An invoice number is a number assigned to uniquely identify invoices. It generally appears near the top of the invoice document so it can be easily noted by both the recipient of the invoice and the business providing it. Invoice numbers allow business owners to organize, categorize, and systematize payment processing in a clear and intuitive way.

In this article, you will learn:

- Why are invoice numbers important?

- How to assign alphanumeric invoice numbers

- How to use invoice numbers: A step-by-step example

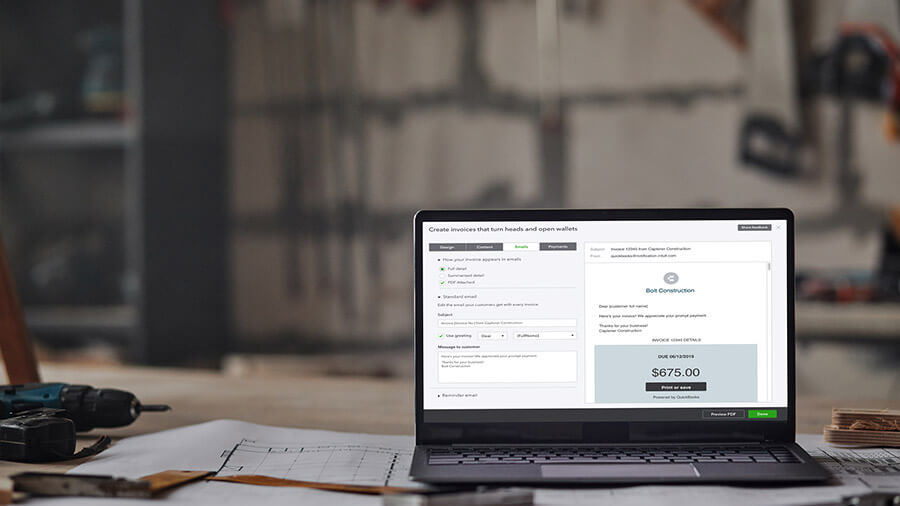

- Assigning invoice numbers with QuickBooks

- Actionable takeaways

Why are invoice numbers important?

Invoice numbers are important because they help businesses keep track of their invoices and payments they’re owed. When you help run a small business and work regularly with other businesses, you’ll likely have many expenses to keep track of. That’s where invoices, and invoice numbers, can help. When it follows invoice number format best practices, discussed in detail below, your invoicing system can become one of your best assets for managing the money coming in.

Businesses use invoices to inform clients of the various expenses they’ve incurred and to request payments. Part of keeping tabs on your money involves employing a smart system for tracking invoices. By creating a smart, intuitive, and scalable system for your invoices, you can make sure you get paid by all the clients who owe you—and that you’re paid up on all your incoming expenses.

Unique invoice numbers are important because they help you track a variety of factors that are critical for keeping your business running smoothly and profitably.

Here are a few benefits of organizing your invoices with invoice numbers:

Keep track how much money you’re currently owed:

By quickly identifying which invoices haven’t been paid yet, you can see how much money you’re waiting on. This can help you plan your monthly budget, see how much cash you can expect in the near future, and assess how quickly you can expect turnaround on invoicing and payment processing.

See which clients have paid:

You can use invoice numbers to track the invoices you’ve sent out, carefully noting which ones have been paid and which ones haven’t. If you notice that a particular client currently has one or multiple invoices unpaid and past due, you know who to reach out to.

Review client payment history:

Sometimes, a client may request information about past transactions they made with you or you might be curious about them yourself. By having well-organized financial records and invoices, cataloged thoroughly using your invoice number system, you can quickly and efficiently find any past payment in your system.

An invoicing system lets your business maintain a record of all its transactions. So, if something comes up in the future, it’s easy to look through old invoices to find the source of the issue. No organizational system is complete without a thorough way to catalog items, however. That’s why invoice numbering systems are critical to keeping your business productive.

Now that you have a good idea why invoicing and invoice numbers are important, you’re probably curious about the best ways to assign them.

How to assign alphanumeric invoice numbers

If you’re just starting out using invoices to bill clients, here are a few simple tricks you can use to ensure that your invoices are well-organized and easily searchable.

1. Start with longer numbers

Simply ordering invoices from '1' can get confusing as you scale up your operation. Start by using a longer number, like 1001, for your first invoice. The next invoice number should be a sequential number that’s easy to keep track of.

2. Use identifying numbers

As you sign new clients, assign them a client number in your internal database. Then, on each invoice sent to that client, append sequential invoice numbers. For example, your first client’s third invoice might be 1003, and your fifth client’s first invoice might be 5001.