3. Find a freelancer

Outsourcing your human resource needs or IT department is one thing, but what about tasks that need to be completed infrequently? Freelancers can fill the gap for roles in your business that aren’t needed all the time.

For infrequent on-demand needs, having a full-time employee doesn’t make sense:

- Example: If you only need to consult with a web designer twice a year, or want to triple the size of your customer support team just during the festive season, freelancers are a great solution.

They increase your operating costs through insurance, paid leave and payroll taxes. Businesses that need to scale up or scale down rapidly can take advantage of the growing pool of freelance workers available to work on a per-project basis while keeping costs down.

There are plenty of online marketplaces that allow you to browse and hire freelancers from all over the world. Though, keep in mind that with freelancers, cheap isn’t always the best option. You’ll save money over time by paying someone more for higher quality work rather than paying a cheaper freelancer that continually disappoints.

4. Integrate an internship

Interns are a great way to lower costs. Interns are new to the job market and have a limited work history. They take on internships to gain real-world professional experience and learn valuable business skills.

Your business benefits as well, because interns are paid less than a regular employee and have reduced employee benefits. In the intern/business relationship, everyone benefits. Internships also reduce recruitment costs.

After an intern has proven they’re an asset to your organisation, you can hire them without having to spend money searching for a qualified candidate. Because you already know this person and understand their abilities, there’s likely no need for an interview process or even training.

5. Entertain different supplier bids

If you work with suppliers regularly, you might want to set up a bidding system for projects and work. If you ask three different suppliers to provide quotes, you can have them compete to see who is willing to provide the work for you at the cheapest price.

Be sure to compile an accurate scope of work or request for proposal (RFP) for suppliers to bid on, as missing information or added complexity can significantly affect the quoted rate. Having an accurate quote can allow you to better plan for anticipated operating expenses.

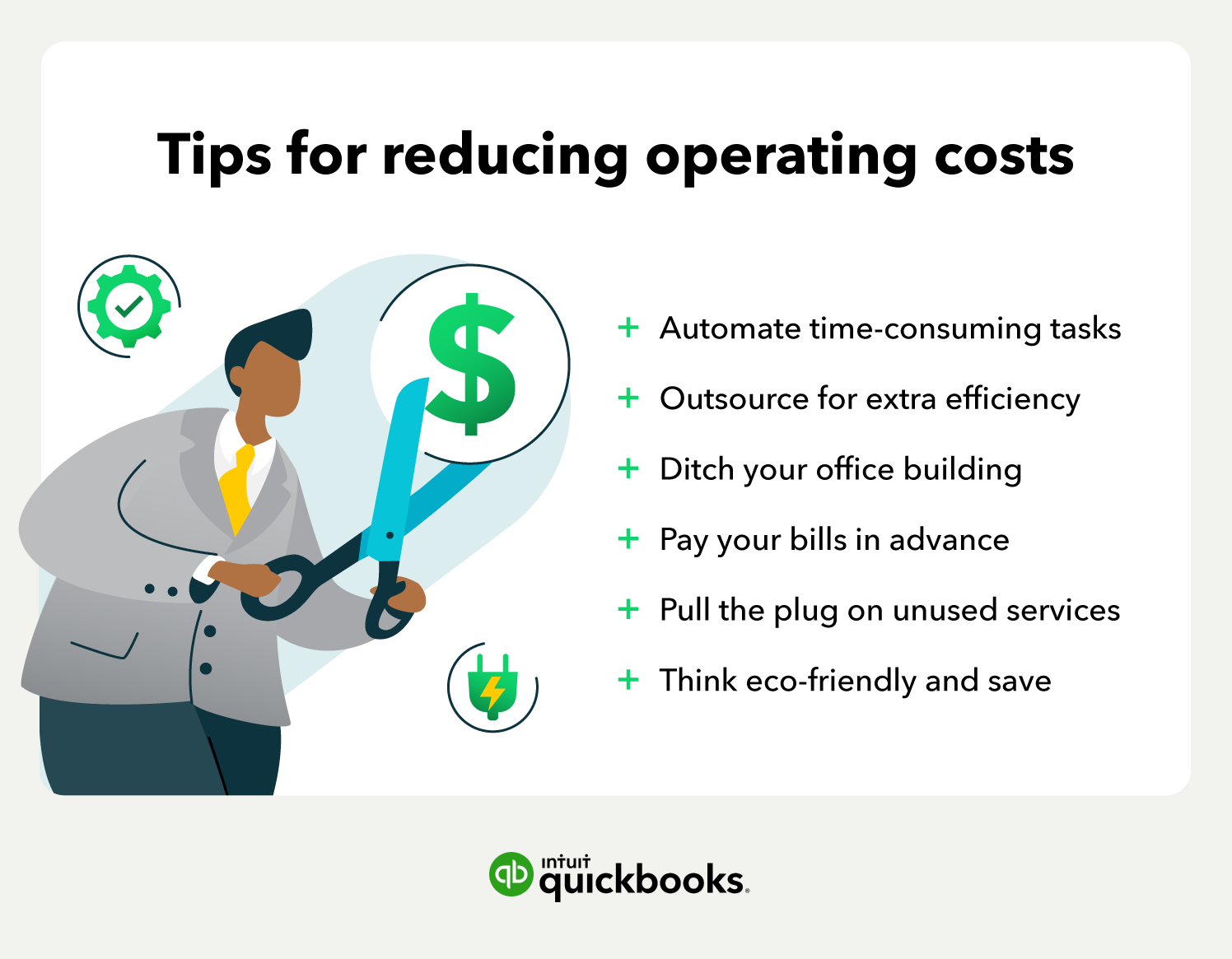

6. Ditch your office building

Leasing office space, paying your utility bills and managing a physical workspace can be a drain on your financial resources. Thousands of companies have opted to get rid of their office space and work completely remotely. Allowing staff to work from home allows businesses to reduce their physical footprint and lower operating costs.

Telecommuting is on the rise across Australia. Before the pandemic, around 30% of employees regularly worked from home; by August 2021, that had jumped to more than 40%. The Australian Bureau of Statistics expects this trend to persist.

With the amount of connectivity available today, the difference between an employee working two cubicles away or working across the country is almost indiscernible. Employees will typically also find working from home advantageous, as they don’t have to spend time and money commuting to the office each day.

7. Pay your bills in advance

Many suppliers will offer a discount if you pay your invoice early. Even a savings of 2%–3% per billing cycle can really add up. Let’s say your annual operating costs are $100,000. If you take advantage of paying invoices early and save 2%, you would end up cutting your costs by $2,000 a year.

At the very least, make sure to pay your invoices on time to avoid any late fees or other penalties. The same goes for loans or any other debt you’ve taken out. Your interest expenses can increase if you’re late or begin to miss payments.

8. Put wasteful habits to rest

You should always be looking for ways to make your business more efficient. By tightening up your processes and procedures, you can reduce waste in both materials and time. If you run a bakery, for example, and find yourself throwing out dozens of bagels and donuts every night, adjust your baking process to reduce all of that waste.

- Encourage your employees to point out inefficiencies and suggest solutions to the problem.

- Consider providing an incentive to employees for alerting you to money-wasting practices within your business.

Again, you can consider this an investment in your company. A small reward to an employee could end up saving you thousands of dollars down the line.

9. Pull the plug on unused services

Sometimes a subscription service just isn’t as useful as we thought it would be. Companies make millions of dollars a year with software-as-a-service apps that companies sign up for, but never get around to using.

- Check with your team to see if the services you’re getting a bill for every month are actually being used.

- Consider downgrading to the free version or cancelling them altogether if they’re idle and/or no one finds them essential in their work.

It’s easy to lose track of unused services, especially if you’ve set them up for recurring payments via auto-pay on your credit card. If you do find a service that you like but don’t use all of the features, try shopping around to see if there are cheaper alternatives available.

Auditing small recurring costs isn’t a one-off task. It should be done regularly to cut costs and keep your organisation lean. Set up a quarterly or biannual reminder to check for unneeded services that you can get rid of.

10. Use free apps whenever possible

Many apps follow the “freemium” model – you can use the base model of the program for free, but you have to pay to get access to additional features. But sometimes, those more sophisticated features never get used, and the company has wasted operational expenses for nothing.