October 2024 Product Update

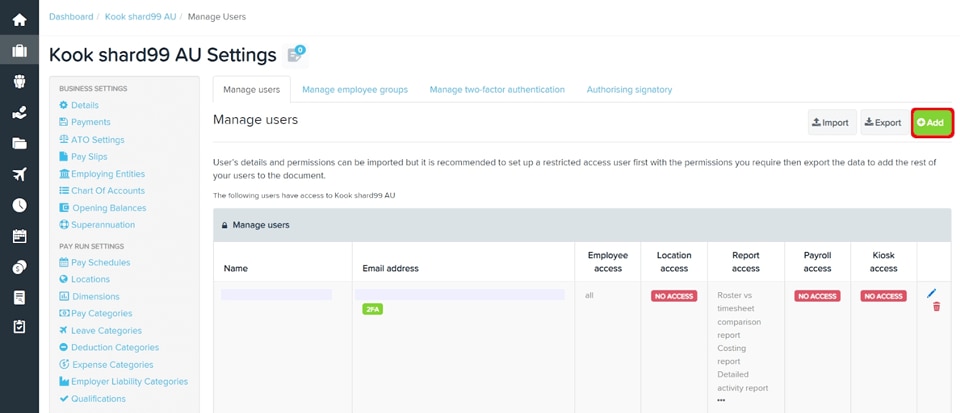

Create a restricted user for pay run creation access

QuickBooks Payroll

We’ve expanded the current restricted user permissions to provide greater flexibility over access to employees and pay runs.

New functionality has been released that will allow restricted users to be able to create pay runs for specific pay schedules, whilst being prohibited from creating pay runs for other pay schedules.

This process enables businesses to select which users have permission to create and view specific pay schedules within the business.

Importantly, in phase 1 of this release in Australia, restricted users with ‘Pay run creation’ access will not be able to submit super, STP or PayDay filings. This functionality will be enabled in phase 2 of this release.

Review the step by step instructions here.

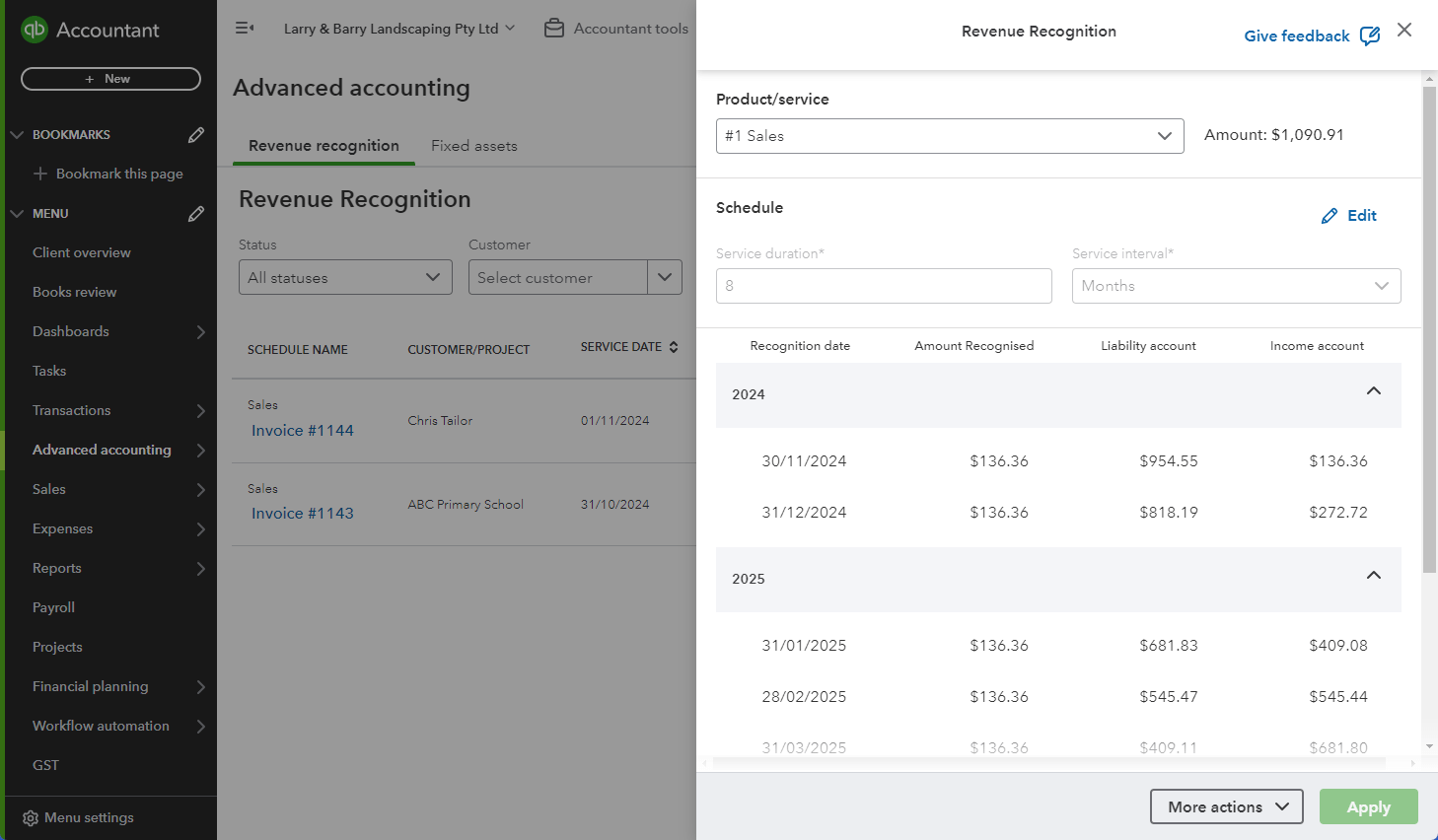

Updated look for Revenue Recognition

QuickBooks Online Advanced

The Revenue recognition functionality in QuickBooks Online Advanced has been given a visual update to help improve your experience.

This update only affects the appearance of the Revenue Recognition scheduling screens; all features and functionality remain unchanged.

To learn how to set up revenue recognition schedules, check out this article.

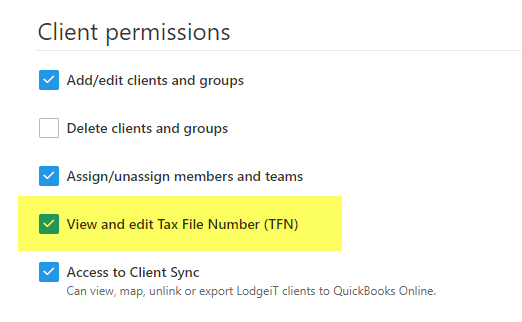

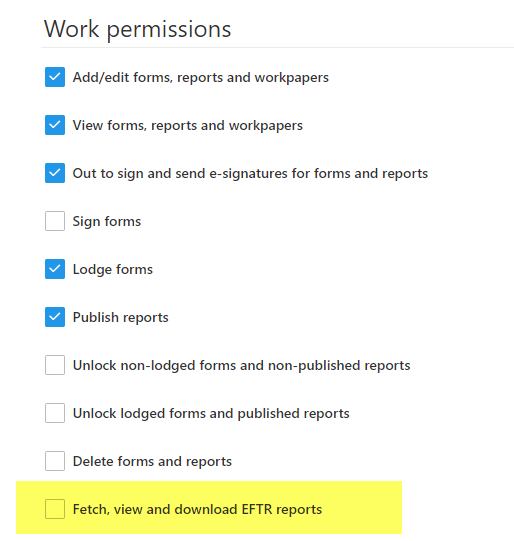

User permissions

QuickBooks Tax

To help you manage who can access sensitive information in your practice, additional user permissions have been added to tax file number access and ATO EFT reports.

View and edit TFNs. You can now configure user permissions to control who can view and edit Tax File Numbers (TFNs) within your practice, ensuring sensitive information is accessed only by authorized personnel.

Fetch, view and download ATO EFT reports. Configure user permissions to fetch, view, and download ATO Electronic Funds Transfer (EFT) reports. This feature allows you to manage access to crucial financial data within your practice.

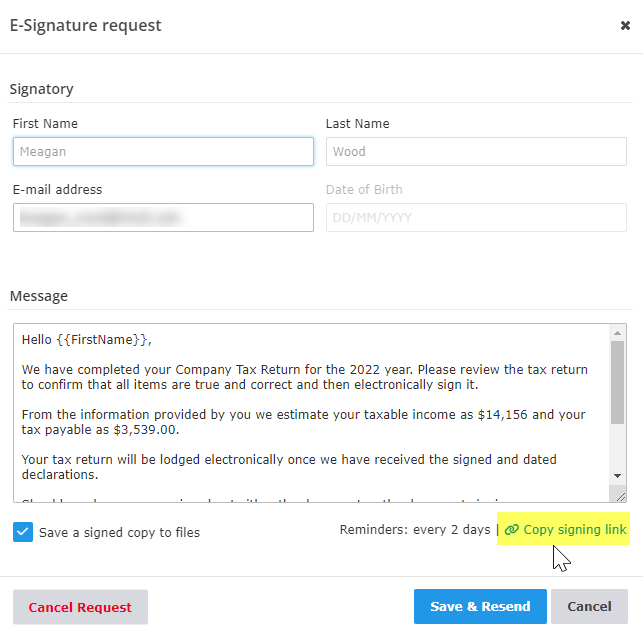

Copy e-signature link

QuickBooks Tax

You can now copy the signing link for each recipient when requesting an e-signature. This feature is especially useful if you need to share the link through alternative channels.

Individual tax return updates

QuickBooks Tax

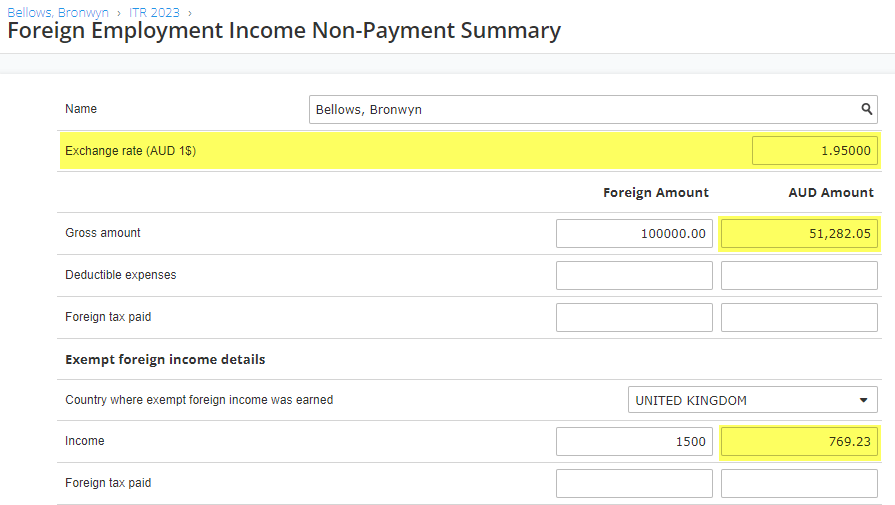

Various enhancements have been made to the Individual form to support foreign rental properties, foreign income conversion and franking credits calculations for dividends.

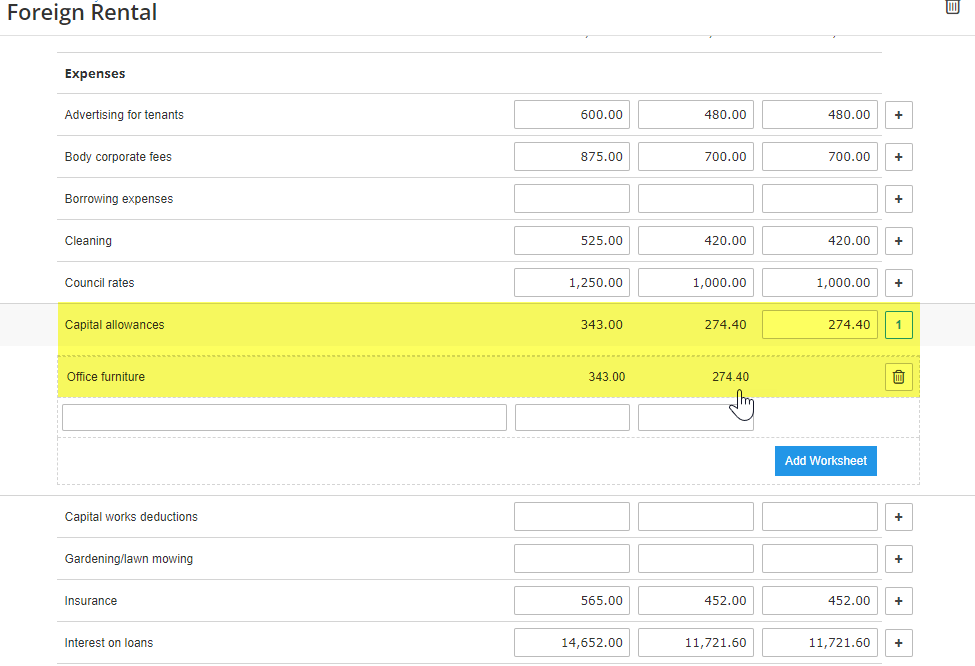

Foreign rental property depreciation schedules

When it comes to managing a foreign rental property, you can now add depreciation worksheets to the Foreign rental worksheet. This is for 2020 returns onwards.

To support foreign income calculations, QuickBooks Tax now automatically converts foreign income to Australian dollars, for returns from 2020 onwards.

You’ll now also find the franking credits are automatically calculated in the dividends worksheet for returns from 2024 onwards.

We’ve extended the capability of recording shares to 4 decimal places for increased accuracy.

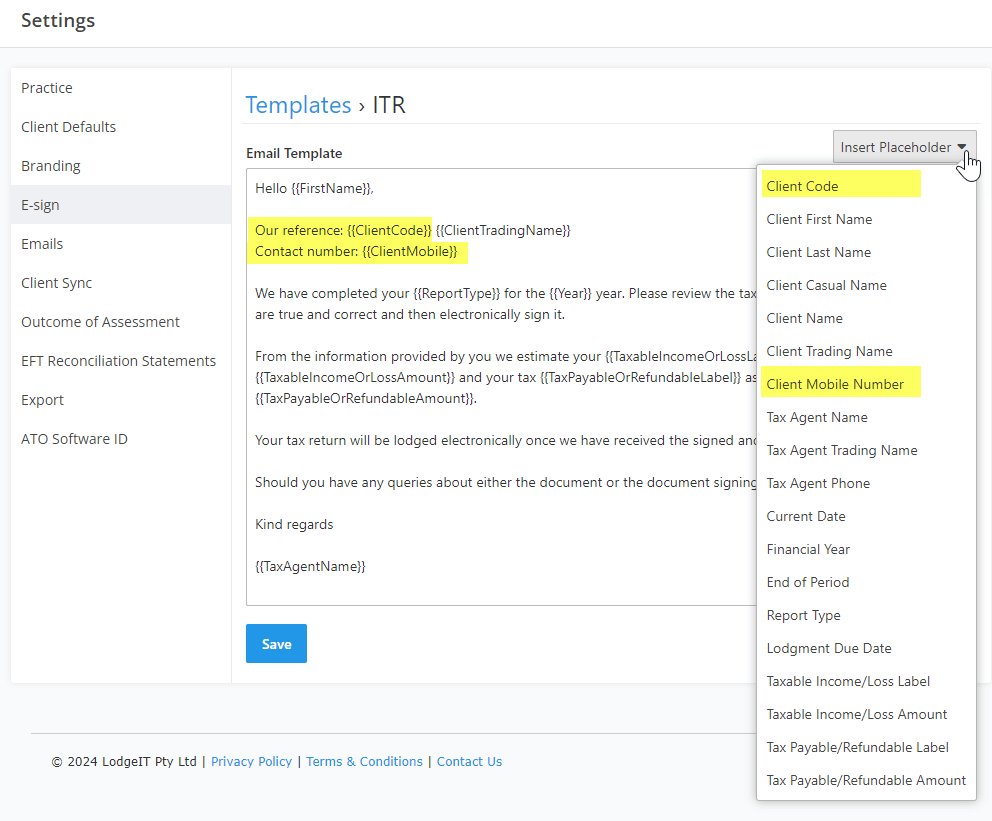

We’ve made both the Client Code and Mobile fields available to embed into your e-signature email templates where required.

Related Articles

TAKE A NO-COMMITMENT TEST DRIVE

Your free 30-day trial awaits

Our customers save an average of 9 hours per week with QuickBooks invoicing*

By entering your email, you are agree to our Terms and acknowledge our Privacy Statement.