In partnership with Intuit QuickBooks, Gafar Fadl, General Manager SMB, Nearmap, chats with Tish Bhagwandeen from the Intuit QuickBooks Trainer Writer Network for some tips on how small-medium businesses can plan and prepare for the End of Financial Year (EOFY).

Take advantage of technology tax deductions this tax time, and set your business up for a successful new financial year

Tish, the last few years have been a bit of a whirlwind, but this EOFY, after a year of runaway inflation, interest rate increases and economic uncertainty, what are you hearing from the small business clients you work with?

Most of my clients are approaching the new financial year with conservative optimism. Given that tax season is around the corner I am starting to deal with predominantly more tax planning queries, however this is also being very closely linked with looking at cashflow requirements over the next 6-12 months. We are predominantly doing a lot more interest rate sensitivity analysis on cash flow and profitability. Clients are also recognising business diversification is a key element to keep ahead of some of the economic challenges.

The long-awaited Small Business Technology investment boost has now been enacted by the Government too.

The small business technology boost will be a good mechanism to keep driving businesses towards technology investment to achieve efficiency. The measure was first announced back in March 2022, but only enacted as law on 23 June 2023, meaning businesses with an annual turnover of less than 50 million will be able to claim an additional 20% of the expenditure incurred for the purposes of digitizing operations. Some of the eligible expenditures will include depreciating assets, certain IT services, and software-related expenses, including subscriptions to QuickBooks Online and solutions like Nearmap. As always, it’s important to speak to your accountant when making such purchases. While the legislation only supports purchases and subscriptions to technology until 30 June 2023, it’s important to note it has been backdated to 29 March 2022 so small and medium businesses can take advantage of the full benefits.

They can also claim a bonus 20 per cent deduction for eligible expenditure on external training of employees by providers registered in Australia until 30 June 2024.

For businesses whose cash flow has taken a bit of a hit, what can they do?

When cash flow is constricted our instinct is always to tighten up expenses, however, you still need to run a viable business and there are only so many expenses you can cut back on without compromising efficiency and customer satisfaction.

I would encourage businesses to take a look at their revenue cycles – in particular the invoicing cycle for clients. In many services industries, we tend to do the work and bill on completion or delivery of projects. This model is no longer serving small business owners. Where possible you should implement progress billing and if possible weekly billing cycles. Manual collections are rapidly being phased out as more and more businesses move toward technology platforms that offer automated billing and collections.

Prepaying expenses can be a good way to achieve tax efficiency, however, if your cash flow is constricted you may want to move towards a practice of paying suppliers when they are due.

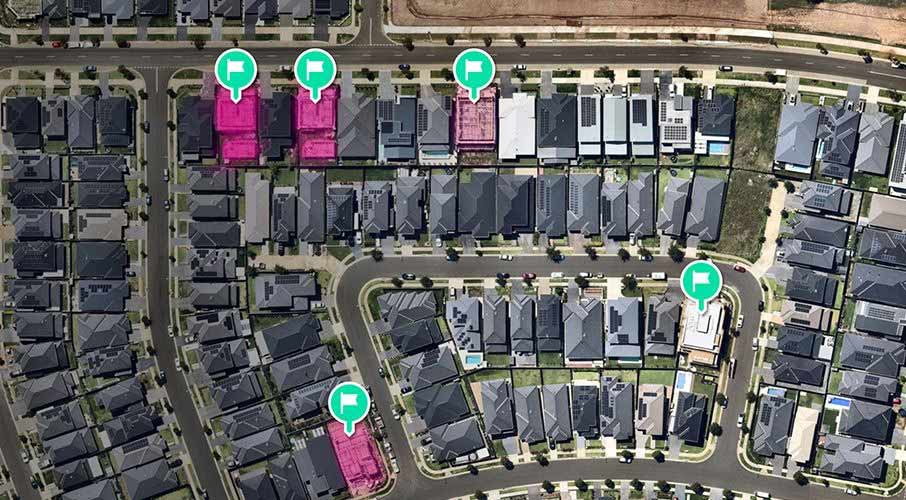

Nearmap helps businesses harness up to date aerial imagery, technology and geospatial know-how.Bondi NSW, May 2023

The loss carry-back offset scheme also ends this financial year. What will that mean for small businesses?

The loss carry-back offset was fundamental in enabling businesses to claw back some of their prior taxes. That strategy helped free up some cash flow so businesses could continue to invest in growing their operations.

With this coming to an end no doubt many businesses will feel the impact of the increased tax liability. This is really where you want to sit down with your accountant to do some tax planning to fully understand the implications on your cash flow and potential tax liability.

And for those businesses in quite a bit of trouble, has there been an uptick in restructuring?

The onslaught of economic uncertainty during 2020 was a huge trigger for most business owners to review the appropriateness of their operating structure. The initial driver then was that different operating structures qualified for different levels of funding, this trend of restructuring has continued, however now we are seeing some of the key drivers being business owners assessing their business risk and personal liability; essentially business owners are seeking increased legal separation between themselves and their businesses. Another key driver to this is companies who are looking to restructure their debt or gain access to short-term cash flow funding.

My personal experience with clients is that there is still a large proportion of business owners who are relatively unaware of the implications of various business structures. Accountants are now taking a more active role in advising our clients on how to best restructure their businesses to reduce personal liability and stay within their business risk appetite.

Temporary full expensing also ends on 30 June. What does it mean, and what can small businesses do about this?

Temporary full expensing was introduced back in 2020 to encourage businesses to invest in new equipment, machinery, and technology through being able to claim an immediate deduction for the full cost of qualifying depreciable assets, rather than over several years.

I have seen many businesses rapidly move to digitise their businesses with the key objectives of not only being able to stay relevant but also driving efficiencies and access to wider global markets. Temporary full expensing was a good mechanism that enabled businesses to invest in new technology projects. With the imminent reduction in the threshold, most of my clients are bringing projects forward so that they continue to gain tax efficiencies whilst still making vital investments in technology.

Gafar Fadl, General Manager SMB, Nearmap also states that the benefit of digitising a small business is proven and clear.

“So much so that the government has and continues to incentivise it. Bringing forward technology projects ahead of the imminent reduction of the threshold may feel intimidating, but with the right technology partner, you can still take a considered and tailored approach to technology adoption in your business,” he says.

How do those measures relate to purchases of business technology and software subscriptions for this financial year and next?

As mentioned earlier, it is vital to discuss these measures with your accountant. Having a comprehensive understanding will help you understand what technology solutions can be implemented, when you can implement them and what is the overall impact on your cash flow especially in terms of efficient tax planning.

One of the key things to bear in mind when thinking about software costs is that whilst it is an investment in your business, these costs can still fall under the ambit of operating expenses and be fully deductible in the year the expense is incurred. This is especially the case when looking at off-the-shelf software solutions.

There may be instances where your business makes a more significant investment in technology and opts to build an in-house solution. In this scenario, there will be more specific rules that apply. Depending on your specific circumstances there may be several methods of claiming the tax deduction.

- Simplified depreciation rules – typically applies to software that is installed and ready to use.

- Prime cost method – assumes that assets will be depreciated evenly over time and the deductions allowable on this basis.

- Diminishing value method – assumes that the value of a depreciating asset decreases more in the early years of its effective life.

It is important to note if the cost of the asset may fall within the instant asset write-off threshold, which may be more beneficial.

If you are looking for further insights, QuickBooks have put together a range of resources to assist business owners on their EOFY Hub for small businesses.

As you can see there are various methods to claiming deductions, to ascertain what is most beneficial to your business, it’s always best to engage with your accountant.

The ATO have their eye on a few things this year as well such as changes to work-from-home expenses. Anything else you’ve seen that the ATO may be paying particular attention to, or things liable to trip taxpayers up?

We have seen changes to the work-from-home deductions. With most of the workforce starting to return to the office on at least a part-time basis, it is expected that the work-from-home deductions will decrease compared to prior years. You are now also required to keep a detailed log of the hours worked from home to substantiate your deduction. Be mindful of these changes, don’t simply claim deductions that you claimed last year.

Travel deductions relating to motor vehicles is another area that is routinely on the radar, if you are claiming your travel on the deemed km method, remember to be realistic about this, don’t simply claim the same as last year. One of the downfalls I see with most individuals who travel for work is that they don’t keep a log book and the result is that they do not qualify for certain deductions relating to motor vehicle expenses that they would have otherwise been allowed had they maintained a log book.

The introduction of STP has given the ATO an increased ability to monitor all aspects of payroll compliance. Payroll compliance can become quite onerous for the average business owner, and in recent times I myself have dealt with many clients coming to me to assist with their payroll compliance.

Dealing with various industry awards and payroll compliance can become very complicated quite quickly. We need to constantly use technology to drive efficiencies and having a system like QuickBooks Payroll by Employment Hero that has a built-in super clearing portal like Beam, as well as automated industry awards becomes imperative.

While many of Australia's top construction companies use Nearmap, small and medium AEC businesses are also achieving great results by optimising their resources.Denham Court NSW, Feb 2023

What key dates do small businesses need to have on their calendars?

Tax returns may not be due until 2024, but small businesses need to begin working with their bookkeeping and accountant partners now, as in coming weeks they need to complete some key items:

- Trust resolutions and dividend declarations need to be documented prior to 30 June 2023

- Single Touch Payroll (STP) declarations to be reviewed and finalised by 14 July 2023 or the relevant closely held payee due date

- Review any superannuation guarantee errors, lodge and pay the Superannuation Guarantee Charge (SGC) statement

- Produce and lodge Taxable Payments Annual Reports (TPAR) by 29 August 2023.

What final tips do you have for small business owners heading into the new financial year?

With inflation and interest rates on the rise it’s important to keep a close eye on expenditure. One of the trends that we see close to year-end is businesses tend to accelerate their expenditure to gain tax efficiencies, my advice is don’t incur expenditure at the compromise of cash flow, preserve your capital.

Perform scenario-based forecasting to work out your businesses serenity to interest rate increase. This is where a software solution like QuickBooks becomes vital as it has a built-in cashflow planner specifically aimed at helping with scenario forecasting.

Pay close attention to your internal business trends – are you seeing any changes in client or customer behaviour? And be proactive in assessing the possible impact on your revenue.

Look for ways to diversify your revenue, and understand how technology, such as subscriptions to new software and digital tools, can help you develop a diversified revenue strategy.

Don’t be afraid to investigate new technology, especially AI. Many businesses are still intimidated by the concept of AI and this hinders their ability to drive improvements and efficiencies through technology.

With the incentives mentioned above, there has never been a better time to look at technology improvements for your business.

In addition to government incentives, Gafar adds that “many technology companies are taking the initiative to empower Australian SMBs to adopt new technologies that can take their business to the next level. Intuit QuickBooks and Nearmap are both running offers for solutions designed to address issues affecting small-medium businesses”.

Avoid a failure to lodge penalty by applying for an agent assessed deferral using our how to guide.

For Australia to become a top 10 digital economy and society by 2030, Nearmap and Intuit are working to remove roadblocks for SMEs which make up 98% of Australian businesses, making software and digital tools more accessible through tax time offers on Intuit QuickBooks and the Nearmap EOFY offer.

This article was written in partnership with Intuit QuickBooks, by Tish Bhagwandeen, CA, Founder and Director, Infinance Solutions, and member of the Intuit QuickBooks Trainer Writer Network.

Tish has more than 12 years of financial experience and an in-depth understanding of business – from managing and growing start-up enterprises to taking care of the daily financial requirements of companies. As a Chartered Accountant, Tish has global experience that spans a variety of industries, having previously worked in the United States and South Africa. After working as a financial auditor she transitioned her career towards that of a Group Financial Controller in the Financial Services sector. After successfully transitioning the company to a sale on the ASX, she has co-founded Infinance Solutions. Tish is all about the numbers and loves working with people and small companies to help them achieve their business goals.

The advice in this article is general in nature and we recommend seeking personalised advice from your accountant before acting on anything in this post.

About Intuit QuickBooks

With automated expenses, invoicing, payroll and GST & BAS lodgement, QuickBooks gives users the confidence they need to run and grow their small business. Find the plan to suit your business and enjoy special tax time offers.

About Nearmap

Nearmap provides easy, instant access to high-resolution aerial imagery, city-scale 3D content, AI data sets, and geospatial tools. Using its own patented camera systems and processing software, Nearmap captures wide-scale urban areas in the United States, Canada, Australia, and New Zealand several times each year, making current content instantly available in the cloud via web app or API integration. Every day, Nearmap helps thousands of users conduct virtual site visits for deep, data-driven insights — enabling informed decisions, streamlined operations and better financial performance. Founded in Australia in 2007, Nearmap is one of the largest aerial survey companies in the world.

Related Articles

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.