QuickBooks Cash Flow can help you forecast tax liabilities like GST to make preparing and paying your BAS a breeze.

We're here for you.

GST Tracking and Lodge BAS Online

Lodge BAS online and track GST - BAS Statement

Track GST and electronically lodge BAS directly from your QuickBooks account. No portals or complicated workarounds, simply prep, e-lodge, and exhale.

Stay on top of BAS and other obligations

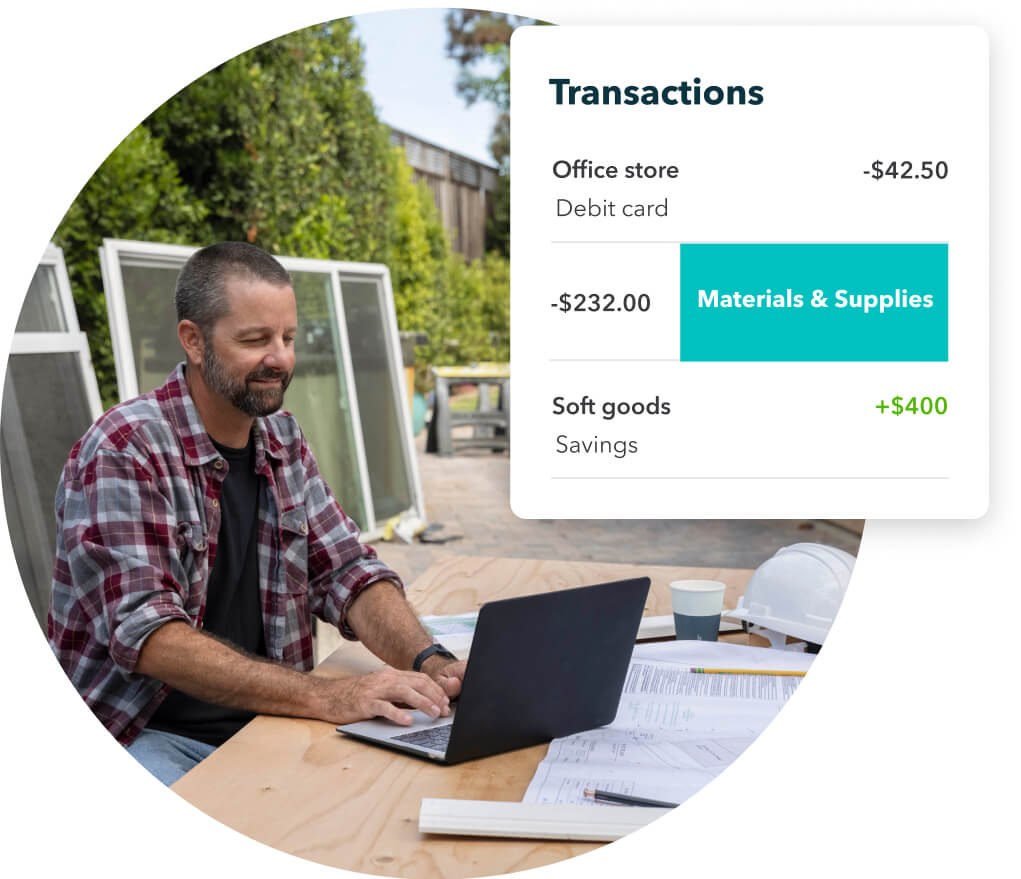

Track, itemise, investigate

Every time you create an invoice or expense, QuickBooks will know if you should add GST. Investigate issues with your BAS, using reports like ‘Transactions without GST’ and ‘Transactions by tax code’.

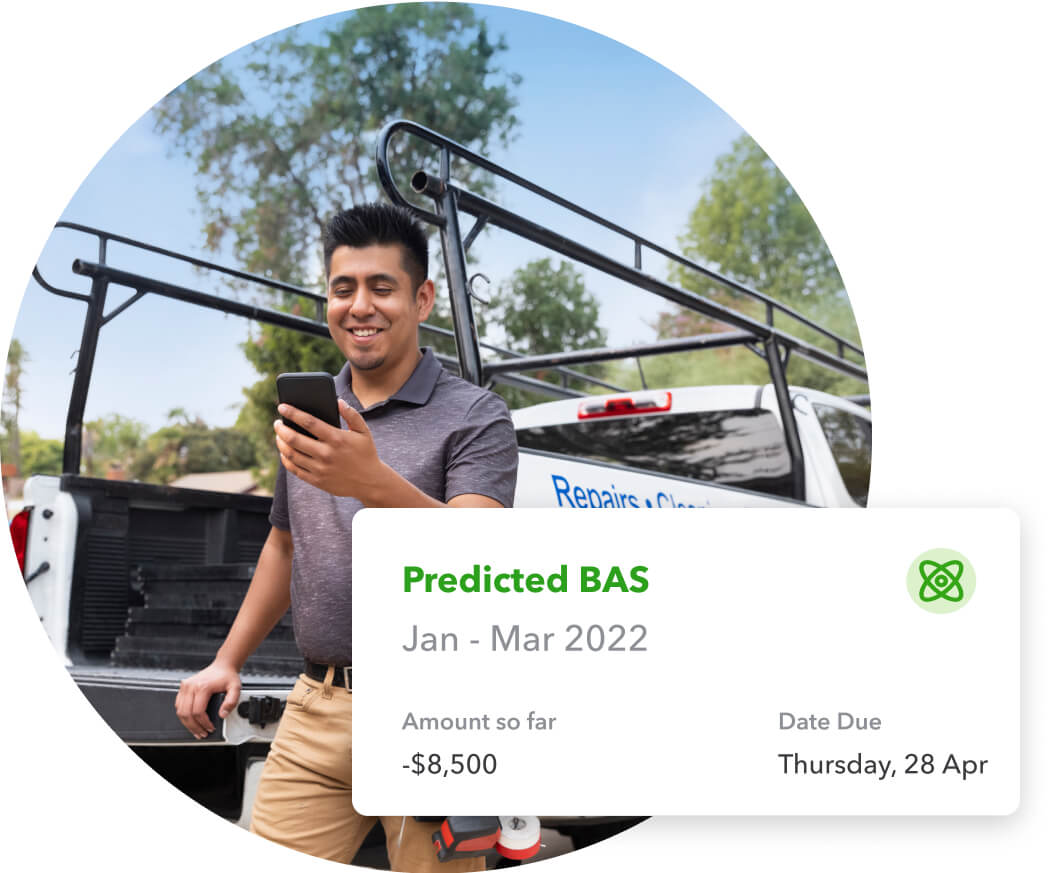

Calculate, organise, overcome

QuickBooks helps you cut activity statement stress by auto tracking and calculating your obligations. You’ll always know how much you owe and when it’s due, so you’re ready to lodge your BAS quickly and easily.

Lodge BAS without leaving QuickBooks

QuickBooks Online makes lodging BAS even easier with electronic lodgement. Now you can prepare and e-lodge activity statements directly from QuickBooks Online. No portals or complicated workarounds, simply prepare, e-lodge, and exhale.

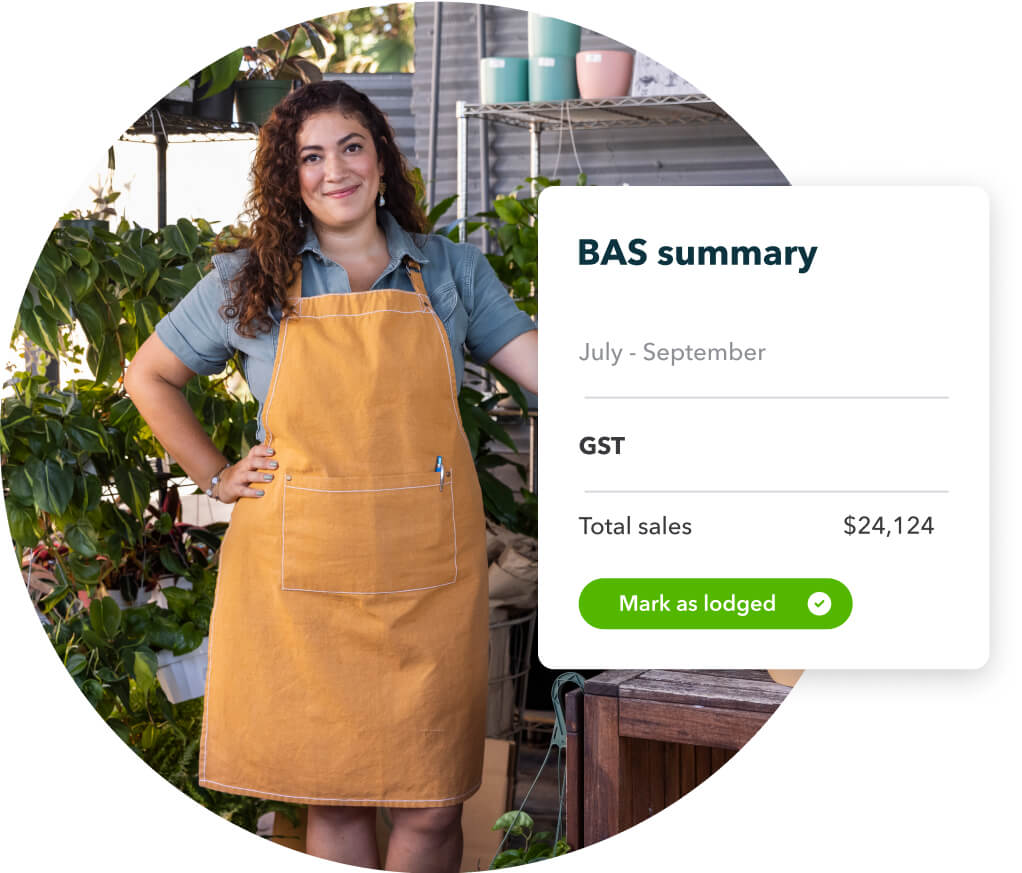

Review, reconcile, rest easy

QuickBooks Online creates a BAS summary for you to review before you lodge. You’ll be notified of any changes to old transactions, and they will carry over to your next summary.

Build the right plan for your business

Want to know more about your tax obligations?

Frequently Asked Questions

Goods and Services Tax (GST) is a tax on goods and services provided or sold by an individual or small business entity.

Taxes are collected by the individual when goods are sold, and taxes are paid when they purchase goods and services from other individuals and businesses.

GST in Australia is generally 10% and applies to almost all goods and services sold or traded in Australia. Learn more about the GST.

Goods and Services Tax (GST) is a tax on goods and services provided or sold by an individual or small business entity.

Taxes are collected by the individual when goods are sold, and taxes are paid when they purchase goods and services from other individuals and businesses.

GST in Australia is generally 10% and applies to almost all goods and services sold or traded in Australia. Learn more about the GST.

If your business or enterprise has a GST turnover of $75,000 or more, you will likely need to register for GST. See the ATO for the latest guidance, or speak with your tax agent. Learn more here.

If you’re ready to take the plunge and become a GST business, rest assured GST registration isn’t too complex. Check out our article on how to register for GST for free.

If you're registered for GST, you must charge GST at the current rate of 10% when supplying goods or services that are subject to this tax. Learn more about paying GST in our article on including or excluding GST.

GST reporting for small business entities consists of 3 key values as of July 1, 2021:

- Total Sales (including GST collected)

- GST on sales

- GST on purchases

The total GST owed and paid to the ATO will be GST Collected minus GST Paid.

The Business Activity Statement (BAS) is used for reporting and paying goods and services tax (GST), Pay As You Go (PAYG) Instalments, PAYG withholding tax and other tax obligations to the ATO.

It is usually filed monthly or quarterly, and for most QuickBooks users, it will be quarterly.

If you are registered for GST, the ATO will automatically send you a BAS when it is time to lodge, and all businesses registered for GST are required to lodge BAS by the due date, even if they have nothing to claim.

Learn more here.

Lodging BAS is as simple as letting QuickBooks know your current BAS lodgement frequency and what components you need to lodge. Every time you add a transaction with GST to QuickBooks, the GST amounts will be automatically collected for that period, with no manual GST entries required. Learn more about lodging BAS.

E-lodge allows you to lodge your BAS directly with the ATO from your QuickBooks Online account, saving you time filling out BAS forms. Learn how to set up e-lodgement here.

You can lodge PAYG Withholding amounts at the same time you lodge your BAS.

If you have connected QuickBooks Payroll powered by Employment Hero, all PAYG amounts will be captured in each pay run completed there, and that information will automatically populate when you lodge your BAS.

Learn more here.

You can lodge PAYG Instalment amounts at the same time you lodge your BAS. Learn more here.

FREE Business Health Check

Find out how your business is performing. Complete this short questionnaire to receive a free personalised Business Health Check report!

Get up and running with a free setup session

Our experts can help you:

- Connect your bank accounts and credit cards

- Create and send customised invoices

- Automate your expenses

- Learn super useful tips and tricks

- QuickBooks reserves the right to change pricing, features, support and service at any time. Prices are in AUD and include GST. See our Terms of Service for further information.

- Pricing: All prices are in AUD and include GST.

- ProAdvisor Program: Please find the terms of our ProAdvisor program here.

- $2/3/5 per month for 3 months: For new subscribers, enjoy a $2/3/5 subscription on QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus for the first 3 months of your subscription (Offer). The discount will applied from the date of your enrolment and will continue for 3 months. From month 4, you will be charged the then current monthly retail price for your subscription. See current prices here. QuickBooks Payroll and QuickBooks Time prices are not eligible for any discount and will be invoiced separately according to your usage on a monthly basis during your subscription. Intuit reserves the right to request information to verify the eligibility of a purchaser of the Offer. Acceptance of such verification information is at the reasonable discretion of Intuit, which may revoke the Offer and impose a monthly cost for the subscription at the then current retail prices, at any time if it considers the purchaser is ineligible for the Offer.

- 50% off for 12 months: For new subscribers, enjoy a 50% discount off the current monthly retail price for QuickBooks Self-Employed, QuickBooks Online Simple Start, QuickBooks Online Essentials or QuickBooks Online Plus for the first 12 months of your subscription (Offer). The discount will applied from the date of your enrolment and will continue for 12 months. From month 13, you will be charged the then current monthly retail price for your subscription. See current prices here. QuickBooks Payroll and QuickBooks Time prices are not eligible for any discount and will be invoiced separately according to your usage on a monthly basis during your subscription. Intuit reserves the right to request information to verify the eligibility of a purchaser of the Offer. Acceptance of such verification information is at the reasonable discretion of Intuit, which may revoke the Offer and impose a monthly cost for the subscription at the then current retail prices, at any time if it considers the purchaser is ineligible for the Offer.

- 30% off for 3 months (Advanced): For new subscribers to QuickBooks Online Advanced, enjoy a 30% discount off the current monthly retail price for the first 3 months of your subscription (Offer). The discount will apply from the date of your enrolment and will continue for 3 months. From month 4, you will be charged the then current monthly retail price for your subscription. See current prices here. QuickBooks Payroll and QuickBooks Time prices are not eligible for any discount and will be invoiced separately according to your usage on a monthly basis during your subscription. Intuit reserves the right to request information to verify the eligibility of a purchaser of the Offer. Acceptance of such verification information is at the reasonable discretion of Intuit, which may revoke the Offer and impose a monthly cost for the subscription at the then current retail prices, at any time if it considers the purchaser is ineligible for the Offer.

- 30% off for 12 months (Advanced): For new subscribers to QuickBooks Online Advanced, enjoy a 30% discount off the current monthly retail price for the first 12 months of your subscription (Offer). The discount will apply from the date of your enrolment and will continue for 12 months. From month 13, you will be charged the then current monthly retail price for your subscription. See current prices here. QuickBooks Payroll and QuickBooks Time prices are not eligible for any discount and will be invoiced separately according to your usage on a monthly basis during your subscription. Intuit reserves the right to request information to verify the eligibility of a purchaser of the Offer. Acceptance of such verification information is at the reasonable discretion of Intuit, which may revoke the Offer and impose a monthly cost for the subscription at the then current retail prices, at any time if it considers the purchaser is ineligible for the Offer.

- 30% off for 3 months (existing subscribers): For existing QuickBooks subscribers who upgrade to QuickBooks Online Essentials, Plus or Advanced, enjoy a 30% discount off the current monthly retail price for 3 months of your subscription (Offer). The discount will be applied from the date you upgrade in-product and will continue for 3 months. From month 4, you will be charged the then current monthly retail price for your subscription. See current prices here. QuickBooks Payroll and QuickBooks Time services and prices are not eligible for any discount and will be invoiced separately according to your usage on a monthly basis during your subscription. Intuit reserves the right to request information to verify the eligibility of a purchaser of the Offer. Acceptance of such verification information is at the reasonable discretion of Intuit, which may revoke the Offer and impose a monthly cost for the subscription at the then current retail prices, at any time if it considers the purchaser is ineligible for the Offer.

- Free Trial: First thirty (30) days of subscription to QuickBooks Online, QuickBooks Self-Employed and QuickBooks Payroll (including QuickBooks Advanced Payroll), starting from the date of enrolment, is free. During the free trial, you may pay any number of employees using QuickBooks Payroll free of charge. To continue using QuickBooks after your 30-day trial, you'll be asked to present a valid credit card for authorisation and you'll be charged monthly at the then-current fee for the service(s) you've selected.

- QuickBooks Payroll powered by Employment Hero: Payroll services are offered by a third party, Employment Hero. QuickBooks Payroll is only accessible via QuickBooks Online subscriptions. You will be charged $5.00 (incl. GST) per month for each ‘active employee’ paid using QuickBooks Payroll. An ‘active employee’ is one who has been paid at least once in the billing month. For Advanced Payroll, there is an additional monthly subscription fee of $10 (incl GST). Pricing, terms and conditions, including service options, are subject to change.

* Employment Hero was voted the leading payroll solution for SMBs <50 employees (Australian Payroll Association 2021 Payroll Benchmarking Study)

- Customer support: Call or chat to an expert for QuickBooks Online Accountant, QuickBooks Simple Start, Essential, Plus, and Advanced or use in-product QB Assistant and chat for QuickBooks Self-Employed. You'll also find useful resources in the QuickBooks Community.

- Compatible Devices: QuickBooks Online, QuickBooks Self-Employed and QuickBooks Payroll require a computer with Internet Explorer 10, Firefox, Chrome, or Safari 6 and an Internet connection (a high-speed connection is recommended). The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. QuickBooks Online and QuickBooks Payroll are accessible on mobile browsers on iOS, Android, and Blackberry mobile devices. Devices sold separately; data plan required. QuickBooks Payroll cannot be used on the mobile apps. Not all features are available on the mobile apps and mobile browser. QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Product registration required.

- Get paid faster: Get paid 2.5x faster invoicing with PayPal

* PayPal and QuickBooks customers get paid on average in less than 5 days, which is over 7 days faster than the average for invoices that get paid with other payment methods. Data is for paid invoices that were created in QuickBooks in Australia between 23.05.22 and 23.11.22

- Tax deductions: Tax deductions not guaranteed due to being subject to user data entry errors. Mileage calculation provided by the Australia Taxation Office - 85 cents per kilometre for the 2023-2024 income year. To a maximum of 5,000 business kilometres per car (Deductions are only applicable to cars)

- Customer Service Awards: Excellence in Customer Service Award at the CX Australia Awards 2022

- Multiple file discount: Multiple file discount applies to QuickBooks Australia customers only and valid when signing up for more than one QuickBooks Online subscription in one order. Further terms and conditions available here. Not applicable to QuickBooks Self Employed.

- Reviews: GetApp, Capterra, Google Play Store, Apple App Store reviews as at date 08/01/24.

- Cost per day claim: Based on a QuickBooks Simple Start Plan at its regular retail price of $25 per month and a 31 day month.

- Cost per day claim (annual): Based on a QuickBooks Simple Start Plan at its regular retail price of $270 per year and a 365 day year.

- Annual Billing: You may pay for your QuickBooks Online subscription on an annual, upfront basis to enjoy a discount on the current fees. If you use QuickBooks Payroll powered by Employment Hero, your payroll costs will still be charged monthly to your nominated payment method in accordance with your usage as set out here. If you cancel your QuickBooks Online subscription within the pre-paid 12 month period, you will not be eligible for a refund, but will retain full access to your QuickBooks Online subscription for the remainder of the 12-month period. Unless cancelled by you prior, your annual subscription will auto-renew on the 12 month anniversary of your sign-up date using the billing details you have given us. Discounts, prices, terms and conditions are subject to change.

- Over 7 million customers: Based on number of global QB customers (ecosystem) (7.1m) worldwide as of October 2022.

- Free Onboarding: Applicable to Buy Now subscriptions on QuickBooks Simple Start, Essentials and Plus plans. Not available for QuickBooks Self-Employed.

- Save Hours: Save up to an average of 29 hours per month with QuickBooks.

- * Based on a survey conducted by Intuit Australia Pty Ltd in September 2022. Time saving is in comparison to previous accounting method, based on 184 responses from customers that saw time savings.

- Get access to QuickBooks Tax: ***Access QuickBooks Tax, powered by LodgeiT, by becoming a member of the QuickBooks ProAdvisor Program (it’s free to join). Find out more about the ProAdvisor Program here, including the terms of the QuickBooks Tax offer in the Program here.

- QuickBooks Time Disclaimers & Offers for Australia: For Important pricing offers and disclaimers with further information, please see here.

- *Full terms and conditions for access to QuickBooks Tax, powered by LodgeiT as part of the the Proadvisor Program can be found here. QuickBooks reserves the right to change pricing, features, support and service at any time.

- **Intuit conducted a study involving 56 interviews with accountants and bookkeepers who used Books Review for BAS preparation between March to December 2021 and found that when using Books Review, participants reduced the time spent preparing their clients BAS Reports by around 40%.

- Our Terms of Service apply to all QuickBooks Online subscriptions. Please review them carefully.

© 2024 Copyright © Intuit Australia Pty Ltd.

All rights reserved. Terms and conditions, features, support, pricing, and service options subject to change without notice.

By accessing and using this page you agree to the Terms and Conditions