What is a TPAR?

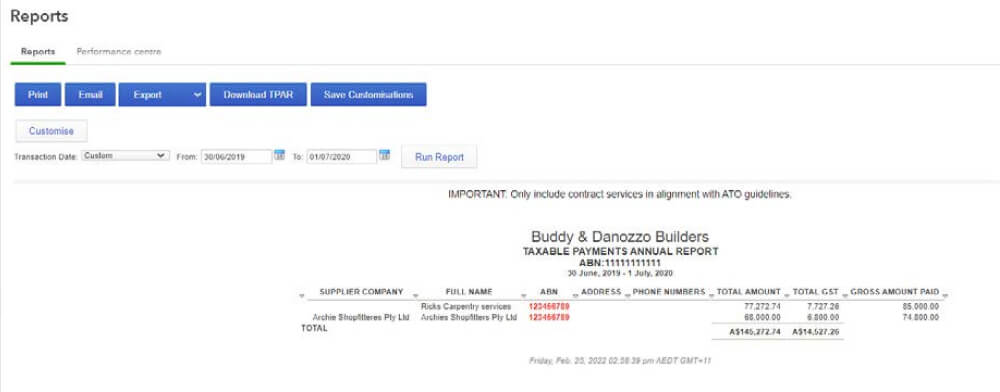

Businesses in Building and Construction, Courier, or Cleaning need to report the total payments made to contractor services each year.

Note: these industries may change, so it’s important to review the relevant ATO legislation.

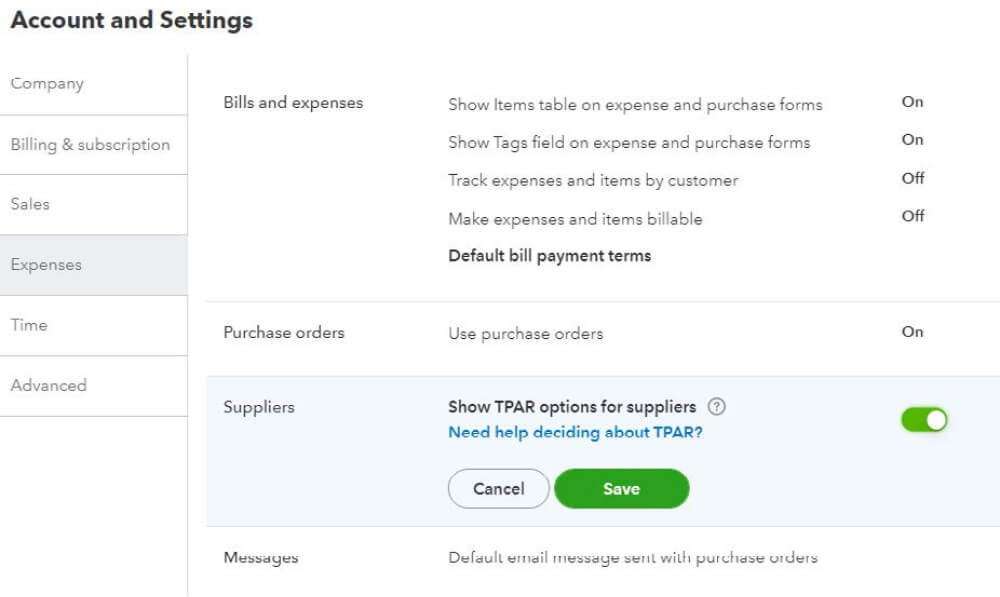

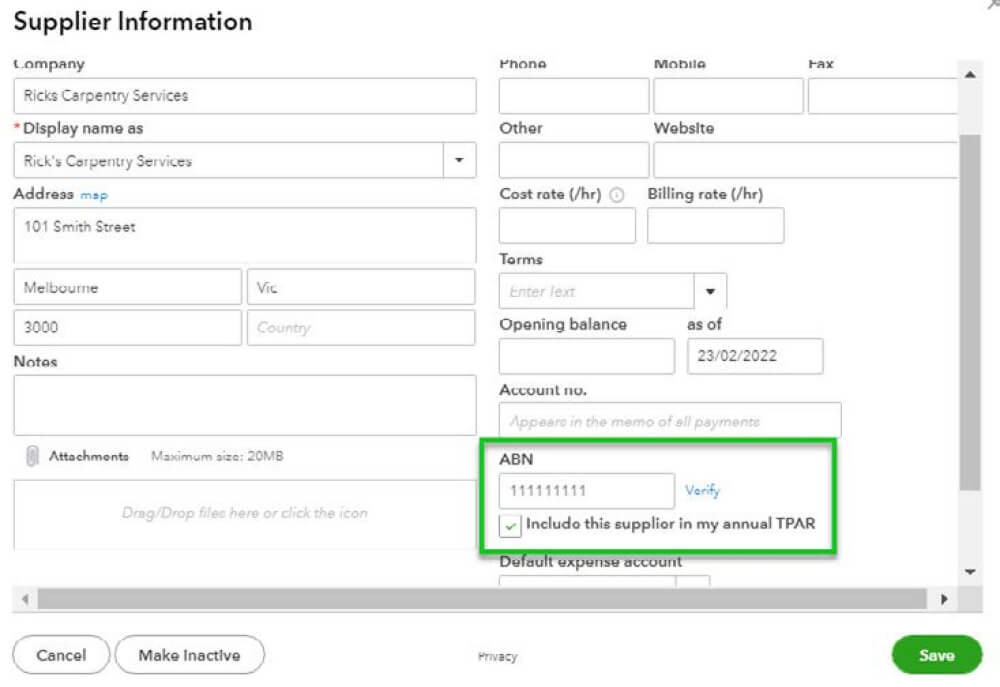

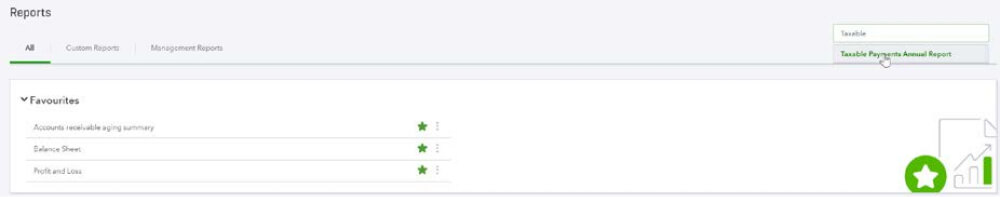

These payments need to be reported to the ATO by 28 August each year. QuickBooks Online enables each relevant transaction to be highlighted for inclusion in the TPAR report, ready for electronic export to the ATO.