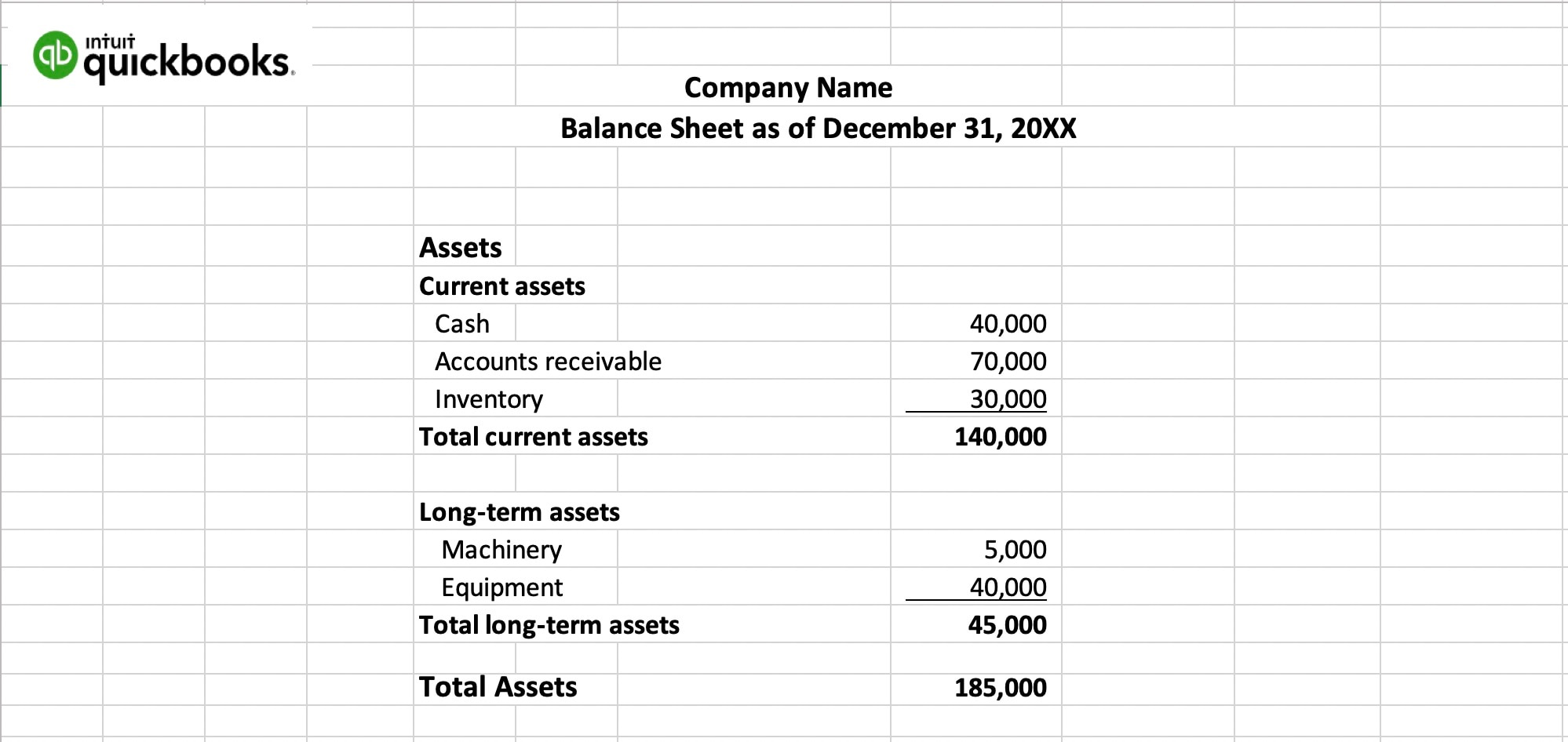

Balance Sheet

While an income statement shows how your business performed over time, a balance sheet is more like a snapshot of what your business is worth at a specific moment. This format of financial statement is like taking a photo of your business's position on a particular day.

The balance sheet answers questions like: "What do we own?" "What do we owe?" and "What's left for the owners?"

Your balance sheet is helpful when you need to know if you can pay your bills (liquidity) or if you're carrying too much debt (solvency). Banks and investors require balance sheets because they show your overall financial health at a glance.

The balance sheet equation

Every balance sheet follows one simple rule, called the accounting equation:

Assets = Liabilities + Owner's Equity

The things your business owns (assets) equals the sum of what it owes to others (liabilities) plus what belongs to you (equity).

The key to this equation is that it must always remain balanced. Here's a real-world example: If you borrow $10,000 from the bank to buy business equipment, your assets go up by $10,000 (the equipment), and your liabilities also go up by $10,000 (the loan) – the equation stays balanced. If one side of the equation is out of balance, you need to check your numbers.

Learn more about the accounting equation.

Key components of balance sheets

- Assets: Things your business owns that have value. This includes your cash, equipment, property, money that people owe you (accounts receivable), and inventory.

- Liabilities: What your business owes to others, like loans, unpaid bills, or credit card debt.

- Owner's Equity: What would be left over if you sold all assets and paid all debts. It's essentially the owner's stake in the business.

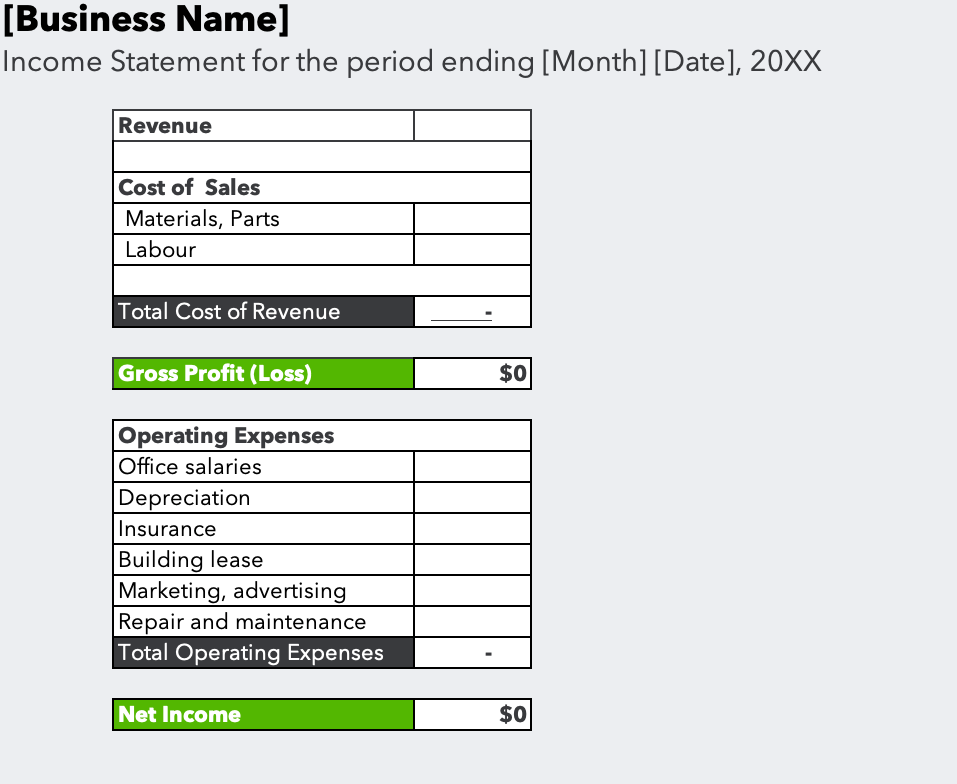

How to create a balance sheet

Creating a balance sheet for your small business doesn't have to be complicated. Using a financial overview template makes it easy. Here's a step-by-step approach:

1) Choose your balance sheet date: While income statements cover a period of time, a balance sheet shows your financial position on a specific day (usually the last day of the month, quarter or year).

2) Total your assets:

- Current Assets: Things that will turn into cash within a year, like money that customers owe you and inventory you plan to sell.

- Non-current Assets: Longer-term things your business owns, like equipment and investments.

Add these up to calculate your total assets.

3) Calculate your liabilities:

- Current liabilities: Debts you'll pay within a year, such as supplier invoices and credit card balances.

- Non-current liabilities: Longer-term debts, like business loans and equipment leases.

Add these up to find your total liabilities.

4) Calculate owner's equity: This represents the owner's investment in the business plus profits that have been reinvested. It includes capital contributed by owners and retained earnings (profits kept in the business).

5) Check that it balances: Your total assets should equal your total liabilities plus owner's equity. If they don't match, double-check your numbers!

Balance sheet template