NOPAT is Net Operating Profit After Tax. It shows a firm’s after-tax profits from day-to-day business operations. Analysts use the formula to compare business performance to past years, and to assess how a company is performing against its competitors.

This article uses an income statement to explain NOPAT, and to point out how the calculation differs from net income, EBIT, and other balances. You’ll learn how to calculate NOPAT, and how the formula can be used to make better decisions from financial reporting insights.

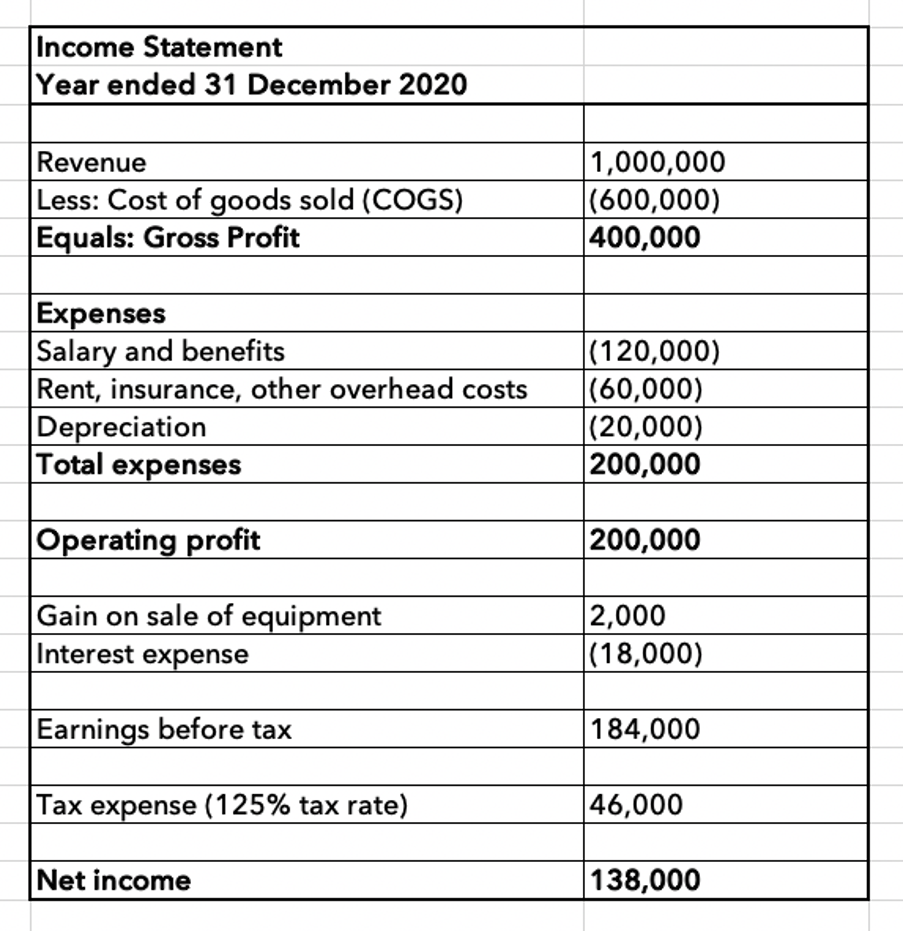

As an example throughout, meet Patty, the owner of Seaside Furniture, a manufacturing company. Here is Seaside’s 2020 income statement: