Hello @LankykatJAX,

I'm glad you've reached out to us here in the Community space. I can share information about entering journal entries in QuickBooks Online.

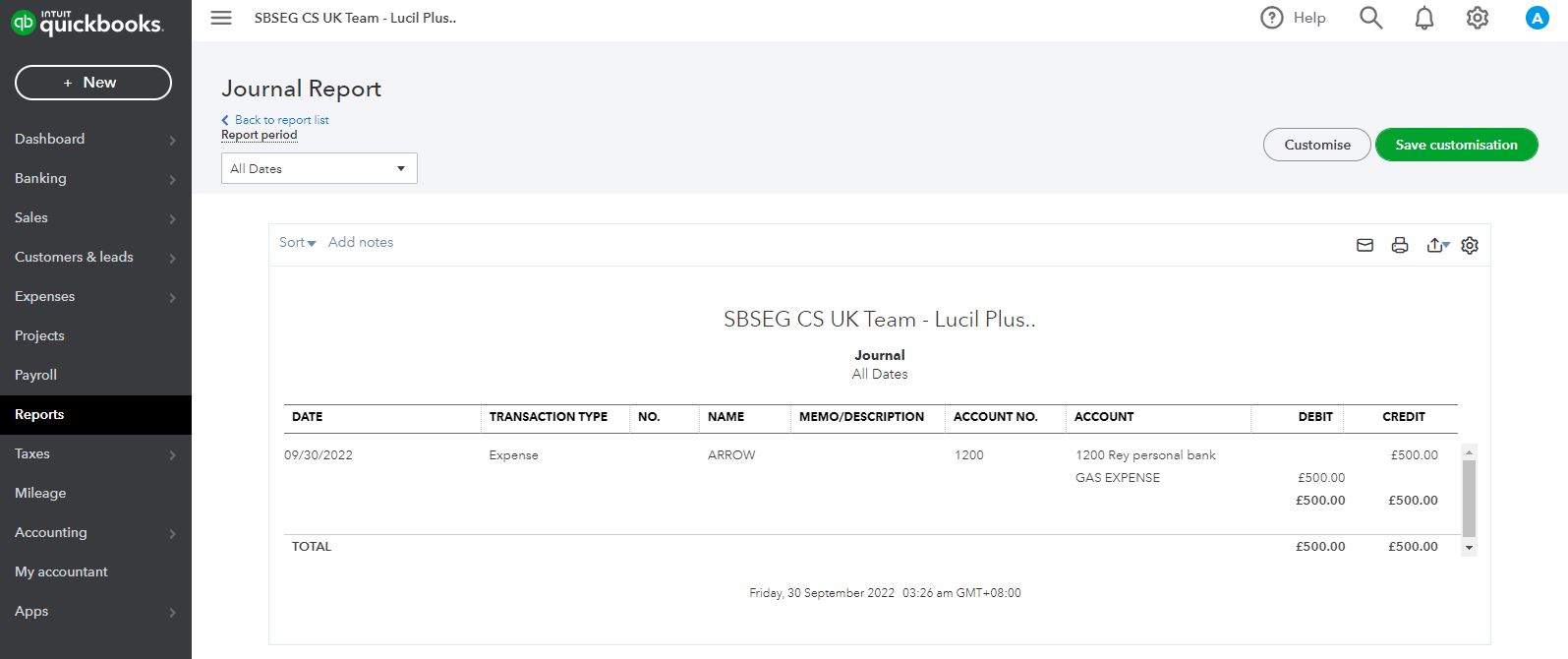

There's a rule of accounting related to expenses like gas purchases. When there is an increase in an expense, you will have to debit it. When there is a reduction, you will have to credit it.

You usually debit expenses and losses and credit incomes and gains. However, it would be best to seek expert advice from an accountant if you're unsure of what to choose or if you need additional guidance.

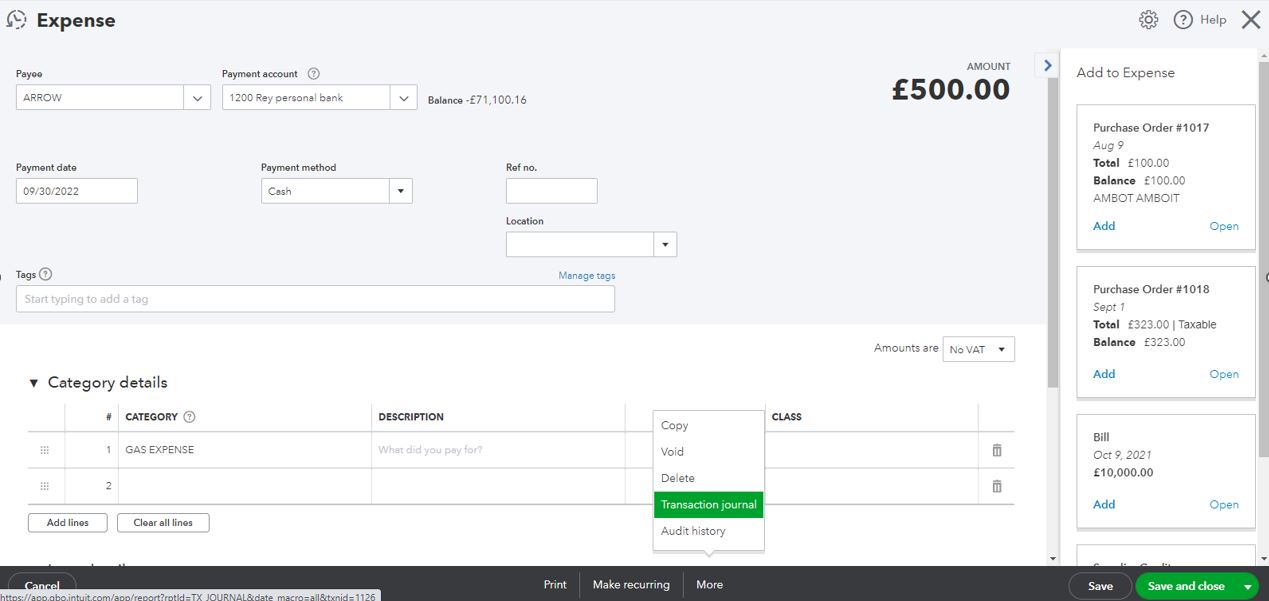

Alternatively, you can also complete your task by utilizing the Expense feature, then using Cash as the payment method. It automatically debits the expense and credits your bank.

Here's how:

- Click the + New option in the upper-left corner.

- Select Expense under Supplies.

- Enter the necessary information.

- Hit Save.

- Click More.

- Select Transaction journal.

- View the Journal report.

Also, did you know you can reverse a journal entry to swap the debits and credits or delete it entirely? You can check out this article to learn more about how you can perform the process in QuickBooks: Reverse or delete a journal entry in QuickBooks Online.

Click the Reply button below if you have additional concerns about entering a general journal. I'm always ready to lend a hand. Have a great day.