Food services represents one of the fastest-paced industries there is. Whether you run a boutique restaurant, franchise, food truck or catering service, key areas of focus (and concern) tend to be the same across business types—sales and cash flow ; labour and food and beverage costs. And that’s as it should be: sales and cash flow ensure you have enough money to pay your bills and your staff, while labour, food and beverage costs can make or break a business.

While bookkeeping comes with the business-owner territory, it’s not likely that you launched your enterprise because you have a passion for financial reporting or generally accepted accounting principles (GAAP). Running a profitable restaurant (or any other food-based operation) takes up a great deal of time. It demands your focus on everything from managing inventory and ordering, to staffing and providing a rich diner experience. So, at the end of a busy day, the last thing on your mind is reviewing financial statements and conducting data analysis.

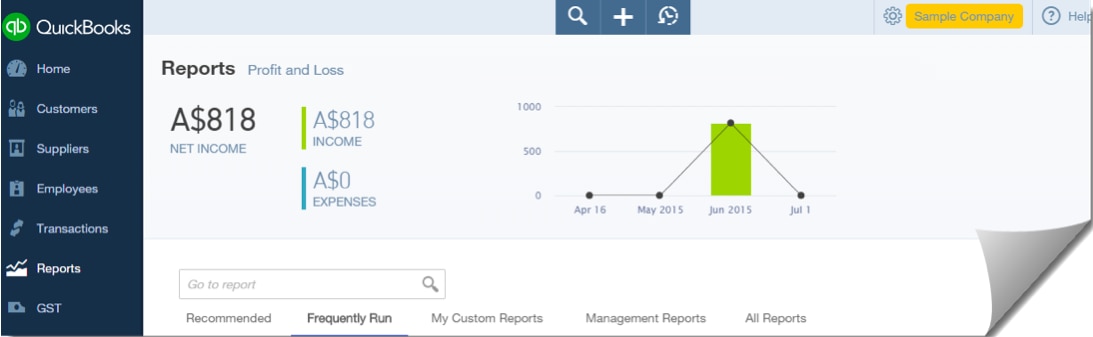

While it may not be your passion, however, maintaining a current and complete view of your financial position is critical to long-term success. This means regular review of monthly financial statements, including the balance sheet, profit and loss (P&L) report and cash flow statements. Packed with business intelligence and key financial insights, these reports help you better assess operational sustainability and risk by identifying potential issues ahead of time—for example, cash shortfalls, spikes in food and beverage costs or lags in sales.

Use this guide to help you navigate key data points on your financial statements. Becoming comfortable with the numbers will help you better understand your business and assist in fueling ongoing success.