Despite a tumultuous 12 months, 80% of employees and business owners in Australia say their company is growing, according to a December 2020 QuickBooks survey. In fact, 22% say their business is growing more than expected. The industries expected to see the most growth in 2021 and beyond are those that make our lives easier and help us grow. We’re talking about finance and insurance, professional services, and construction and restoration.

Future of Small Business: How to succeed in three of Australia’s fastest-growing industries

Why finance, professional services, and construction are thriving

A few key industries are rising to the forefront when it comes to business growth in Australia. So what’s causing finance and insurance, professional services, and construction companies to thrive?

Growing demand for insurance drives growth in finance

The general insurance industry in Australia is expected to grow 5.1% from 2020 to 2025, according to a study by GlobalData. This growth is fuelled by economic recovery following the COVID-19 pandemic and growing demand for insurance against natural disasters like the bushfires and destructive hailstorms of 2020.

This growth is reflected in the data. Nearly 91% of workers in finance and insurance say their business is growing. Only 2% say their business is moving in the wrong direction in terms of growth.

Australian consumers turn to professional services to make life easier

Professional services include industries that provide services to other businesses and households. These services might include creative work, legal help, or accounting services. Many of these businesses took a hit during the COVID-19 pandemic as businesses and households reduced discretionary spending. But they’re coming back strong.

About 75% of those working in professional services say their company is growing. In response to the pandemic, these businesses turned to new technology to connect with clients and optimise their offerings for a digital market. The plurality of professional services providers (34%) say new technology is driving the most growth within their industry today. Another 40% believe new technology will continue to drive growth over the next decade. Jobs in professional business services industries are projected to grow by 7% by 2024, despite some declines in 2020.

Construction industry thrives despite setbacks

The construction industry saw some difficulties in 2020. Workers were impacted by restrictions on construction activity, supply chain disruptions for equipment and materials, and challenges with the availability of labour. But GlobalData says the industry is set to regain growth momentum in the coming years. And the Australian Industry and Skills Committee projects that construction will increase jobs by nearly 9% by 2024. Government incentives have already started to drive an increase in residential home improvements and construction over the past six months.

Workers in the construction industry say shifts in consumer demand are driving the most growth within their industry today. And 73% say their business is currently growing despite setbacks. Looking forward, these workers expect new technology to drive growth over the next decade.

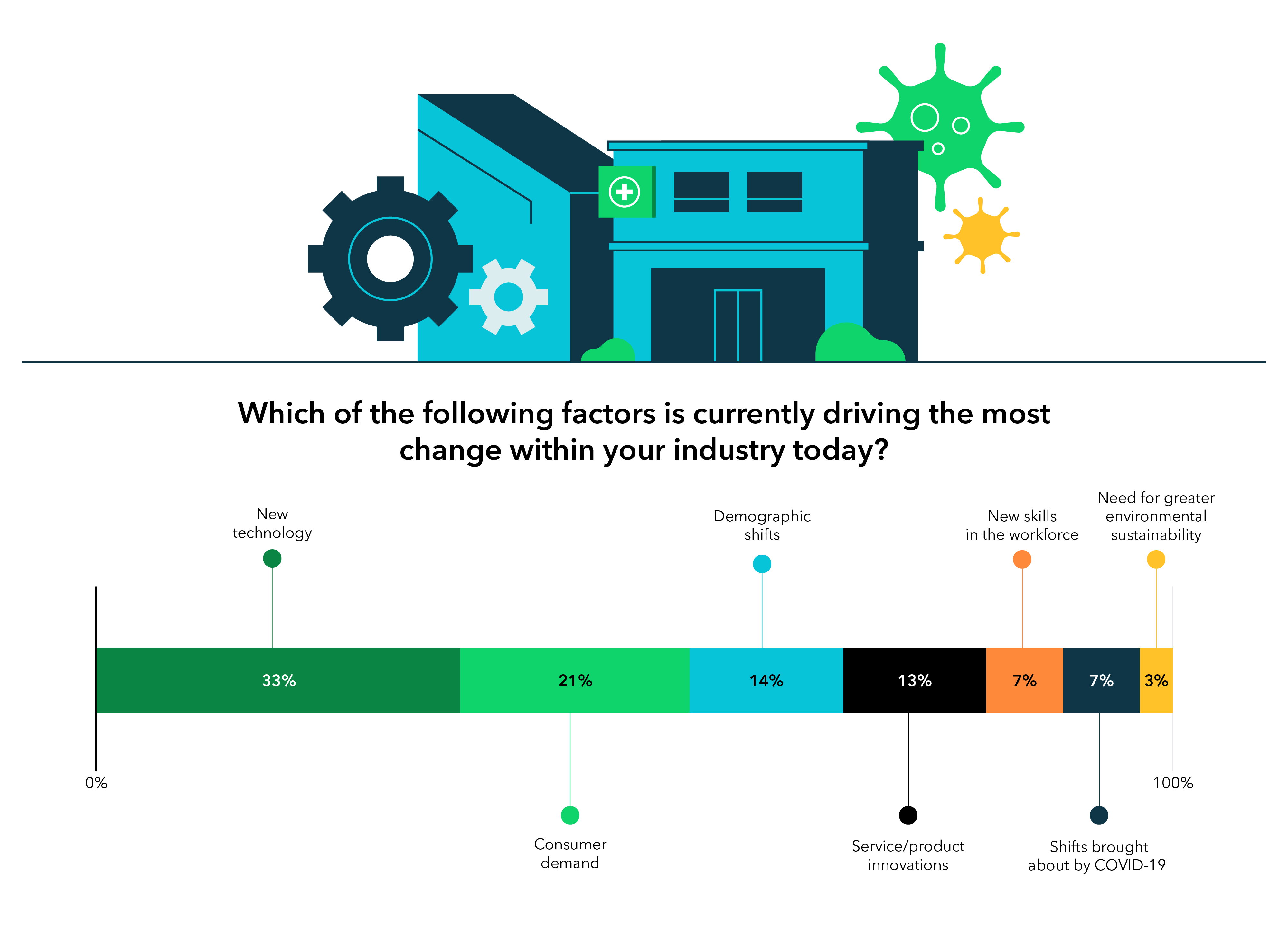

Top drivers of change across industries

Growth aside, these industries don’t look the same as they did 12 short months ago. Respondents say the top drivers of changes across all three industries are:

- New technology

- Consumer demand

- Demographic shifts

COVID-19 leads to positive business changes

Across all industries, 92% of surveyed respondents say COVID-19 led to changes to how they operate. Half of the respondents said these changes are permanent, while the other half expects these changes to be temporary. About 63% agree that these changes were all or mostly positive for their business.

However, businesses that made permanent changes are more optimistic than those that made temporary changes. Approximately 77% of those that made permanent changes to how they operate believe the changes had a positive effect on their business. On the flip side, only 52% of businesses that made temporary changes feel the same. In fact, more than 18% of these businesses believe the changes have had a negative impact.

Construction workers are less happy with COVID changes

While financial and professional services adopted new technology to work online amidst the COVID-19 crisis, the construction industry, which relies on physical work, faced major challenges. Of these workers, 82% say the pandemic led to changes in how they operate, and 58% say those changes are only temporary. And while the majority of financial and professional services (68%) say the changes have been positive, only 55% of construction workers say the same. Another 31% say the changes didn’t make much of an impact on how they operate.

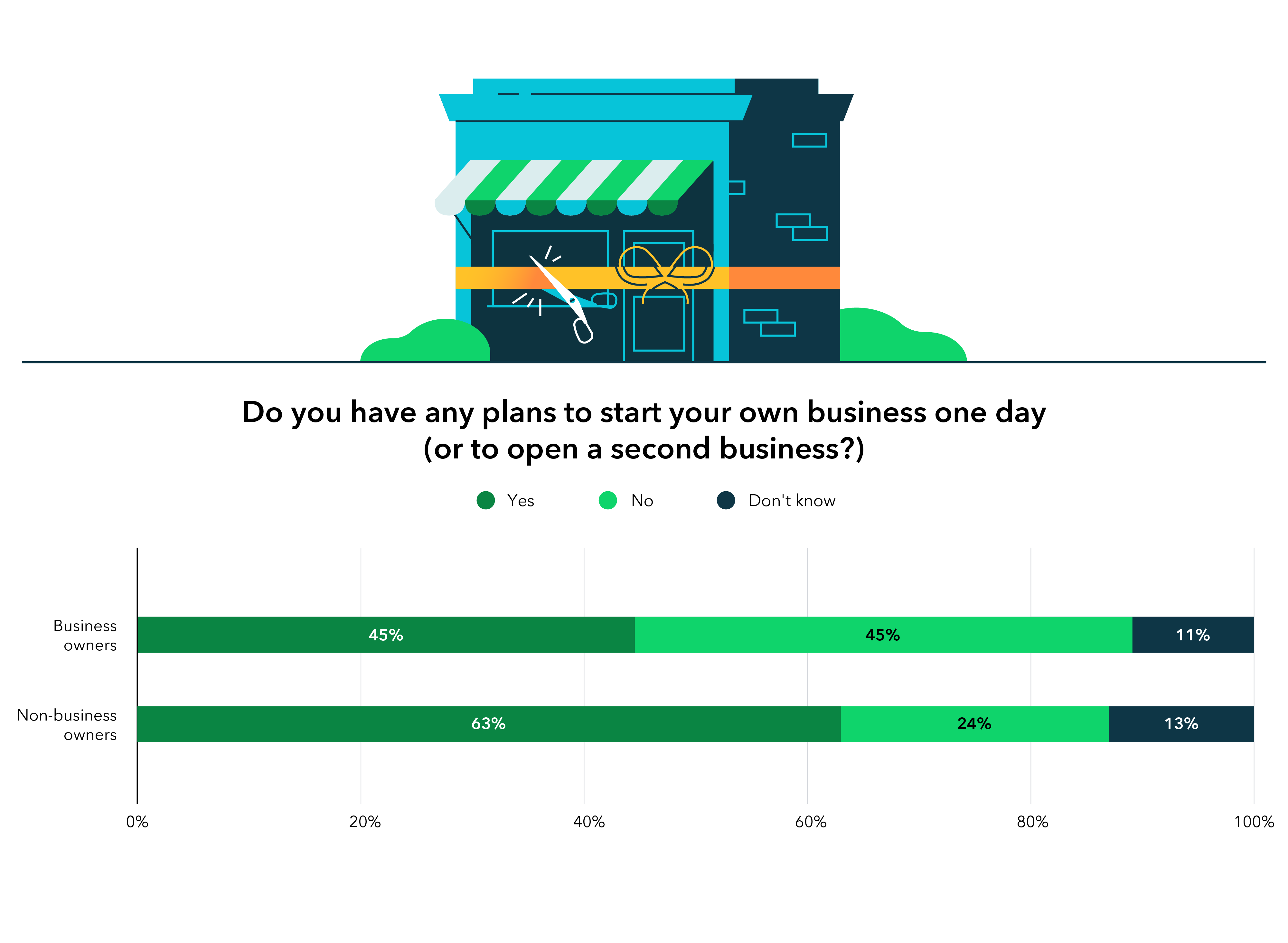

New businesses on the rise

Despite the challenges of 2020, rising entrepreneurs still want to start a new business in 2021 and beyond. Among survey respondents, 63% of non-business owners say they plan to open a business someday; 45% of those who owned a business in the past have plans to start another.

But entrepreneurs are more optimistic about some industries than others. While 67% of workers in financial or professional services say they plan to start their own business someday, another 9% are thinking about it. Construction workers are more on the fence—only 59% say they plan to start a business in the future, while 17% aren’t sure.

Defining success for new business owners

It’s also worth noting that these new business owners may have a different definition of success than their predecessors.

For most, professional success is defined as:

- Financial growth

- Customer satisfaction

- Financial stability

However, those in the construction industry are more likely to prioritise employee satisfaction over financial stability.

From a personal standpoint, workers define personal success by:

- Financial earnings

- Personal achievement in the workplace

- Happiness at work

Financial and professional services are more likely to define success by financial earnings (36% put this at the top of their priorities). Workers in the construction industry, however, are driven more by personal achievement and independence. “Happiness” is a close second across the board.

Challenges new businesses are likely to face

All businesses face start-up challenges, and new businesses are no exception.

Seasoned business owners say the top challenges new businesses are likely to face include:

- Building a customer base

- Pricing for profitability

- Complying with regulations

Construction businesses are likely to face additional challenges in the form of labour and skills shortages.

These same business owners resoundingly agree that financial management is the single most important skill a new business owner should learn within their first year of business. Building strategic partnerships is the second most important skill, according to these business owners.

Partnerships are critical to business success in Australia

When it comes to their own businesses, seasoned business owners say the keys to short- and long-term success are:

- Strong business partnerships

- Great customer service

- Effective marketing and sales

- Quality products and services

- Skilled workers

Unsurprisingly, the construction industry places more value on offering quality products and services and hiring skilled workers when it comes to long-term success. Financial and professional services believe that effective marketing and sales strategies are critical to their short-and long-term success.

Across the board, all respondents agree that a positive customer service experience is especially important.

“Customer service can be one of the most valuable investments you make in your business. Remember, customers contact you when they need you most. Your team needs the time, space, and skills to get this right. The secret to success here is to be proactive. Look at every interaction as an opportunity to learn from your customers. By sharing these insights, you can build empathy right across your business.

At Intuit, we have taken this one step further by using feedback from our customers to build predictive technology that helps them to find solutions before problems arise. With the right approach, you can build better relationships with your customers and even better products or services. This can be transformational.”

Todd Stanley, Vice President & Global Customer Success Leader, Intuit QuickBooks

“I believe success is built on the combination of customer service and technology. You need great employees, of course. But you also need to automate the things that can be automated so your workforce is free to focus on solving bigger problems for customers. This empowers them. It gives them time to focus on excellence, and this benefits them as well as your customers.”

Deborah Sweeney, CEO, MyCorporation

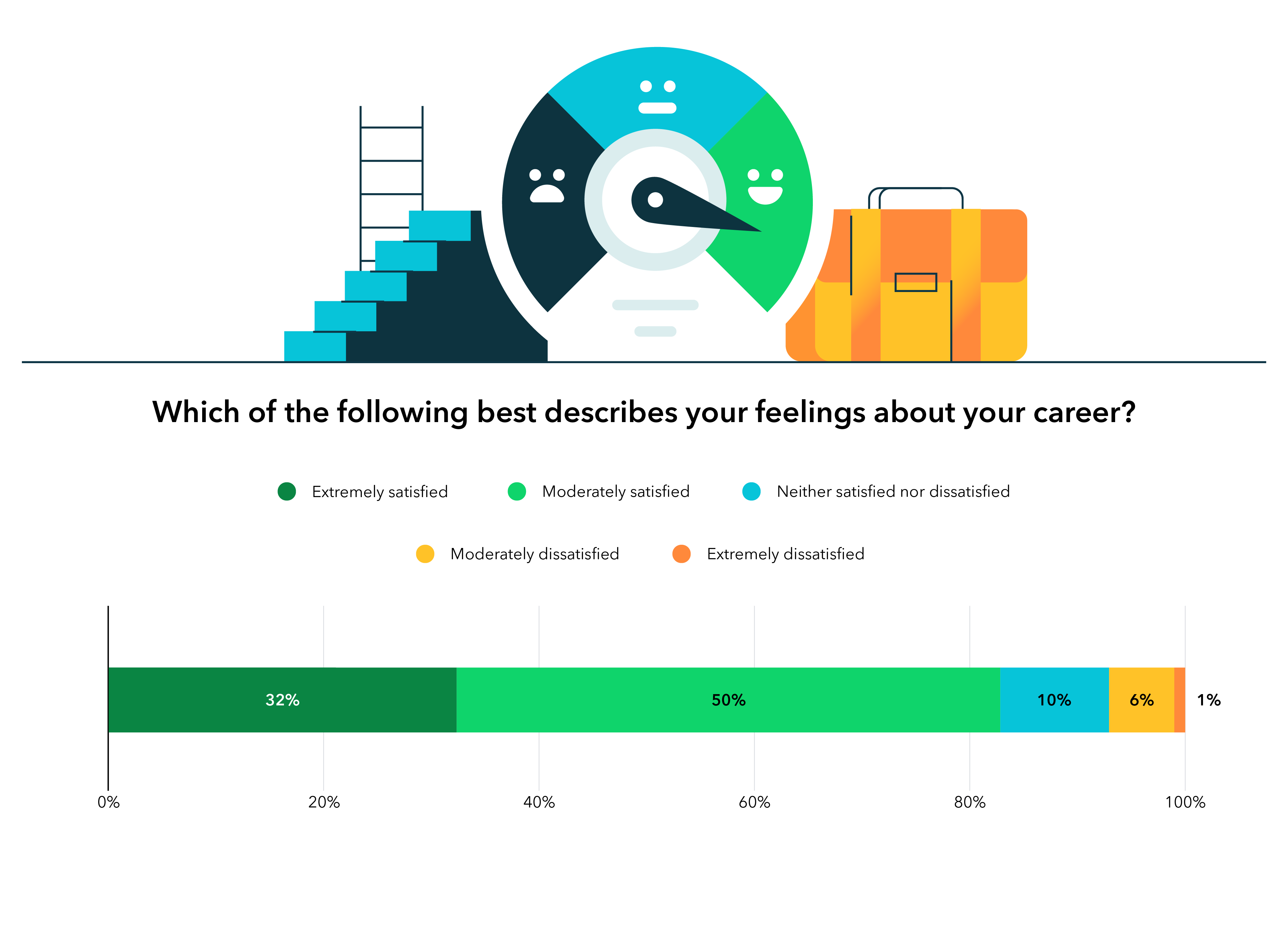

Job satisfaction among industries

Success is one thing, but satisfaction is another. Across all three industries, 82% of workers say they feel moderately or extremely satisfied with their careers. Workers who feel satisfied at work define success by financial growth and financial earnings. Surprisingly, those who feel very satisfied with their career are more likely to want to own their own business.

Across the board, the majority of respondents say they would encourage others to follow a similar career path. This includes 77% of those in financial and professional services and 80% of those in construction.

All respondents feel good about their future prospects when it comes to earning potential within their industry. Workers in the construction industry feel especially good about job satisfaction but less positive about workplace benefits. In financial and professional services, workers feel good about earning potential but not as good about retirement options.

Employees prioritise personal achievement over financial success

Diving into the data, we find that 75% of employees say they are satisfied with their careers, compared to 90% of managers and supervisors. Additionally, employees are more likely to define success by personal achievement. Happiness at work and financial success tie for second place. On the flip side, managers value financial growth above all else—no close seconds.

Construction workers feel less confident about their education

About 81% of financial and professional services workers are satisfied with how their education prepared them for their current job. Meanwhile, 78% feel confident in the Australian education system to prepare the future workforce.

However, only 71% of construction workers are satisfied with the preparation their education provided, and only 66% feel confident in the education and training of the future workforce. Of these workers, 28% say new hires always require additional training to do their jobs effectively, but almost all respondents (88%) say new hires often or sometimes need training when they start work.

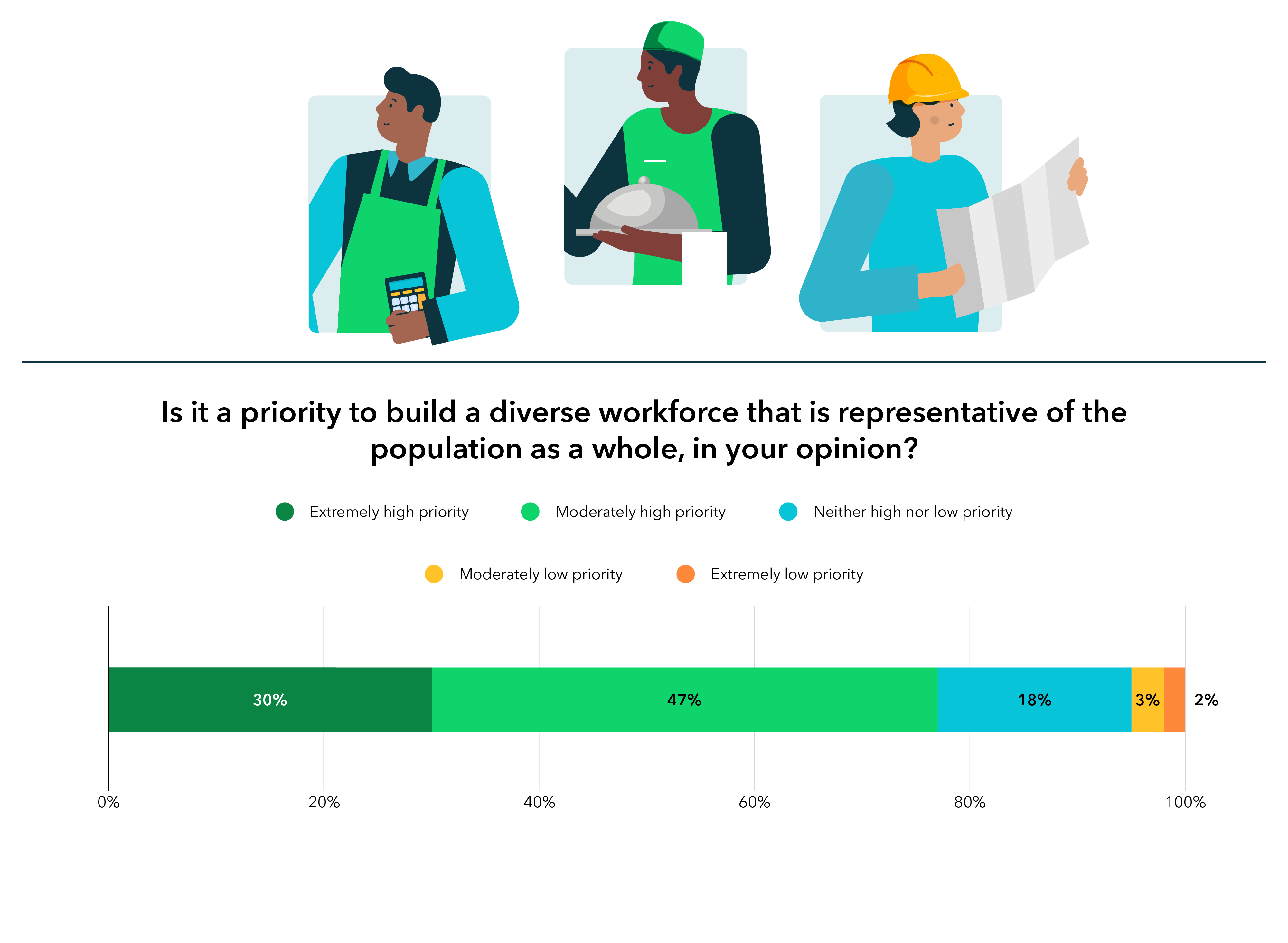

Growing businesses focus on diversity

As companies grow, so do their teams. And in the aftermath of 2020, more businesses are making diversity a priority when it comes to hiring top talent. Approximately 77% of respondents say building a diverse workforce is a priority. That number jumps to 80% for financial and professional services but drops to 66% for construction businesses.

Growing companies also are more focused on diversity than those that are stagnant or focused on contracting. About 82% of growing companies say diversity is a high priority within their business compared to 55% of companies experiencing little to no growth.

Good news: New business owners are following suit. Approximately 38% of those who plan to open a business say workplace diversity is an extremely high priority, and another 49% say it’s a moderately high priority.

Research methodology and sample

In December 2020, QuickBooks used an online survey with 29 questions to collect data from 523 employees and business owners in Australia. The respondents work in finance and insurance; accommodation; professional services; construction and restoration; and real estate, rental, and leasing. The audience panels were provided by Pollfish, with a 57:43 split between male and female respondents. Of the respondents, 40% are employees; 43% are managers; 6% are directors, vice presidents, or senior vice presidents; and 7% are company presidents or business owners. The remainder describes their job title as “other.”

Note that some survey questions in the charts shown above have been abbreviated for legibility. For example, neutral questions used in the actual questionnaire, such as “How satisfied or dissatisfied are you…” have been edited to “How satisfied are you…”.

Where percentages in the charts do not add up to 100, this is due to the numbers being rounded to the nearest decimal place for visual clarity.

Related Articles

Looking for something else?

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.