We're here for you.

Why accountants choose us for their Payroll needs

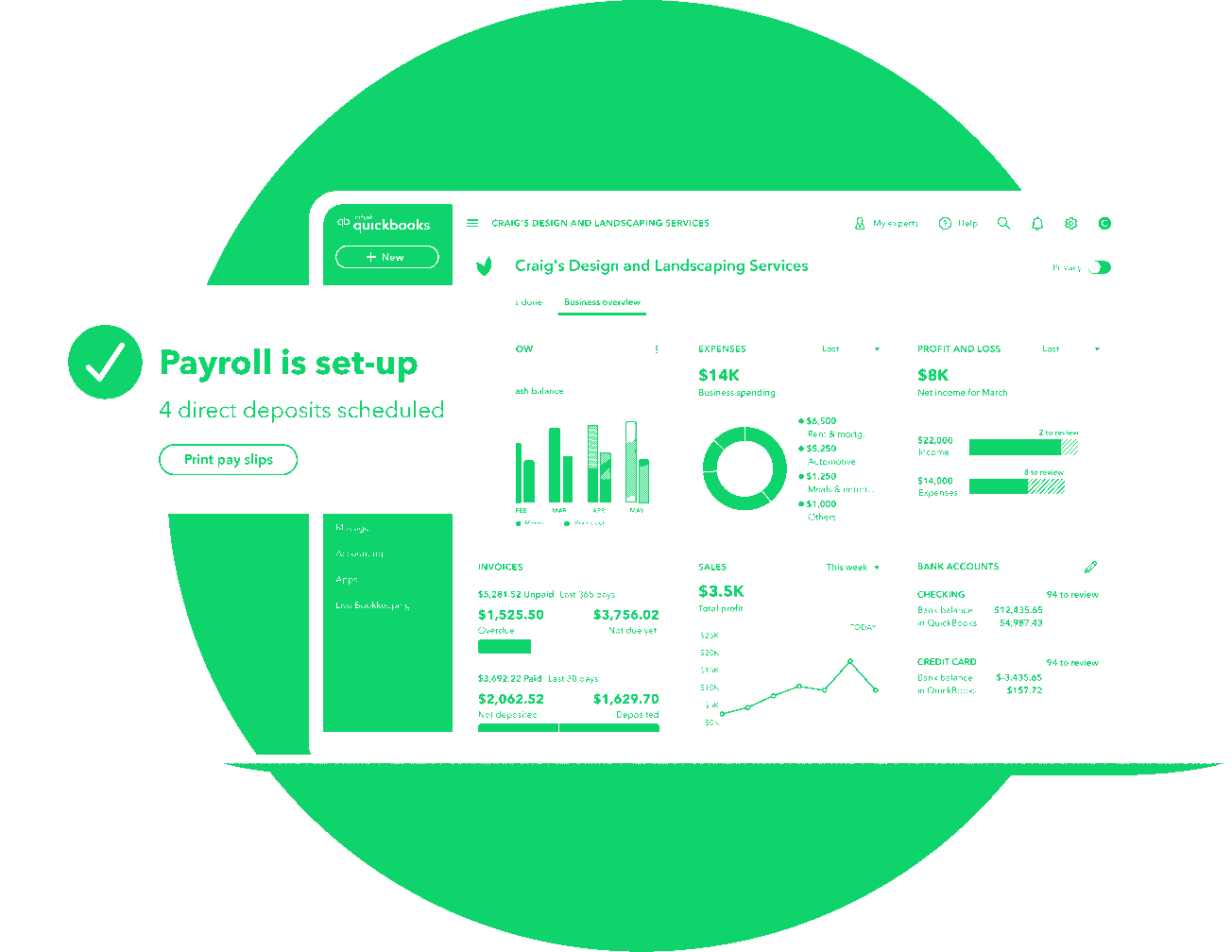

All-in-one integrated platform

We’re compliance obsessed

Award-winning customer support

Pick up the phone and speak to our dedicated payroll experts. No question is too big or small.

Built locally, loved globally

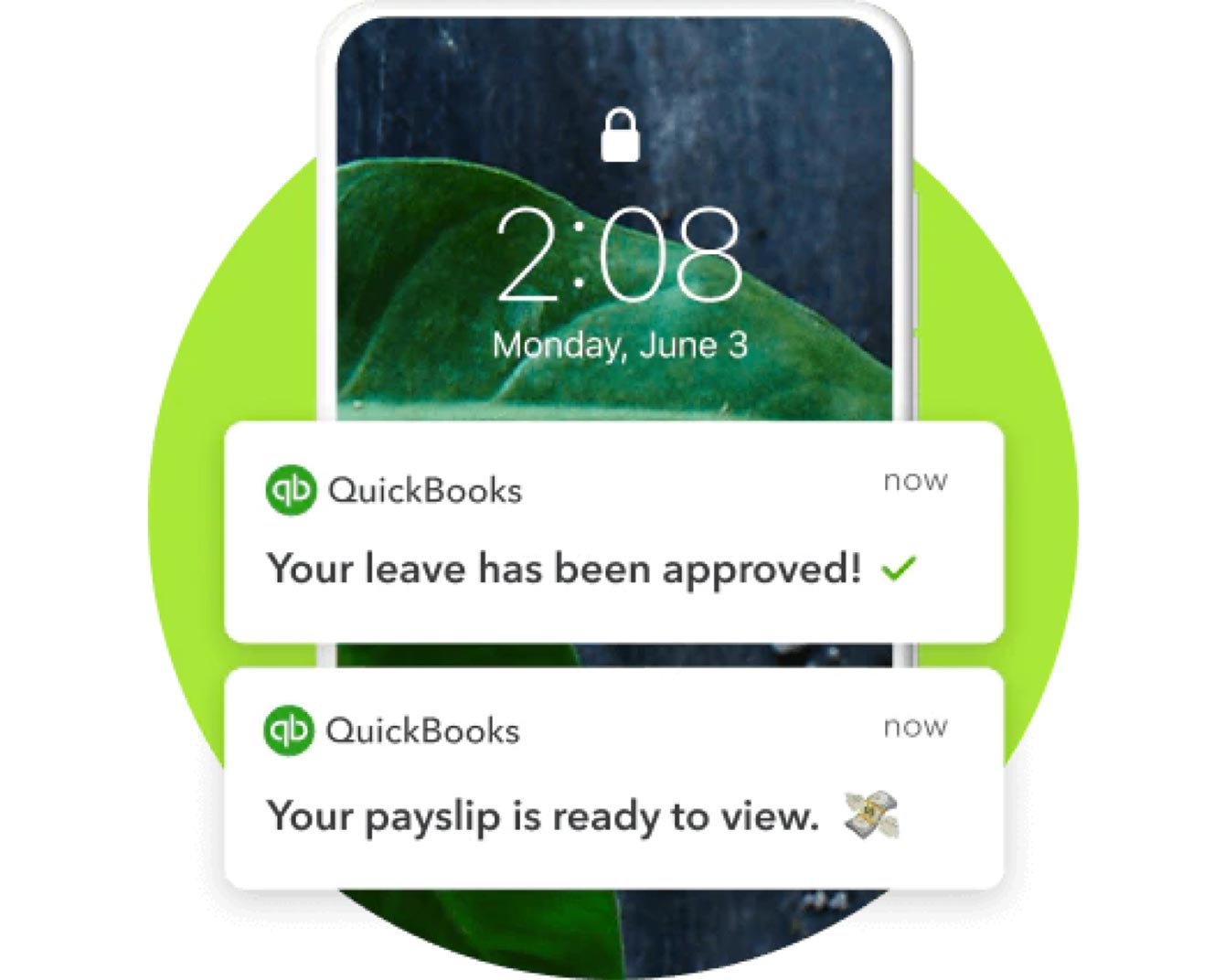

Let your employees serve themselves

All our Payroll plans include the Swag app, which gives your clients’ employees access to self-manage payslips, leave, timesheets and expenses on the go.

Super streamlined contributions

The Advanced Payroll difference

Automated award interpretation

Our prebuilt awards are updated automatically in line with Fair Work conditions, so you can rest assured knowing your clients are paying their employees correctly.

Hear what top Australian accountants are saying about our Payroll Software

Hear what top Australian accountants are saying about our Payroll Software

By All Accounts, Kingscliff, NSW.

Customer since 2016

Get 50% off Payroll plans for your clients

Standard payroll

The perfect small business Payroll solution.

Feature highlights

- Employee portal

- Employee mobile app

- Timesheets

- Single touch payroll

- Super payments

- Leave management

Advanced payroll

For clients who also manage awards and assign rosters.

Feature highlights

- Standard payroll functionality

- Employee portal

- Employee mobile app

- Timesheets

- Single touch payroll

- Automated super payments

- Leave management

- Automated award interpretation

- Rostering

- Time and attendance tracking

How to set up QuickBooks Payroll

- Sign in to QuickBooks.

- Select the client who needs Payroll.

- Click on the Employee tab.

- Choose your Payroll plan.

Note: You'll need a QuickBooks Online or QuickBooks Online Accountant subscription to use QuickBooks Payroll.

New to QuickBooks and want more info? Learn more.

Did you know? You can access a QuickBooks Payroll for your firm for free by signing up to the ProAdvisor Program. Find out more.