Hello,

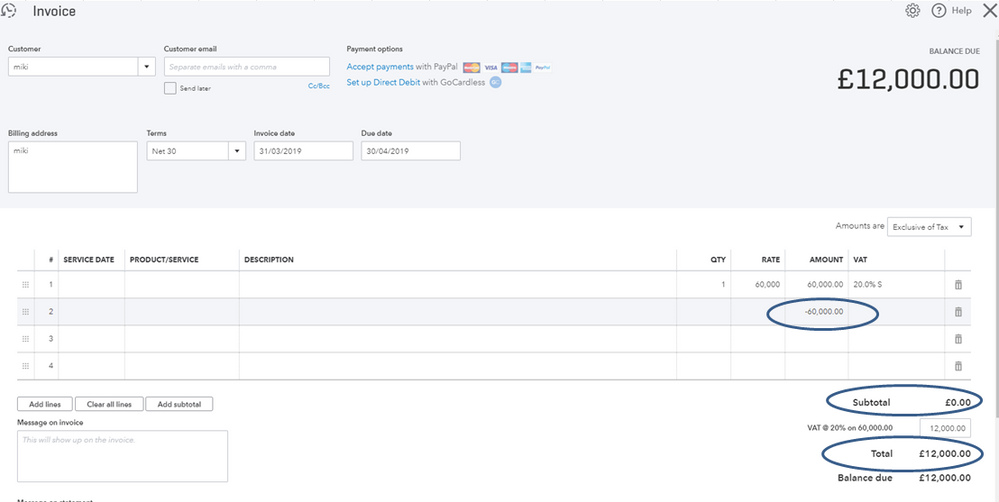

You’ll need first to manually calculate the invoice amount that could come up with the VAT of £12000. For instance the VAT rate is 20.0%, you can enter an invoice amount of 60,000 to get 12000 of VAT. To exclude the 60,000 amount from the total, you can create another line with the -60,000 to offset the amount.

I’ve attached a screenshot below to further illustrate the steps. I’d would still suggest consulting your accountant to record this properly in your books.

Please visit us again if you have other questions with QuickBooks.