Enable Payroll automations

Learn how to enable Payroll automations on QuickBooks Payroll powered by Employment Hero.

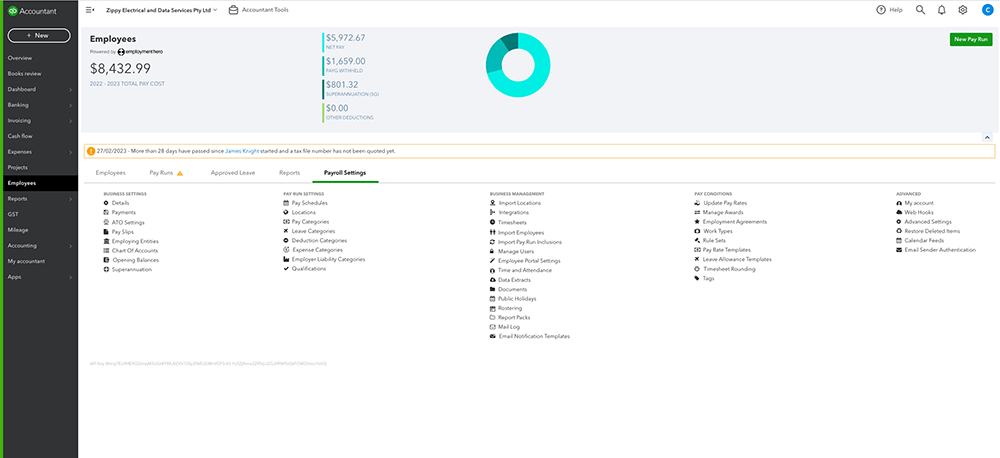

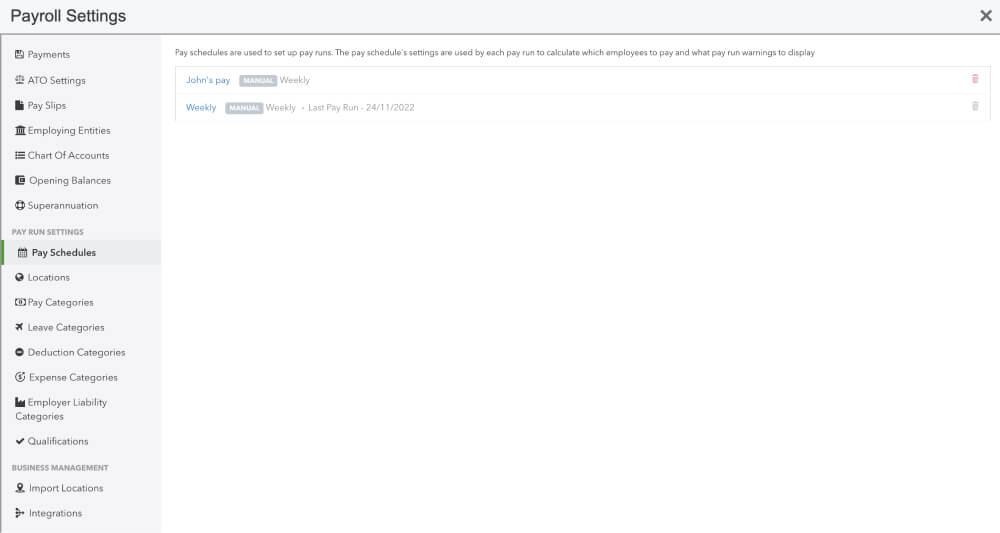

Step 1: Go to Payroll Settings

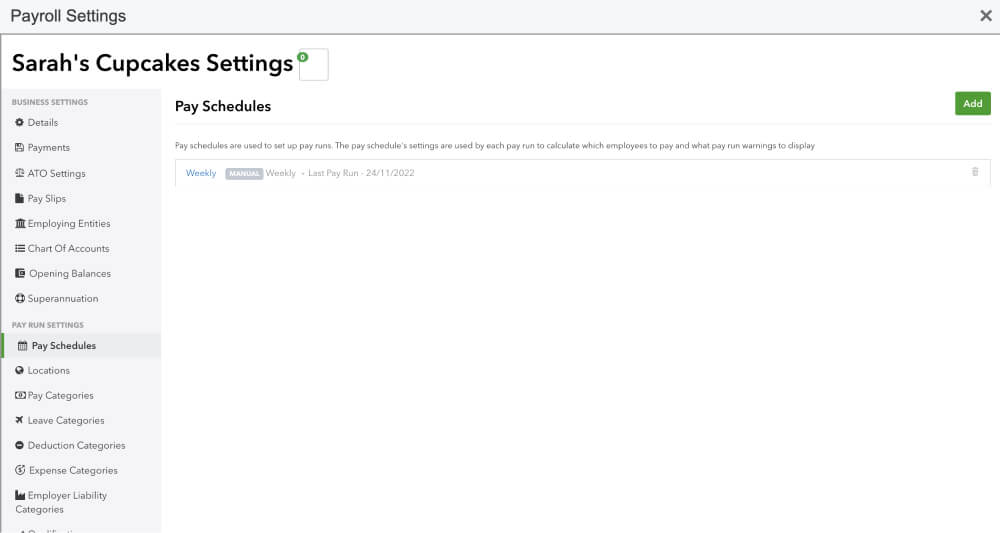

Step 2: Click Pay Schedules

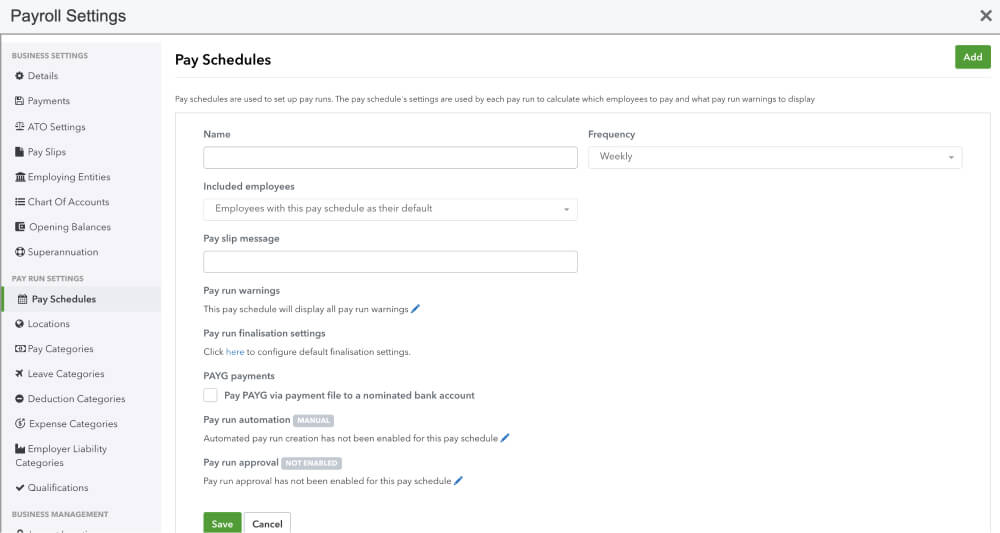

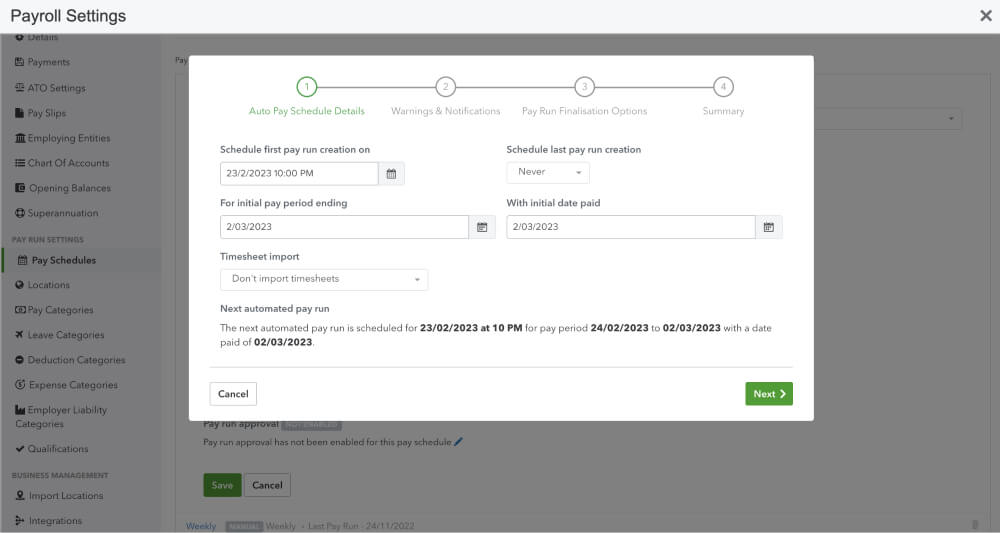

Step 3: Click Add button in top right corner

Step 4

Add your pay run details and frequency. Click next to be taken to the automated Payroll wizard and follow instructions.

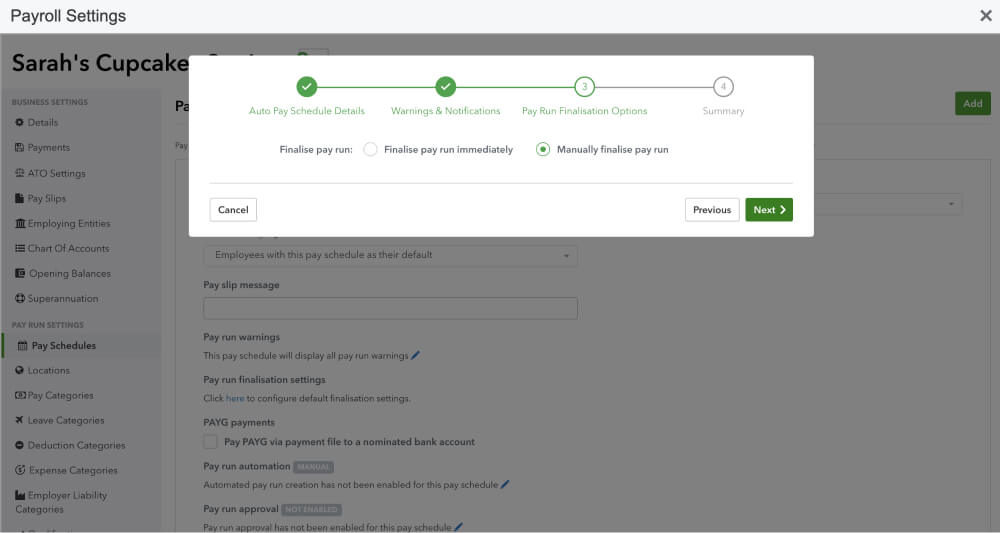

Automated Payroll Wizard

Step 5: Auto pay schedule

Select the Payroll automation frequency that works for you and if timesheet data needs to be brought across.

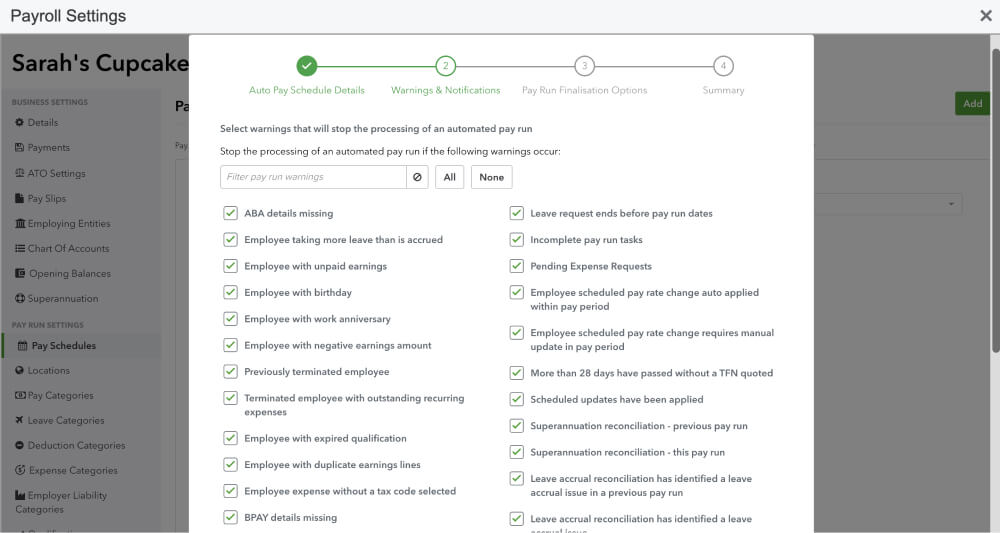

Step 6: Warnings & notifications

Select your preferred notifications to stop the automation and who needs to be informed to complete an action before the payrun is finalised.

Step 7: Pay run finalisation

Choose whether to immediately or manually finalise the pay run, and how to publish payslips, notify employees and generate reports.

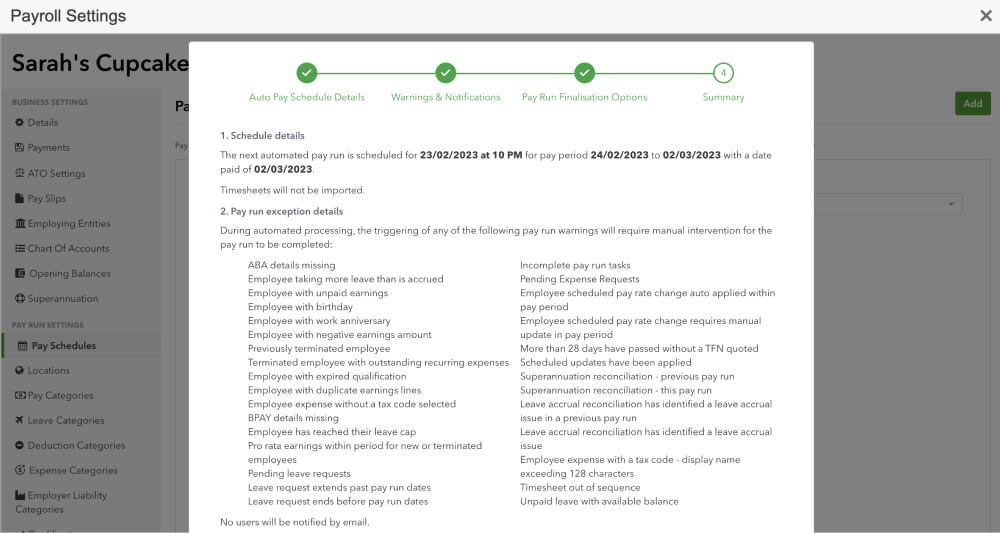

Step 8: Review & Complete

Check your configuration, click complete and you’ve set up your automated pay run.