Pre QuickBooks Online we had our desktop-based accounting software packages, which required obtaining a copy of the client file.

It really wasn’t fun transferring back and forward, either by way of backing up the clients file on a CD to work from the office, using drop-box transfers, USB stick and then most of the time we had a deadline to get the file back to the client which placed restrictions on their workload and more stress load on us to get this completed.

QuickBooks Online allows you to do this work on the live online file from anywhere, at any time without inconveniencing you or your client, and no stress attacks to complete ASAP love that.

This will speed up your workload at EOFY immensely, no waiting for the file or waiting for the backup file – you can commence finalising all year-end procedures from End of Year reconciliations, PAYG summaries, TPAR’s for the construction industry, reporting to the accountant for financials required for your clients’ tax returns, and of course lodging BAS with the ATO.

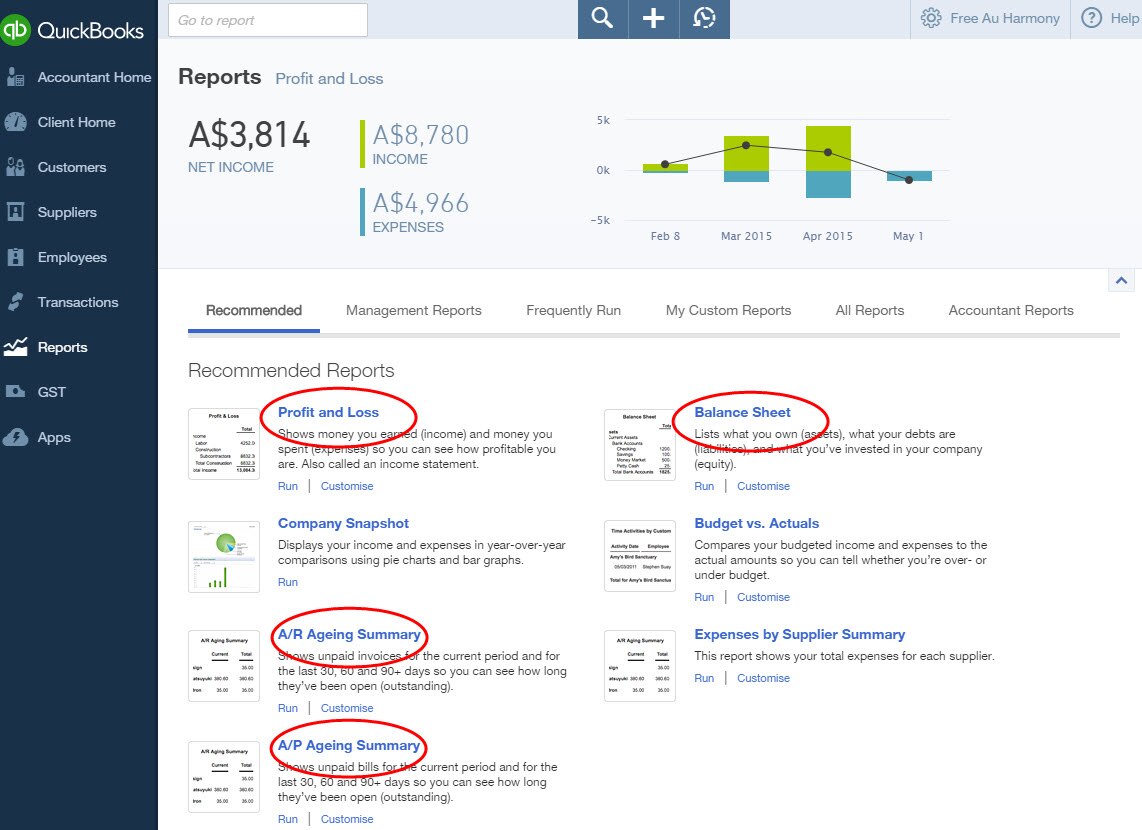

The reporting available in QuickBooks Online makes our process of locating errors quicker and easier, such as the General Ledger report found in the Accountant Reports (some of these reports are only found in our QBOA login as an Accountant), tailoring via customising reports. With Management Reports, now I can present reports to clients looking professional – Easy!

And I can’t forget to mention, no more rolling over of financial years, no more rolling over of Payroll and having access to as many financial years in the file.

For some tips and advice, check out our EOFY Guide and EOFY Checklist.

Here are some seriously easy steps:

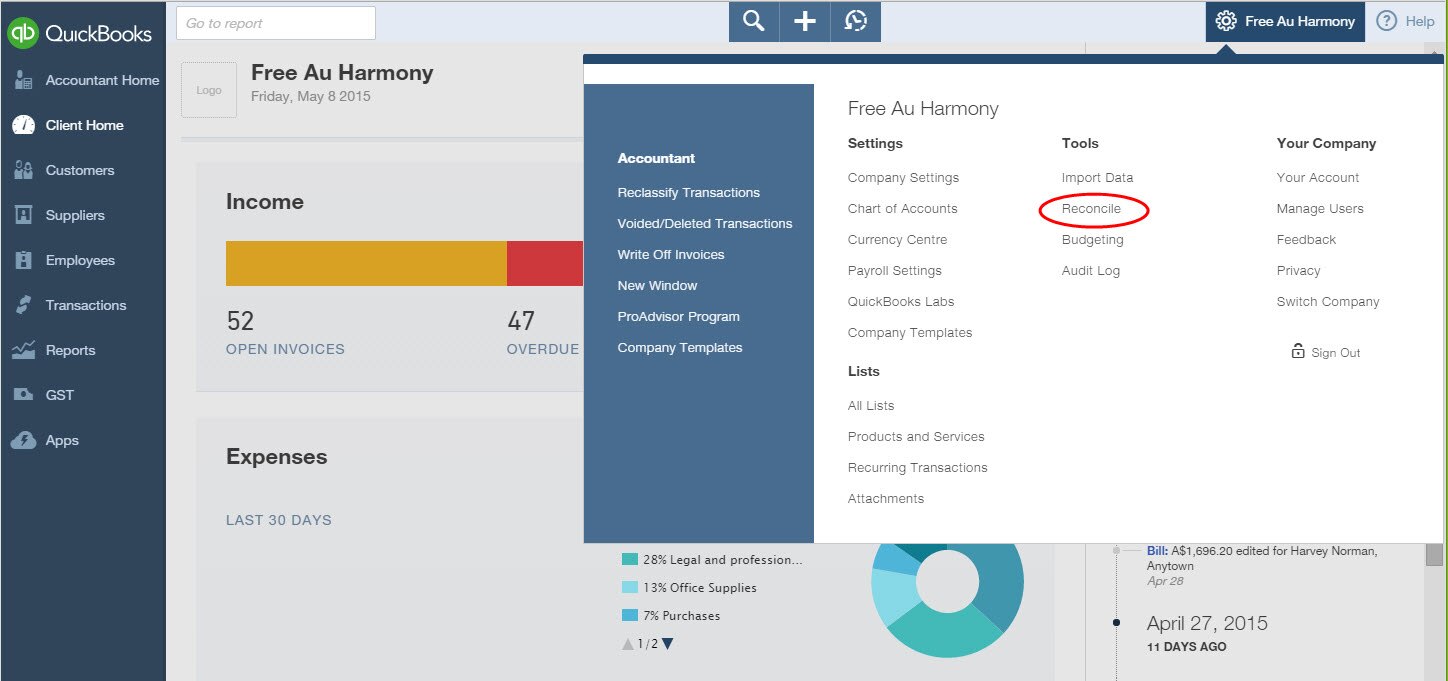

Step 1: Reconcile: Bank accounts, Loan accounts, Term Deposits, Credit Cards and Clearing accounts

Reconciling all the various bank and credit card accounts checking that clearing accounts such as Payroll Clearing accounts are at zero as at June 30. This ensures the accuracy of your bookwork and also verifies that all transactions on your bank, credit cards, and loan accounts have been entered and match to your reconciliations. To read more about how to reconcile accounts see our EOFY Guide.

![Acct & Management Reports[1]](https://quickbooks.intuit.com/oidam/intuit/sbseg/en_au/blog/images/a-e/sbseg-Acct-Management-Reports1.jpg)