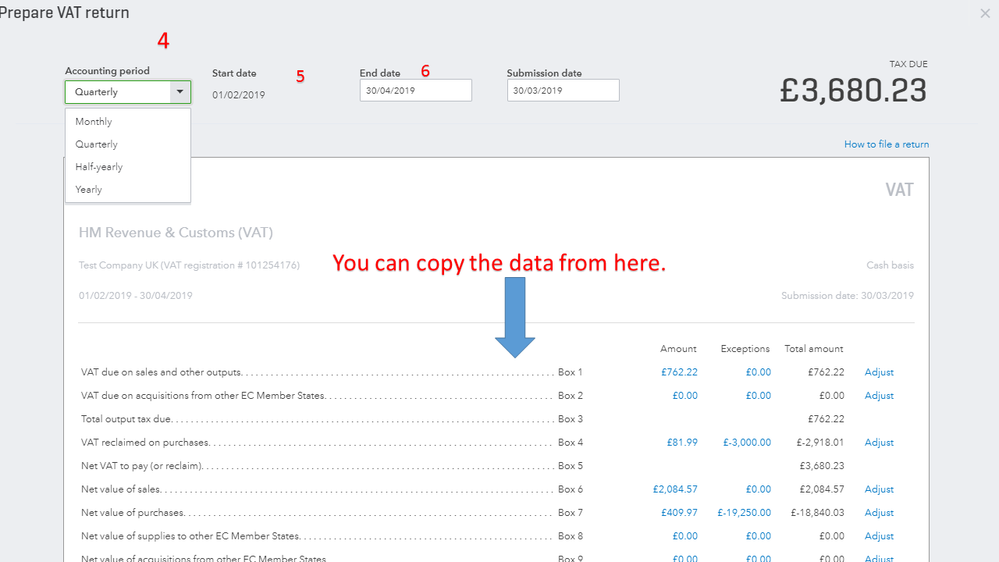

You can manually copy the data from the VAT return and enter them through MTD Bridging Tool.

Before that, have you already entered the products in QuickBooks? If so, let me show you how:

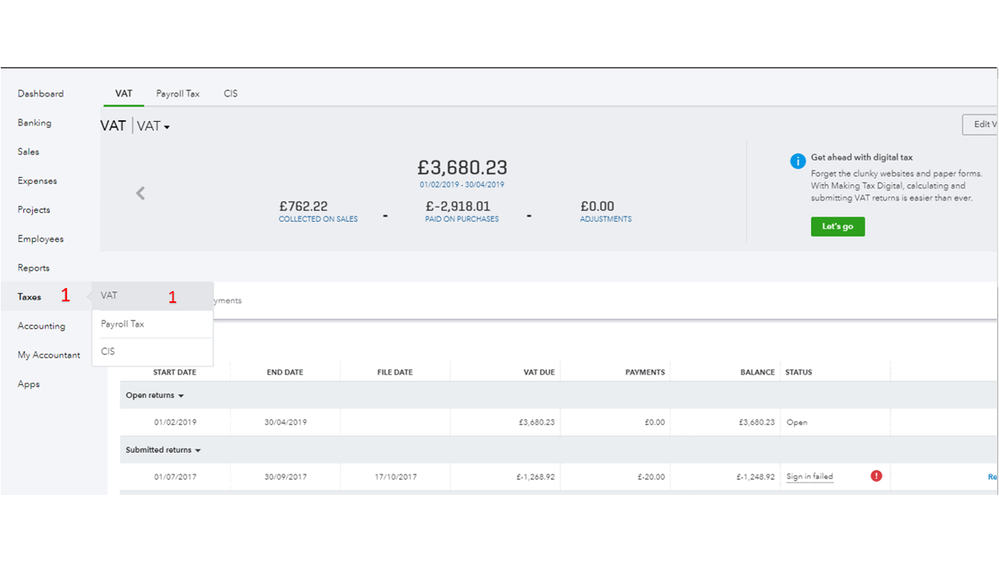

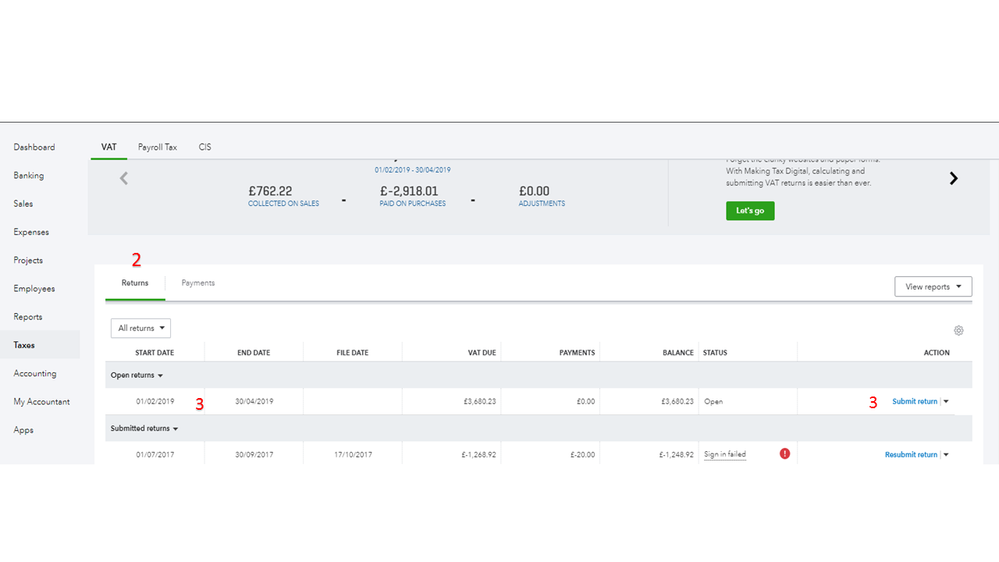

- Go to Taxes on the left panel, then choose VAT.

- In the Returns section, select the return you’re working on.

- Click on Submit return under the Action column.

- In the Prepare VAT return page, select the correct Accounting period.

- For the Start date, enter the period when you want to claim the tax.

- In the End date field, enter the current tax filing period.

However, if these haven't been recorded, follow the steps in this article: How to enter historical information. Once done, you have to enable the MTD feature in QuickBooks so you can submit the return through that option.

Here's how:

- Go to Taxes on the left panel, then click on Let's go.

- Click on the Gear icon at the top, and choose Account and Settings panel.

- Click on the Pencil icon for Making Tax Digital, then choose to Learn how to connect.

- On the Get started with digital tax page, click on Let's go.

Then, let’s authorize QuickBooks to interact with the HMRC. To guide through, refer to this page: Authorise QuickBooks to interact with HMRC - MTD for small business, and proceed to Step 2.

After completing this process, you can now submit the VAT return.

Please let me know or tag my name if you need further assistance. I'm more happy to help. Have a good one!

0 Cheers

- Mark as New

- Bookmark

- Subscribe

- Highlight

- Report Inappropriate Content

We just registered for VAT and MTD in the UK. How can we claim back VAT paid in the 6 months before registration (as allowed by the law)?

Hello Community Users, we just wanted to pop in and update this thread. If you have not done any returns in Quickbooks and you want to claim Vat for a previous period not claimed for purchases. The way to do this would be by doing an adjustment on the specific box in the prepare return section (the VAT 100)

The steps to do this are shown below however we have included a more comprehensive article on how to do VAT adjustments here .

1.Go to Taxes and click on Prepare return.

2.Click the Adjust option next to the Box 4 amount.

3.Enter the Adjustment amount.

4.Add a memo about the adjustment.

5.Click Save.

Any questions we'd be happy to answer them here on the community!

0 Cheers

Recommendations

Featured

Ready to get started with QuickBooks Online? This walkthrough guides you

th...