Under certain circumstances, employees may wish to cash out their annual leave. In these scenarios, the law is very clear that employees are required to be paid the full amount that they would otherwise have been paid. This includes any super payments they would have been entitled to.

Therefore, when cashing out annual leave, employers are required to pay super contributions as normal.

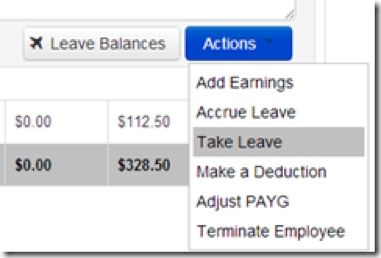

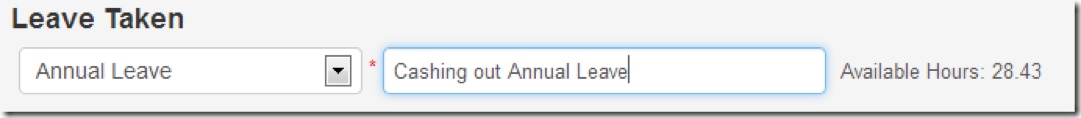

Employment Hero makes it really easy to cash out annual leave and ensure you’re meeting any obligations. To cash out annual leave for an employee follow these simple steps: