Great to have you here in the Community, @Anonymous.

Let's get your VAT codes updated.

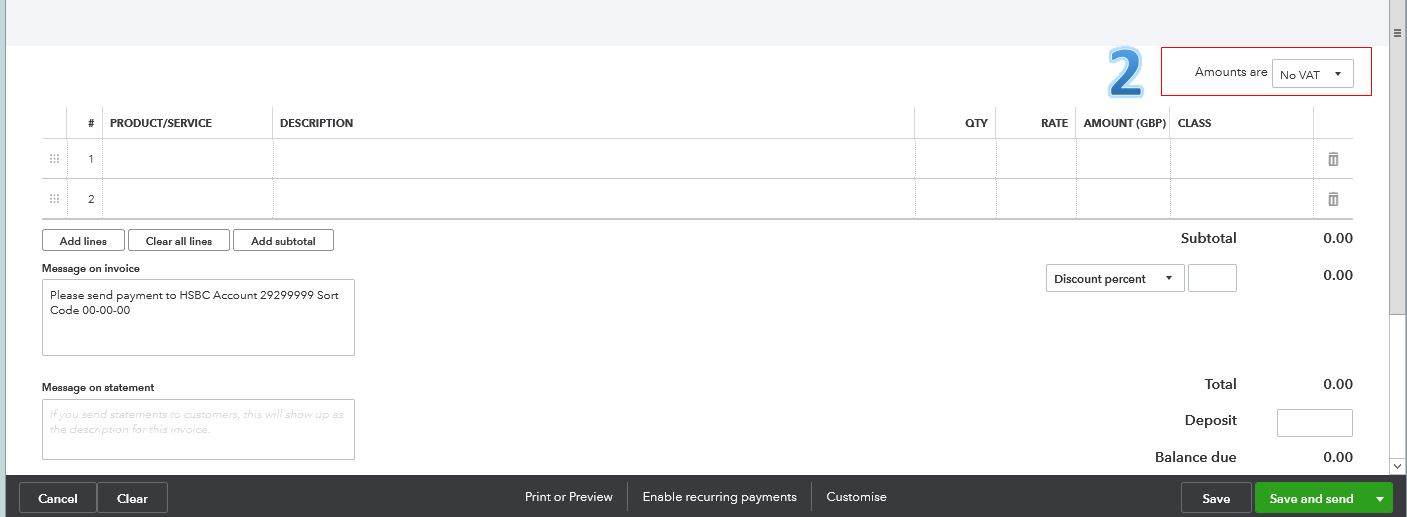

It's possible No VAT was selected on the Amounts are field when creating a transaction. This maybe the reason why the VAT amount isn't updated.

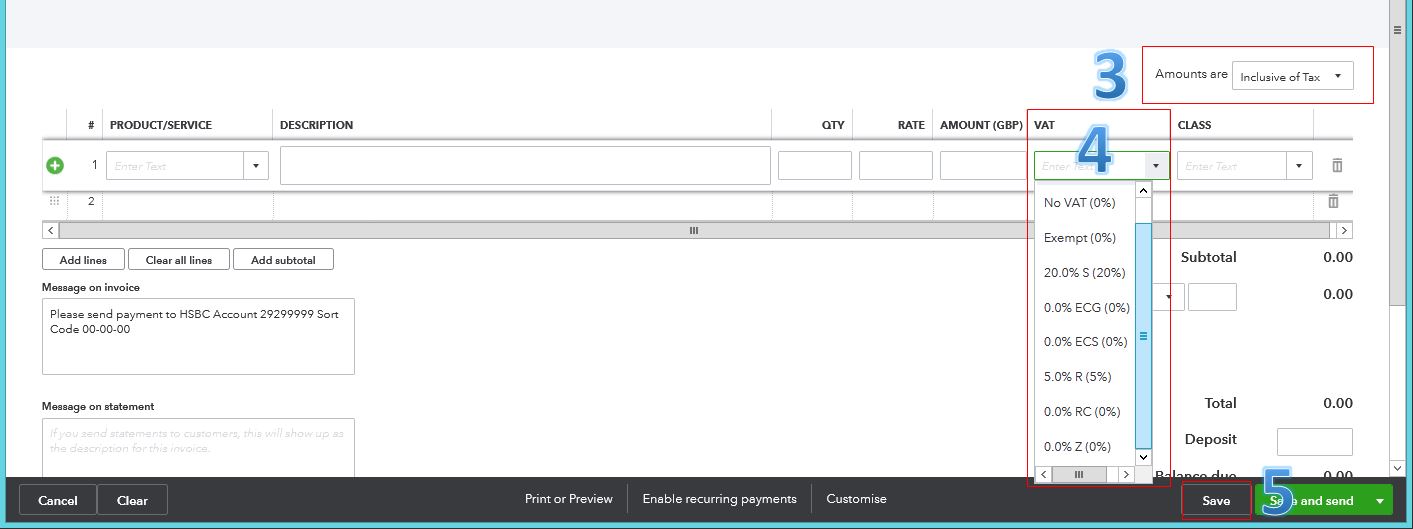

VAT return is based on the transactions created with VAT codes. To help fix this, you can manually open each transaction and review to see if the right tax code was assigned. If not, you can manually edit the tax code and assign it to the correct one. Here's how:

- Go to the transaction you created.

- Make sure the Amounts are field isn't selected to No VAT.

- Choose Inclusive of Tax or Exclusive of Tax.

- On the VAT column, select the correct VAT code.

- Click Save.

Once done, your VAT calculations will be updated in the system.

You can freely navigate all the VAT topics through these Help articles.

That's it, @Anonymous. If you need further assistance, please let me know. I'll be here to help.