QuickBooks makes lodging BAS even easier with e-lodge. No more complicated paper forms to fill in, and no more ATO or MyGov portals to log in to. Now, you can prepare and e-lodge BAS straight from QuickBooks Online.

Once you’ve prepared your BAS in QuickBooks Online for the specific reporting period, follow a few simple steps to connect to the ATO and e-lodge your BAS.

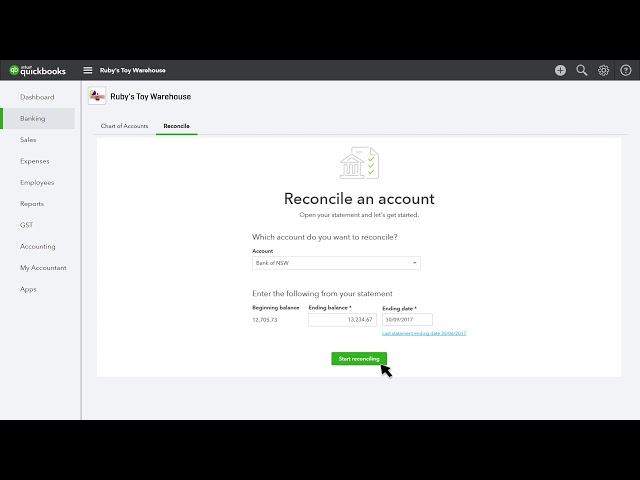

Watch this video on how to setup GST for BAS: