For small businesses

Simplifies tax preparation and lodgement for small businesses in Australia.

Let us take care of your tax compliance and obligations so you can focus on other areas of your business.

Simplifies tax preparation and lodgement for small businesses in Australia.

Let us take care of your tax compliance and obligations so you can focus on other areas of your business.

Easily track your business expenses online year-round and so you’re all set for tax time.

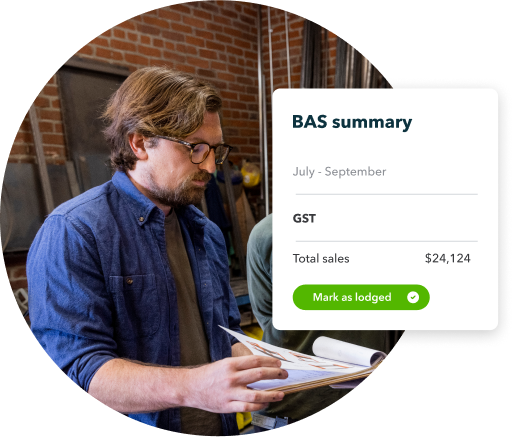

Save hours on tax prep and lodge BAS online directly from your QuickBooks account.

QuickBooks Tax Software can help small businesses track and calculate tax obligations in Australia.

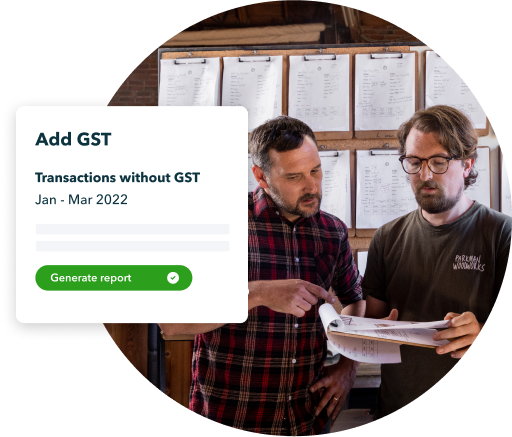

QuickBooks Accounting Software is your online tax assistant. We determine when you need to add GST. You can also investigate issues with your BAS by generating reports such as ‘Transactions without GST’ and ‘Transactions by tax code’.

QuickBooks is an accounting software that can reliably and automatically calculate mileage for tax purposes. This is achieved by tracking kilometres with a smartphone GPS in Australia and seamlessly linking the data to the QuickBooks mobile app.

Get up and running with a free setup session

Our experts can help you:

Save hours on tax preparation and lodgement for your clients with QuickBooks Tax (powered by LodgeiT).

QuickBooks Tax Software is your all-in-one solution for every client and industry.

Streamline your tax and BAS workflows and enjoy the flexibility of lodging BAS with QuickBooks Tax Software online.

Reduce turnaround times for BAS and tax client approvals by enabling your clients to sign their forms electronically.

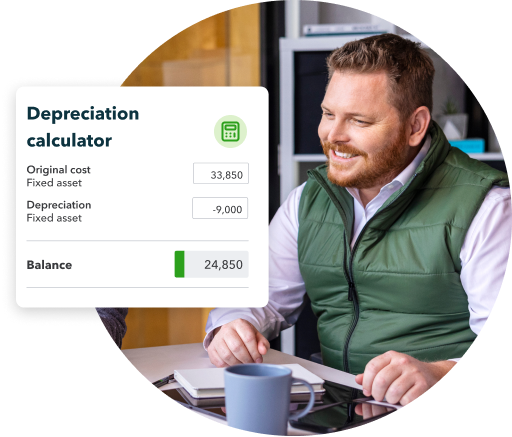

Leverage a range of calculators to support tax preparation:

QuickBooks offers the highest level of multi-layered security to keep you and your client data safe. Hosted on Amazon’s enterprise-grade facilities in Australia and conforming to the global Information Security Management Standard, rest assured that your client data is well protected. Every login also requires two-factor authentication (2FA) to prevent unauthorised access.

Streamline your workflows and efficiently finalize your clients' books on a single screen with the online assistance of QuickBooks Tax Software

QuickBooks Online uses artificial intelligence (AI) to automate repetitive and time-consuming tasks for accountants.

such as:

This will allow you and your accounting firm to increase productivity by easily staying on top of your taxes.