Saving you time this end of financial year

Get ready for the end of the Australian financial year on June 30 by letting QuickBooks give you a helping hand with our end of financial year (EOFY) guide.

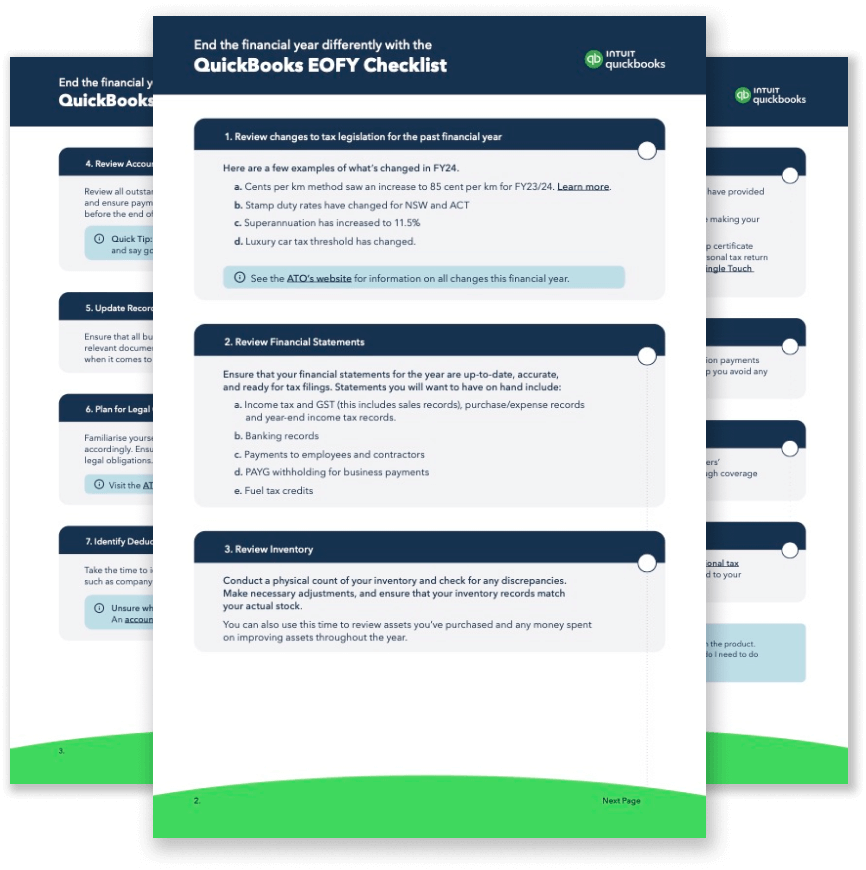

End of financial year checklist

The end of the financial year is an important time of the year when businesses need to ensure they have submitted all necessary reporting requirements to the ATO. Use our end of financial year checklist to stay organised and prepared for tax time.

End of financial year explained

Overcome end of financial year fear and get set up for success in FY24/25.

What is EOFY?

End of financial year (EOFY) is the time when Australian small businesses finalise their bookkeeping, lodge tax returns and plan for the new year.

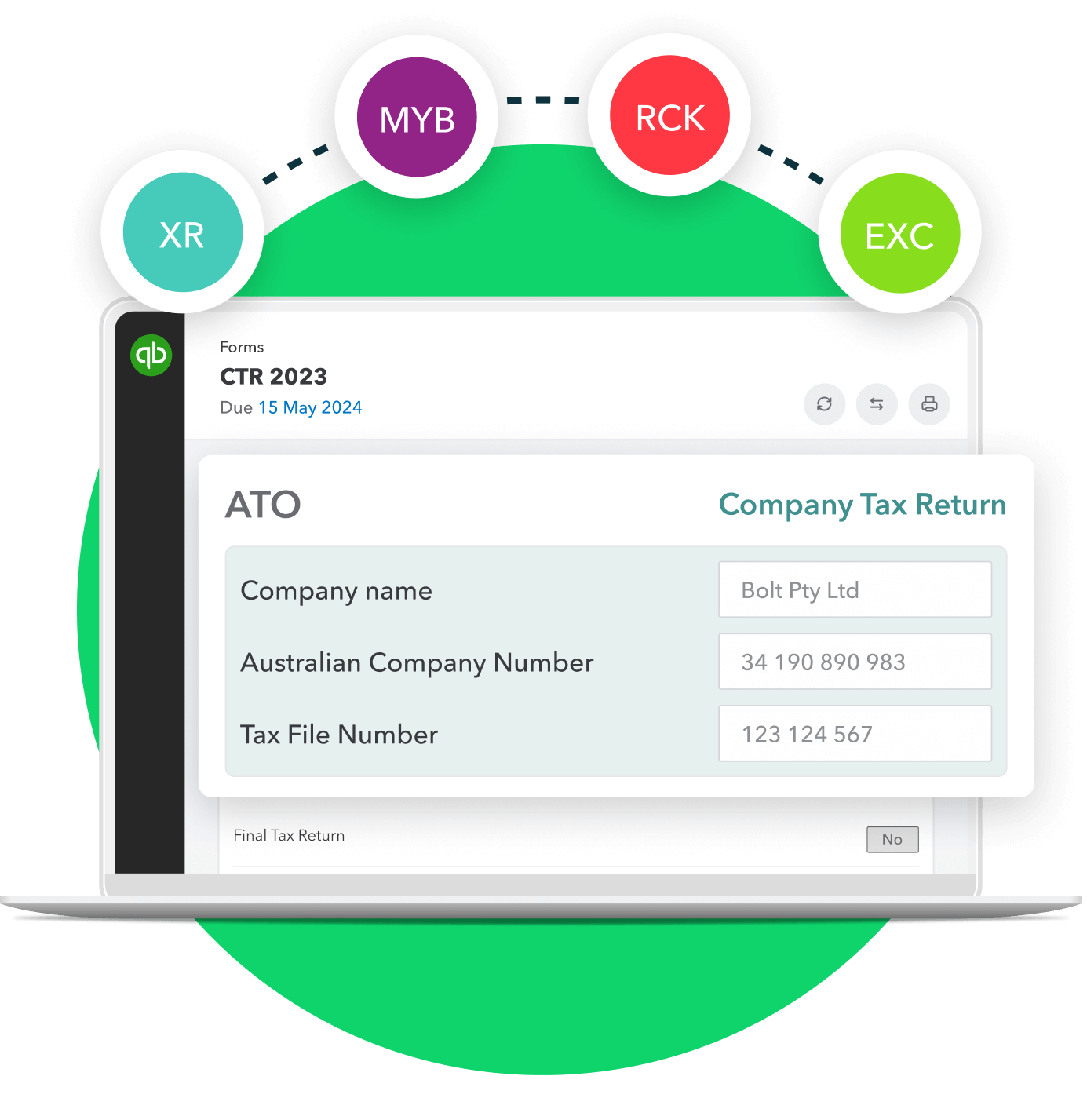

Many businesses use accounting software like QuickBooks Online to automate EOFY tasks and maximise their tax return, and work with an accountant or tax agent to ensure they stay compliant with the ATO.

EOFY deadlines

The tax year in Australia, ends on 30 June 2024 and you must lodge your taxes with the Australian Taxation Office (ATO) by 31 October 2024.

If you use a registered tax agent they can lodge it at a later date, but make sure to engage them by 31 October.

Tax calendar

Please refer to the ATO website for finalised FY24 tax dates.

Date

I'm Self-Employed

I'm Small business

Jun 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

Jun 30

It’s officially the end of financial year.

Get ready for tax time by organising your accounts to give to your accountant.

It's officially the end of financial year.

Super guarantee contributions (SGC) must be paid by this date to qualify for a tax deduction.

Start getting ready for tax time by inviting your accountant to view your QuickBooks Online account.

Jul 1

Happy new (financial) year!

Lodge your tax return anytime between now and October 31.

Happy new (financial) year!

Jul 14

If you're Single Touch Payroll (STP) reporting, payment summaries will automatically be made available for your employees through myGov as an income statement. Find out more at the Single Touch Payroll (STP) hub.

Jul 21

Your Q4 BAS is due today. If you use a tax agent, lodgement of BAS is extended.

Refer to dates here or speak to your tax agent.

Jul 28

Q4 BAS is due.

Pay your quarterly PAYG instalment notices today.

Pay your Lodge your quarterly PAYG instalment notices today. Use the ATO PAYG calculator for an estimate.

Q4 BAS is due.

Pay your quarterly PAYG instalment notices today.

Pay your superannuation guarantee charge (SGC) statement today.

Aug 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

Sep 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

Sep 30

Lodge your quarterly PAYG withholding payment summary annual report.

Lodge your quarterly PAYG withholding payment summary annual report.

Oct 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

Pay your annual PAYG withholding payment instalment today. That’s only if you're registered to pay annually.

Oct 31

If you are using a registered tax agent, the lodgement period is extended until 15 May of the following year.

If you are using a registered tax agent, the lodgement period is extended until 15 May of the following year.

Nov 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

Nov 28

Lodge your superannuation guarantee charge (SGC) statement today.

Pay your SGC from quarter 1 today.

Dec 21

Lodge your monthly BAS today.

Lodge your monthly BAS today.

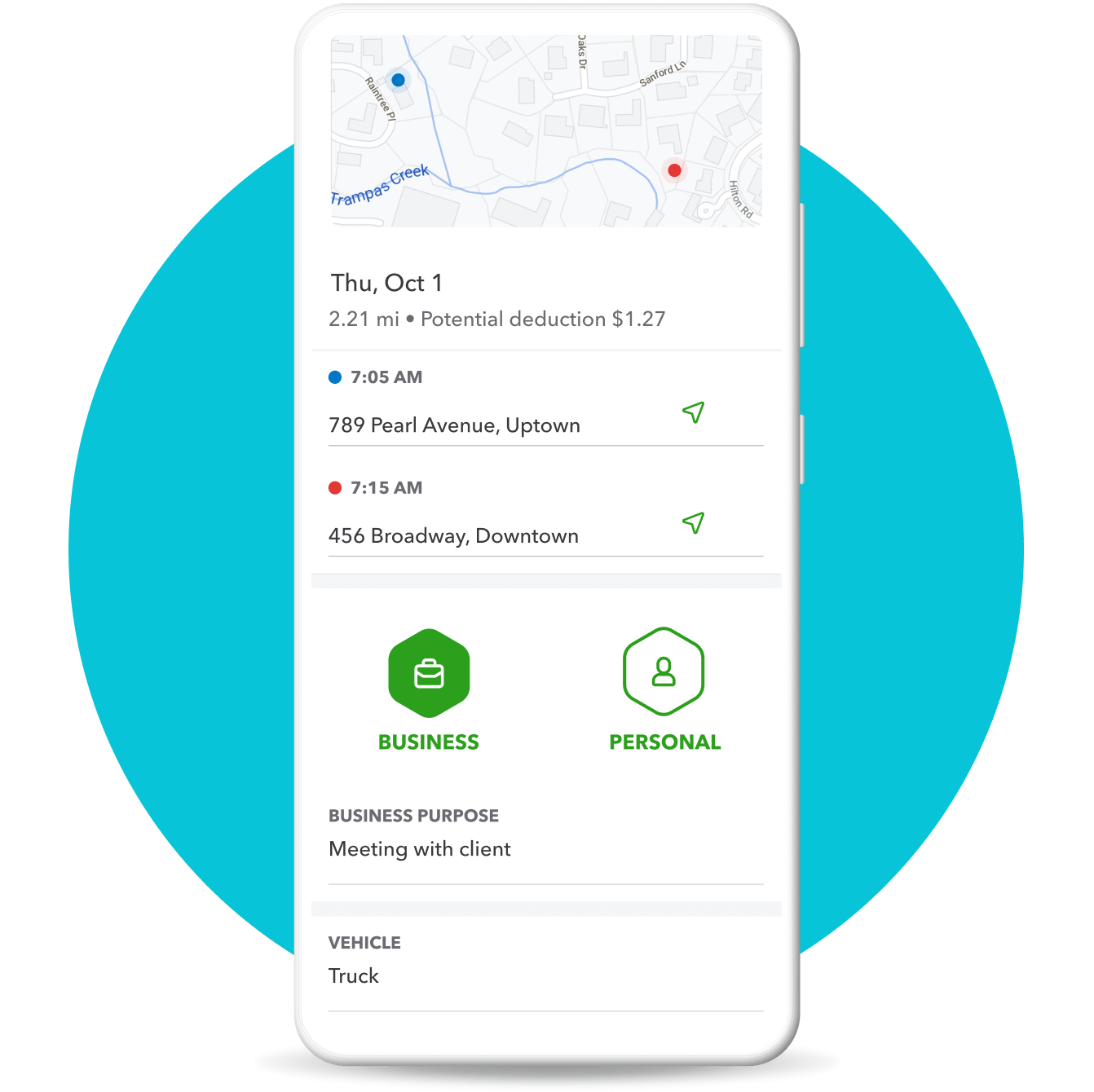

Drive down your tax bill

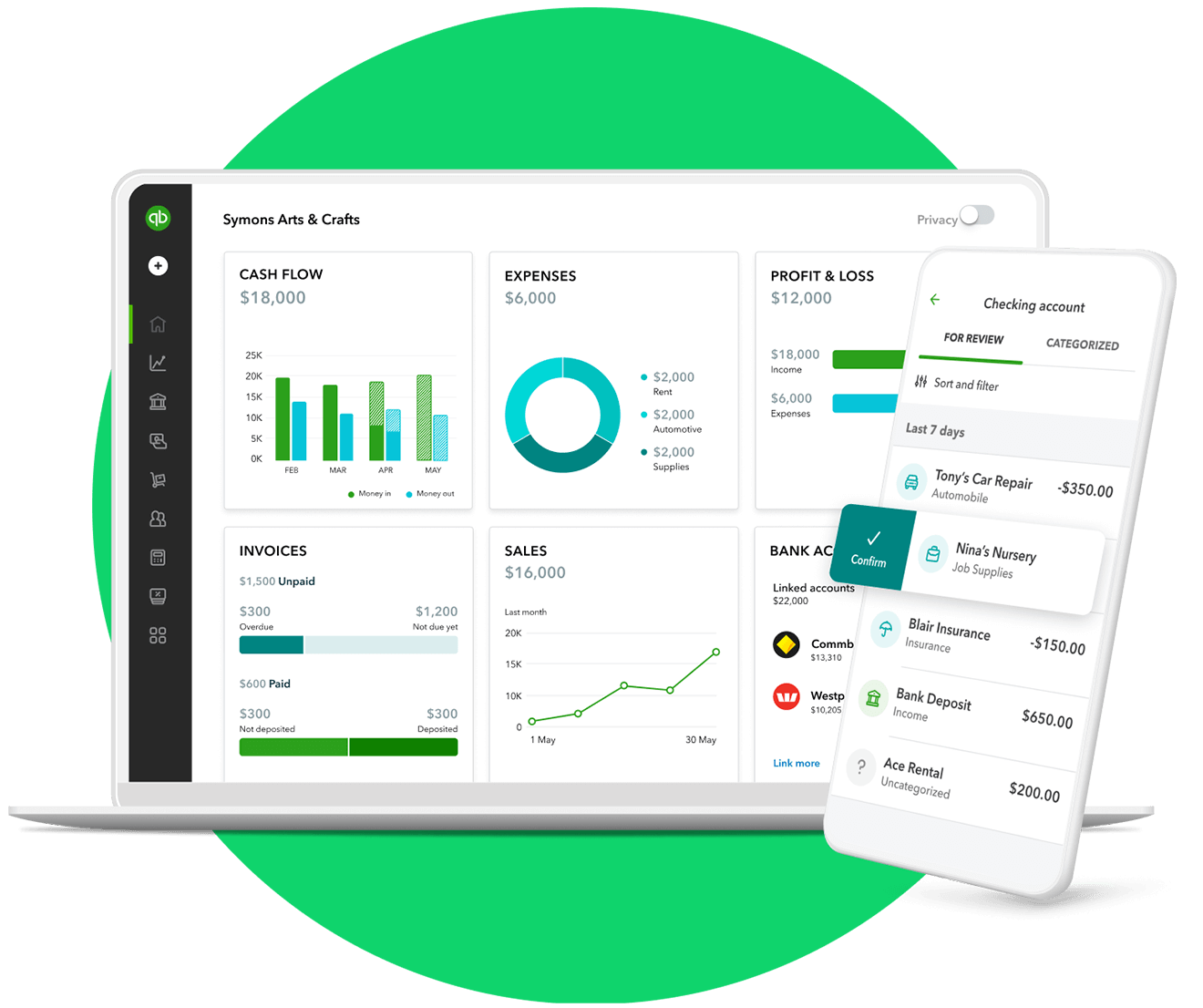

Claiming back money on your driving? Don't miss a single trip. The QuickBooks mobile app lets you track every trip, then mark your journey as either business or personal.

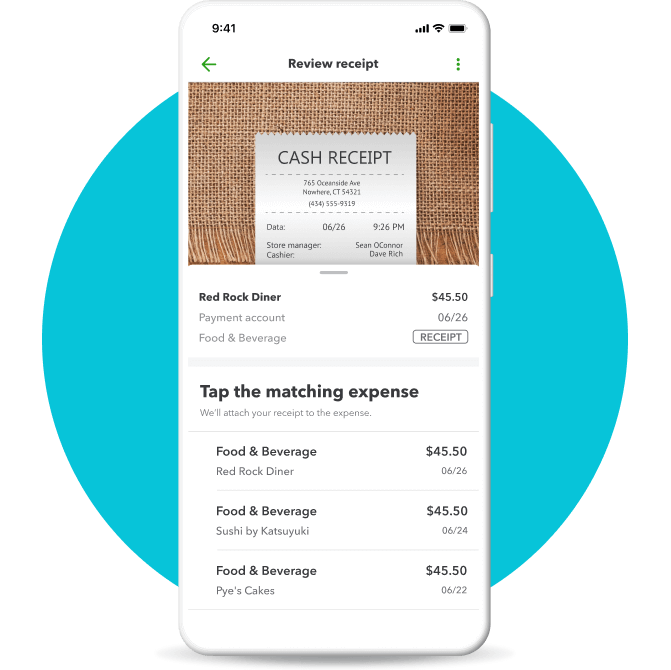

No more lost receipts

Snap receipts on the go with our app. We’ll extract the relevant data like date, amount, GST component and payment method—then match the details to an expense.

Effortlessly organised

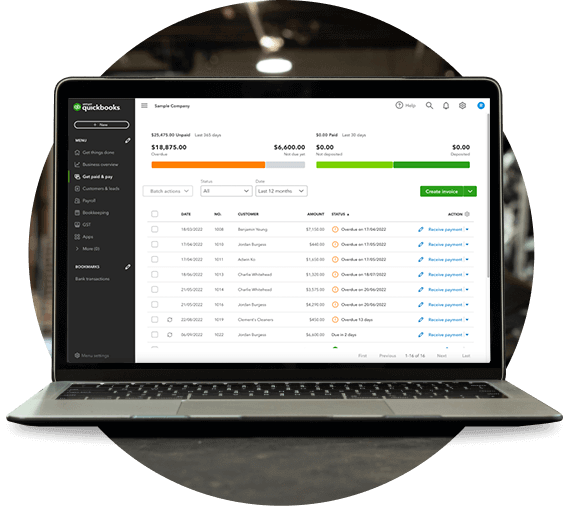

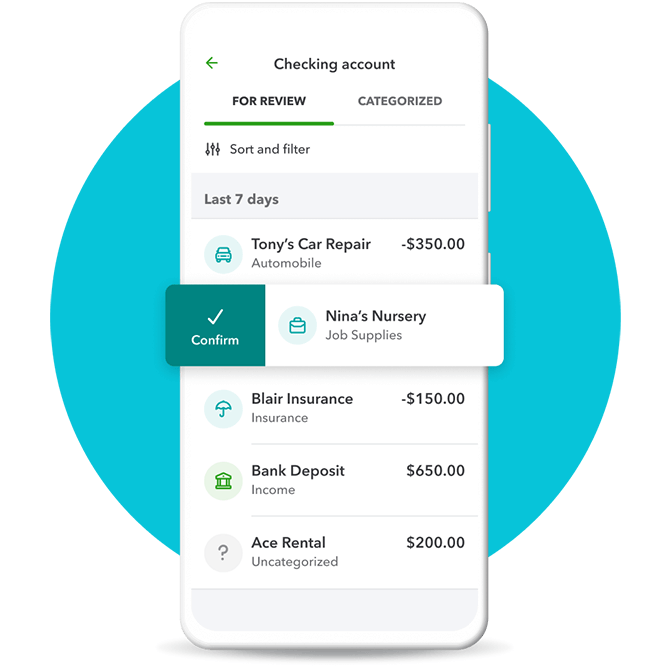

Connect your bank accounts, credit cards, PayPal, and more to pull in income and expenses as they occur. Transactions are sorted, categorised and ready for year end account closing.

Help when you need it

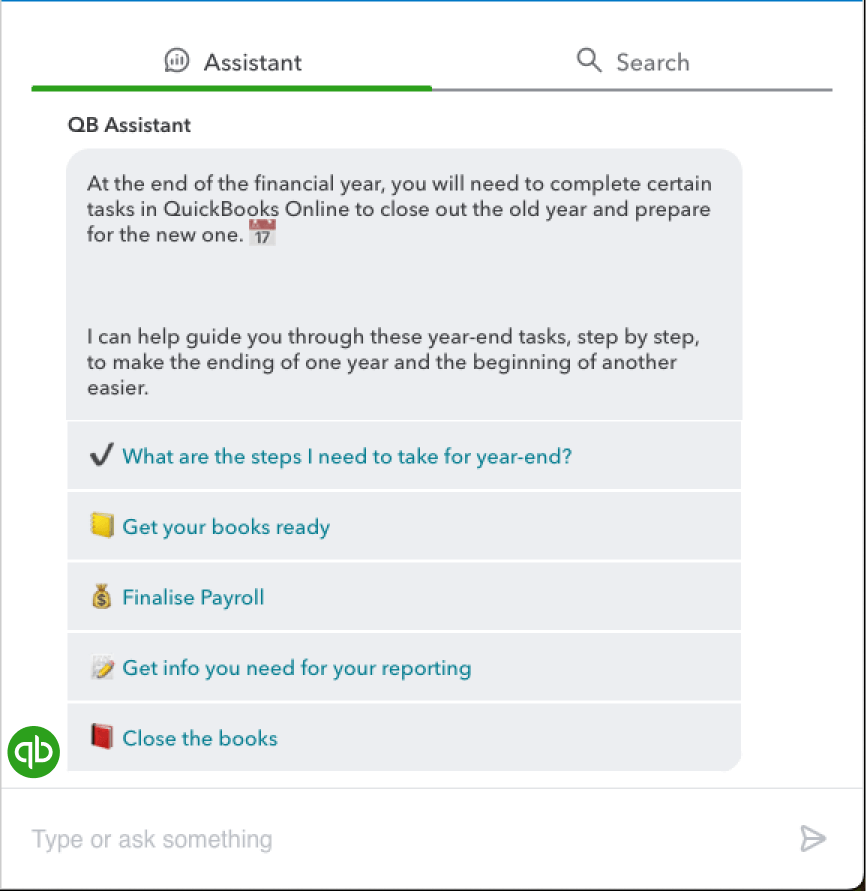

Select the Help icon from anywhere in QuickBooks Online and enter 'What do I need to do for the EOFY?'. Our Digital Assistant will walk you through the EOFY process in real time.

Want to know more about tax?

FAQs - Tax

Want to know more about payroll?

FAQs - Expenses

Discover expert tips on improving your EOFY workflows, driving efficiencies with AI, and improving your EOFY onboarding process.

Guides

Discover expert tips on improving your EOFY workflows, fixing your tech stack and improving your engagements process.