There are many time saving apps that work with QuickBooks Online which can improve your productivity. Today let’s look at the integration between QuickBooks Online and GovReports.

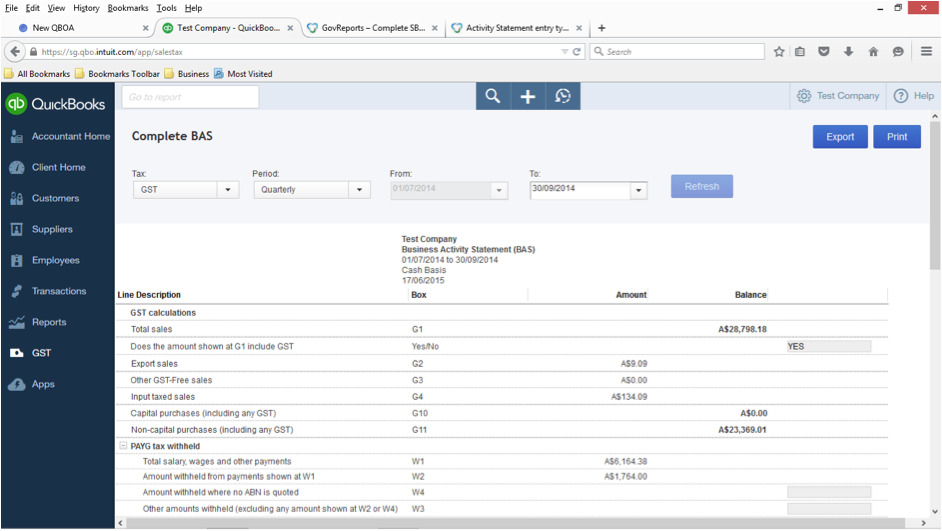

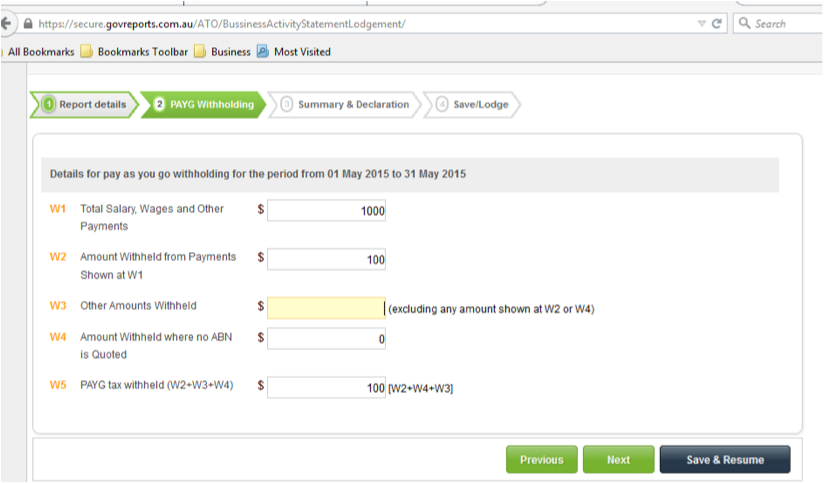

All in all, taking a completed BAS from QuickBooks Online into GovReports should take no more than 5 minutes of your time. Not having to manually complete the BAS return can improve accuracy through the elimination of typographical errors such as inverting numbers or inputting the information into the incorrect client return.

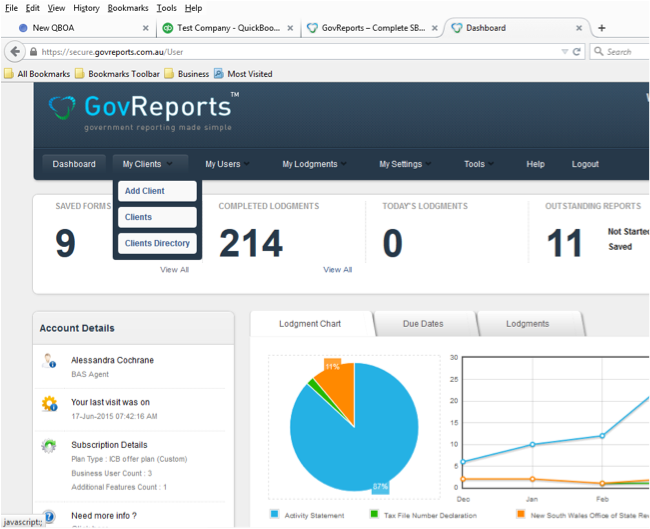

So why as a bookkeeper and BAS agent do I find the interface between GovReports and QuickBooks Online useful?

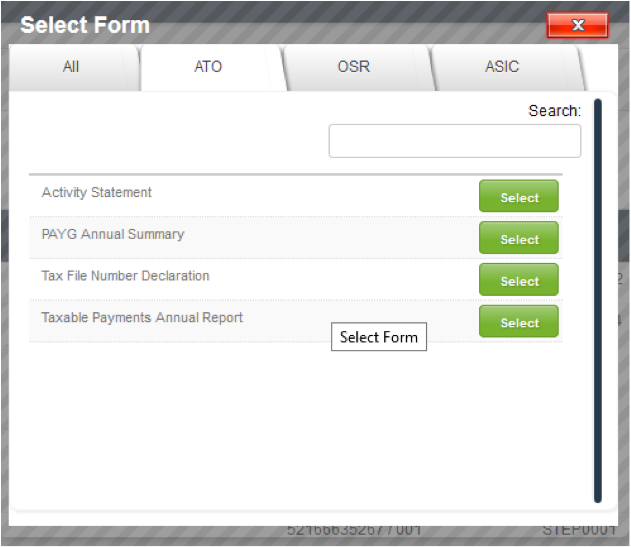

– I can access and lodge the BAS returns and payroll tax returns for all my clients in one location

– Depending on the subscription level I choose, I have the option of a Client Lodgement Management system for keeping track of my documents on top of the SBR interface with the ATO

– Linking between GovReports and the ATO and State Revenue offices is simple, especially if I am dealing with Payroll tax returns across multiple states. I can access the documents from one location. No need to remember half a dozen different passwords or Auskey passwords or go through the different screens for each state. Your Auskey is securely uploaded into GovReports once (and you are prompted when it needs to be renewed) – no need to remember passwords as you lodge

– You have the ability to set up clients and users with different levels of access

– You can see which returns are outstanding from the Outstanding Listings Report

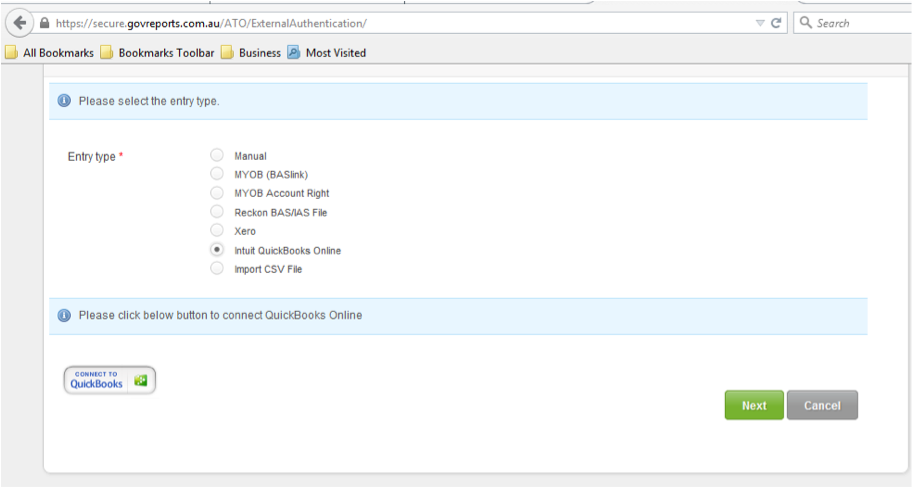

Before you begin you will need to make sure that you have completed the BAS return in QBO.