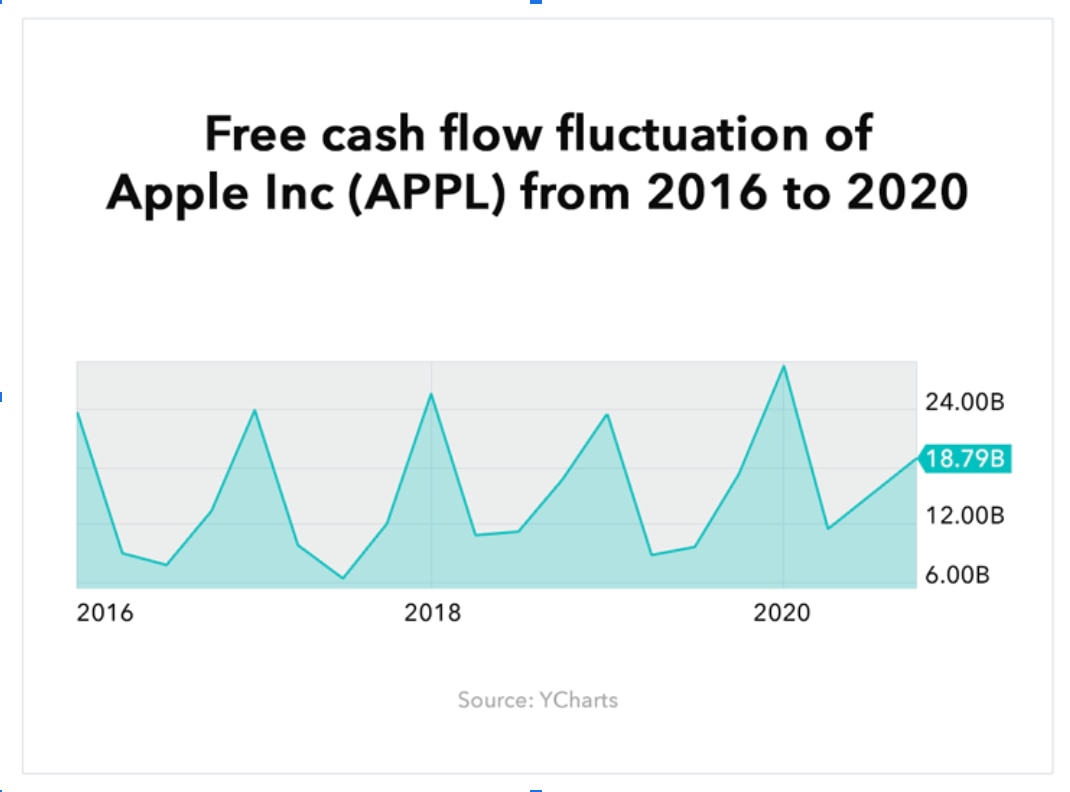

Free cash flow (FCF) is what metric business owners and investors use to measure a company’s financial health. FCF is the amount of cash a business has after paying for operating expenses and capital expenditures (CAPEX), and FCF reports how much discretionary cash a business has available. For investors, free cash flow is an indicator of a company’s profitability, which influences a company’s valuation.

Below, we’ll explore the importance of the free cash flow formula and what it reveals about a company’s financial performance. Keep reading for a comprehensive explanation of the free cash flow formula, or navigate directly to a section you’d like to learn more about.